As the U.S. stock market experiences slight fluctuations ahead of a major Federal Reserve interest rate decision, investors are closely monitoring growth companies with high insider ownership. In this environment, stocks with high insider ownership can signal strong confidence from those closest to the company’s operations and strategy, making them particularly interesting.

The 10 largest growth companies with high insider ownership in the USA

|

name |

Insider ownership |

Profit growth |

|

Atour Lifestyle Holdings (NasdaqGS:ATAT) |

26% |

23.2% |

|

GigaCloud Technology (NasdaqGM:GCT) |

25.7% |

24.3% |

|

Victory Capital Holdings (NasdaqGS:VCTR) |

10.2% |

32.3% |

|

Atlas Energy Solutions (NYSE:AESI) |

29.1% |

42.1% |

|

Super Micro Computers (NasdaqGS:SMCI) |

25.7% |

27.1% |

|

Hims & Hers Health (NYSE:HIMS) |

13.7% |

40.7% |

|

Credo Technology Group Holding (NasdaqGS:CRDO) |

14.1% |

95% |

|

EHang Holdings (NasdaqGM:EH) |

32.8% |

81.5% |

|

BBB Foods (NYSE:TBBB) |

22.9% |

51.2% |

|

Carlyle Group (NasdaqGS:CG) |

29.5% |

22% |

Click here to see the full list of 175 stocks from our Fast-Growing US Companies with High Insider Ownership screener.

We’ll look at some of the best tips from our screener tool.

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform that helps advertisers improve the marketing and monetization of their content both in the United States and internationally, with a market capitalization of $37.63 billion.

Operations: AppLovin’s revenue segments include $1.49 billion from apps and $2.47 billion from the software platform.

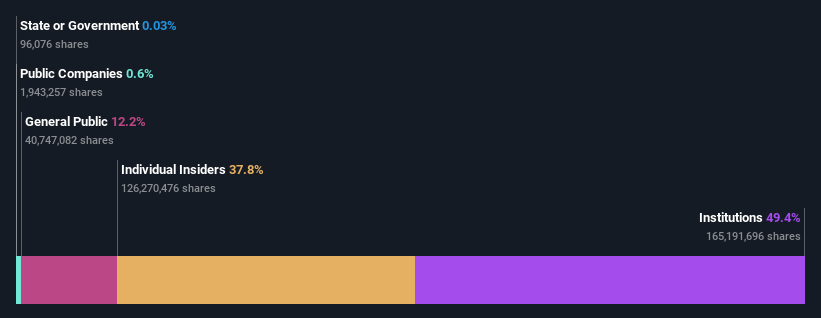

Insider ownership: 38.4%

AppLovin’s revenue is expected to grow significantly at a 24.2% annual rate, outperforming the U.S. market. Despite a high level of debt and recent significant insider selling, the company reported strong results for the second quarter of 2024, with net income increasing to $309.97 million from $80.36 million a year ago. Revenue forecasts for the third quarter of 2024 are between $1.115 billion and $1.135 billion, reflecting continued growth momentum despite the company being removed from several Russell indexes in July 2024.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDD Holdings Inc., a multinational trading group with a market capitalization of approximately $131.92 billion, owns and operates a diversified portfolio of businesses.

Operations: The company’s revenue comes mainly from the Internet software and services segment, which generated CNY 341.59 billion.

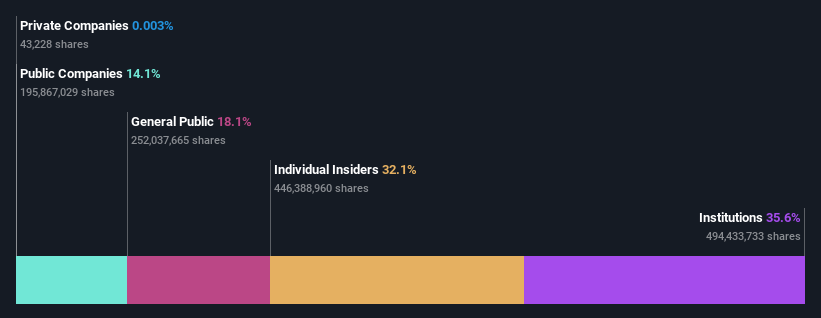

Insider ownership: 32.1%

PDD Holdings is experiencing robust growth, with profits expected to rise 17.3% and revenues 18.9% annually, outperforming the U.S. market. The company reported impressive results for the second quarter of 2024, with net profit rising to CNY 32 billion from CNY 13.11 billion a year earlier. However, PDD is facing legal challenges over alleged misleading statements and security issues in its applications, which could affect investor sentiment despite its strong financial performance and high insider ownership.

Simply Wall St Growth Rating: ★★★★☆☆

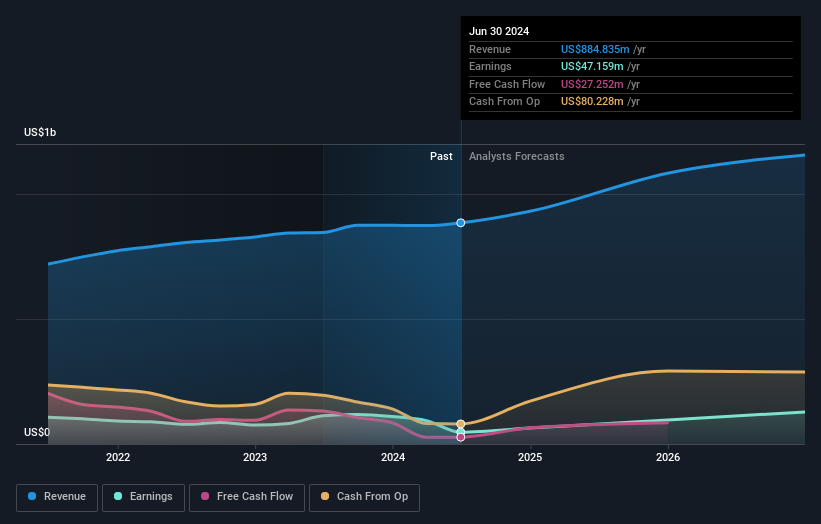

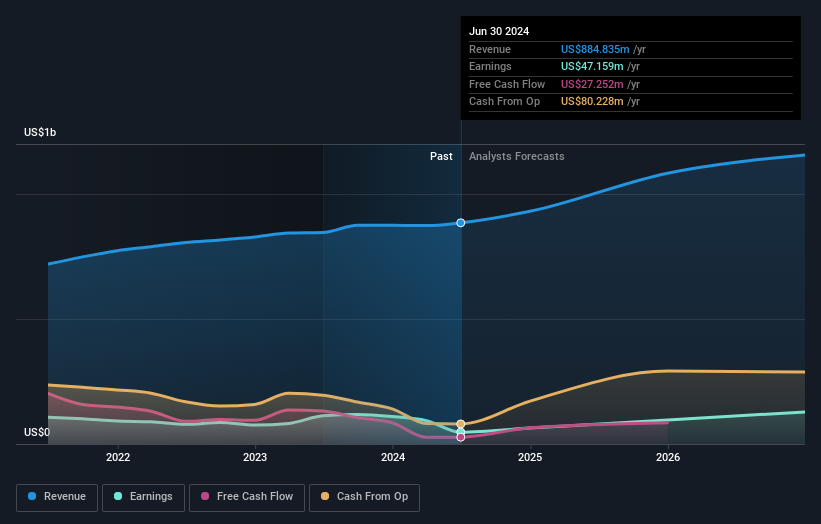

Overview: Shutterstock, Inc. operates a platform that connects brands and companies in North America, Europe, and internationally with high-quality content and has a market capitalization of $1.19 billion.

Operations: The company’s revenue comes primarily from the Internet Information Providers segment, which generated $884.84 million.

Insider ownership: 25.9%

Shutterstock is experiencing moderate growth, with revenue expected to grow 8.9% annually, slightly above the U.S. market. The latest Q2 2024 results showed a significant decline in net income to $3.63 million from $50.01 million last year, impacting profit margins and earnings per share. Insider ownership remains high, bolstered by strategic leadership changes and the launch of innovative AI products such as the generative 3D API platform, positioning the company for future growth despite current financial challenges.

Take advantage

Ready to venture into other investment styles?

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. This is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not own any shares in the stocks mentioned. The analysis only considers shares held directly by insiders. It does not include shares held indirectly through other vehicles such as corporations and/or trusts. All forecasted sales and earnings growth rates refer to annualized (per year) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:APP, NasdaqGS:PDD and NYSE:SSTK.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]