The external fund manager backed by Berkshire Hathaway’s Charlie Munger, Li Lu, makes no bones about it when he says, “The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.” So it may be obvious that you need to consider debt when thinking about how risky a particular stock is, because too much debt can ruin a company. We find that RITEK Corporation (TWSE:2349) has debt on its balance sheet. But should shareholders be concerned about its use of debt?

When is debt a problem?

Debt helps a company until it struggles to pay it back with either fresh capital or free cash flow. In the worst case scenario, a company can go bankrupt if it can’t pay its creditors. While it doesn’t happen too often, we often see indebted companies permanently dilute shareholder ownership because lenders force them to raise capital at a fire-sale price. The benefit of debt, of course, is that it often represents cheap capital, especially when it replaces a company’s dilution with the ability to reinvest at a high rate of return. The first step in looking at a company’s debt levels is to look at its cash and debt together.

Check out our latest analysis for RITEK

How much debt does RITEK have?

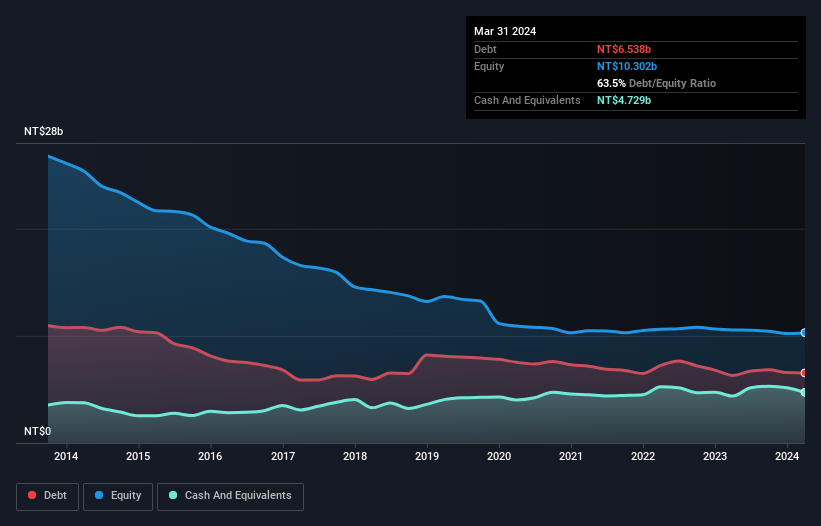

The chart below, which you can click on for more details, shows that RITEK had NT$6.54 billion in debt in March 2024; roughly the same as the year before. On the other hand, the company has NT$4.73 billion in cash, resulting in net debt of about NT$1.81 billion.

A look at RITEK’s liabilities

From the latest balance sheet data, RITEK had liabilities of NT$3.90 billion due within a year and accounts receivable of NT$4.81 billion due thereafter. On the other hand, the company had cash of NT$4.73 billion and accounts receivable of NT$1.72 billion due within a year. So, RITEK’s liabilities total NT$2.27 billion more than its cash and near-term receivables combined.

This deficit is not so bad since RITEK is worth NT$10.6 billion and could thus probably raise enough capital to stabilize its balance sheet if it needed to. Still, it is worth taking a close look at the company’s ability to repay debt. Undoubtedly, we learn the most about debt from the balance sheet. But you can’t look at debt completely in isolation since RITEK needs profits to service that debt. So when thinking about debt, it is certainly worth looking at the earnings trend. Click here for an interactive snapshot.

Over the last 12 months, RITEK has managed to keep its revenue fairly stable and has not been able to report positive earnings before interest and taxes. That’s not exactly impressive, but not too bad either.

Reservation by the buyer

Over the last twelve months, RITEK generated a loss before interest and tax (EBIT). More specifically, the EBIT loss came to NT$369m. Considering that, along with the liabilities mentioned above, we are not very confident that the company should take on so much debt. Frankly, we believe the balance sheet is far from balanced, although it could be improved over time. We would feel better if the company turned its last twelve months loss of NT$194m into a profit. To put it bluntly, we think it is risky. The balance sheet is clearly the area to focus on when analyzing debt. But ultimately, every company can have risks that exist off the balance sheet. We have identified 1 warning signal with RITEK, and understanding them should be part of your investment process.

Of course, if you’re one of those investors who prefers to buy stocks without the burden of debt, you should discover our exclusive list of net cash growth stocks today.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.