Deeanne King, Executive Vice President and Chief People Officer of T-Mobile US Inc (NASDAQ:TMUS), sold 15,437 shares of the company on August 8, 2024. The transaction was reported in a recent SEC filing. Following this sale, the insider now owns 35,588 shares of T-Mobile US Inc.

Over the past year, Deeanne King has sold a total of 39,765 shares of T-Mobile US Inc. and purchased no shares. This recent sale is part of a broader trend seen within the company. Over the past year, there have been 79 insider sales and no insider purchases.

T-Mobile US Inc., a major player in the telecommunications industry, provides a wide range of wireless services to consumers and businesses in the United States. As of the last trading day, T-Mobile US Inc.’s share price was $190, giving the company a market capitalization of approximately $226.59 billion.

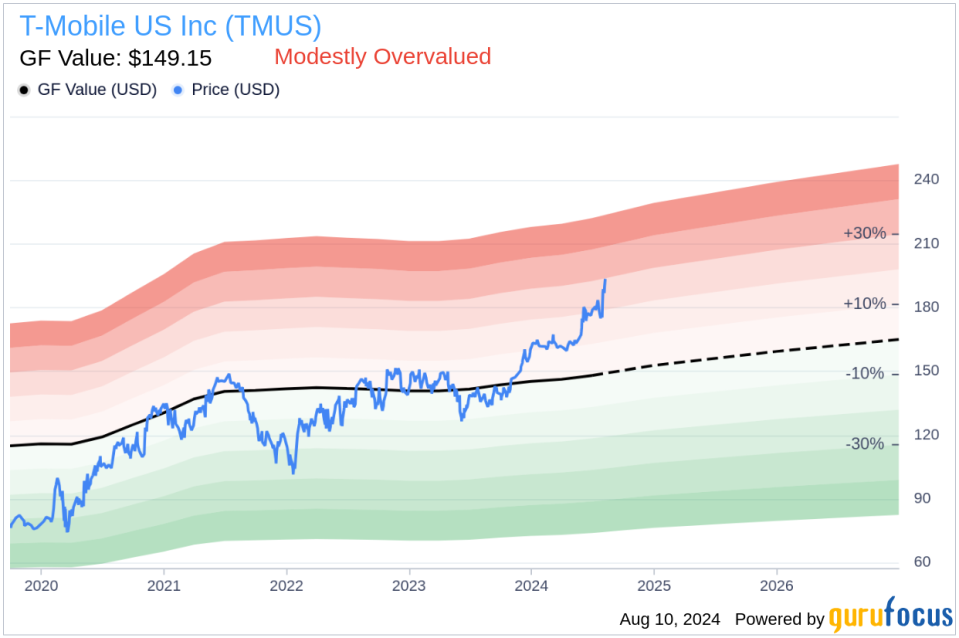

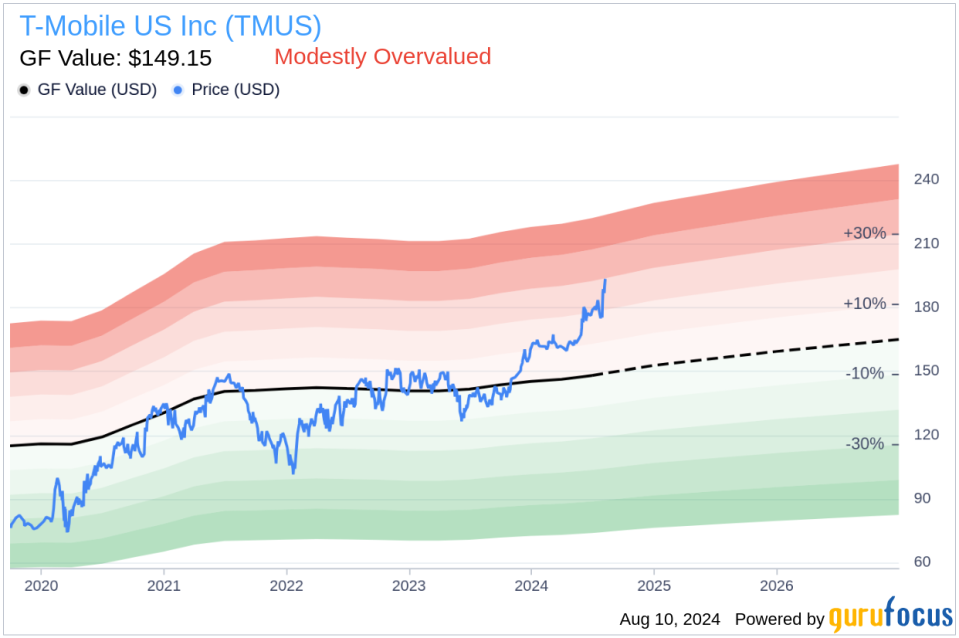

The stock currently has a price-to-earnings ratio of 24.34, which is higher than the industry average of 15.645. This ratio is also lower than the company’s historical median price-to-earnings ratio. GF Value, an estimate of intrinsic value calculated by GuruFocus, is $149.15 per share, which suggests that the stock is slightly overvalued with a price-to-GF Value ratio of 1.27.

The GF value is determined by taking into account historical trading multiples such as price-to-earnings ratio, price-to-sales ratio, price-to-book ratio and price-to-free cash flow together with a GuruFocus adjustment factor based on past earnings and growth as well as Morningstar analysts’ estimates of future business performance.

Investors and analysts closely watch insider transactions as they can provide valuable insight into a company’s financial health and future prospects. The consistent pattern of insider selling at T-Mobile US Inc. may be of interest to shareholders and potential investors.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.