Ethereum gas fees have fallen to their lowest levels in several years due to increasing transactions on the network’s Layer 2 networks.

This significant decline has made on-chain transactions significantly cheaper for users and sparked discussions about their long-term impact on the network.

Reducing Ethereum gas fees leads to increased supply

According to Etherscan data, the average gas fee on the Ethereum mainnet fell below 1 Gwei yesterday, but has since recovered to around 2 Gwei, or about $0.06. However, some transactions can still incur fees of up to 5 Gwei, about $0.22.

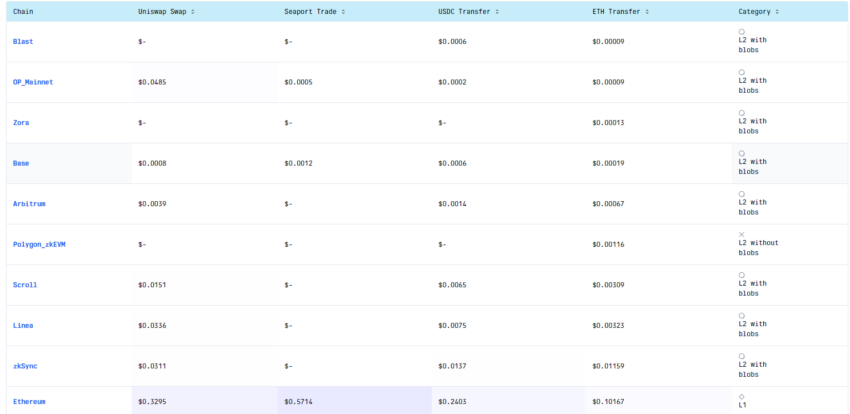

This fee reduction is also noticeable on Ethereum’s Layer 2 scaling solutions. Data from Gasfees.io shows that average fees for Optimism, Base, Arbitrum, and Linea are currently below $0.01.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Market observers said the drop in gas fees could be related to the introduction of blob-based transactions as part of the Dencun upgrade in March. This upgrade significantly increased transaction volume on Layer 2 due to lower fees.

For comparison, data from L2beats shows that prominent Layer 2 networks like Base and Arbitrum now process more transactions per second than Ethereum itself. Last day, Base processed 39.80 transactions per second (TPS) and Arbitrum managed 17.28 TPS. In contrast, Ethereum processed about 12.17 TPS.

These trends have led some stakeholders like Martin Koppelman, co-founder of Gnosis, to advocate for increased Layer 1 activity. Koppelman suggests that increasing the gas limit, even with low fees, could be a strategic move to boost base layer usage.

“In my opinion, Ethereum needs to get more L1 activity again, and while it sounds counterintuitive at such low rates, increasing the gas limit can be part of a strategy,” he explained.

On the other hand, the fee cut has raised concerns about network inflation. With less ETH being burned, the supply on the network has increased.

According to Ultrasound.money, only 120 ETH were burned in the past day, while the supply increased by more than 2,500 ETH. This imbalance indicates a growing ETH supply and counteracts the deflationary trend observed previously.

Read more: How to invest in Ethereum ETFs?

If this trend continues, Ethereum supply could increase by over 943,000 ETH, or $2.5 billion, next year.

Disclaimer

In accordance with the Trust Project’s guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article is intended to provide accurate and up-to-date information, but readers are advised to verify the facts themselves and consult a professional before making any decisions based on this content. Please note that our Terms of Service, Privacy Policy and Disclaimer have been updated.