- XRP is trading at $0.5879 and is approaching the psychologically important $0.60 level.

- Ripple is preparing to launch its stablecoin, even as the SEC chief continues to take a tough stance on crypto regulation.

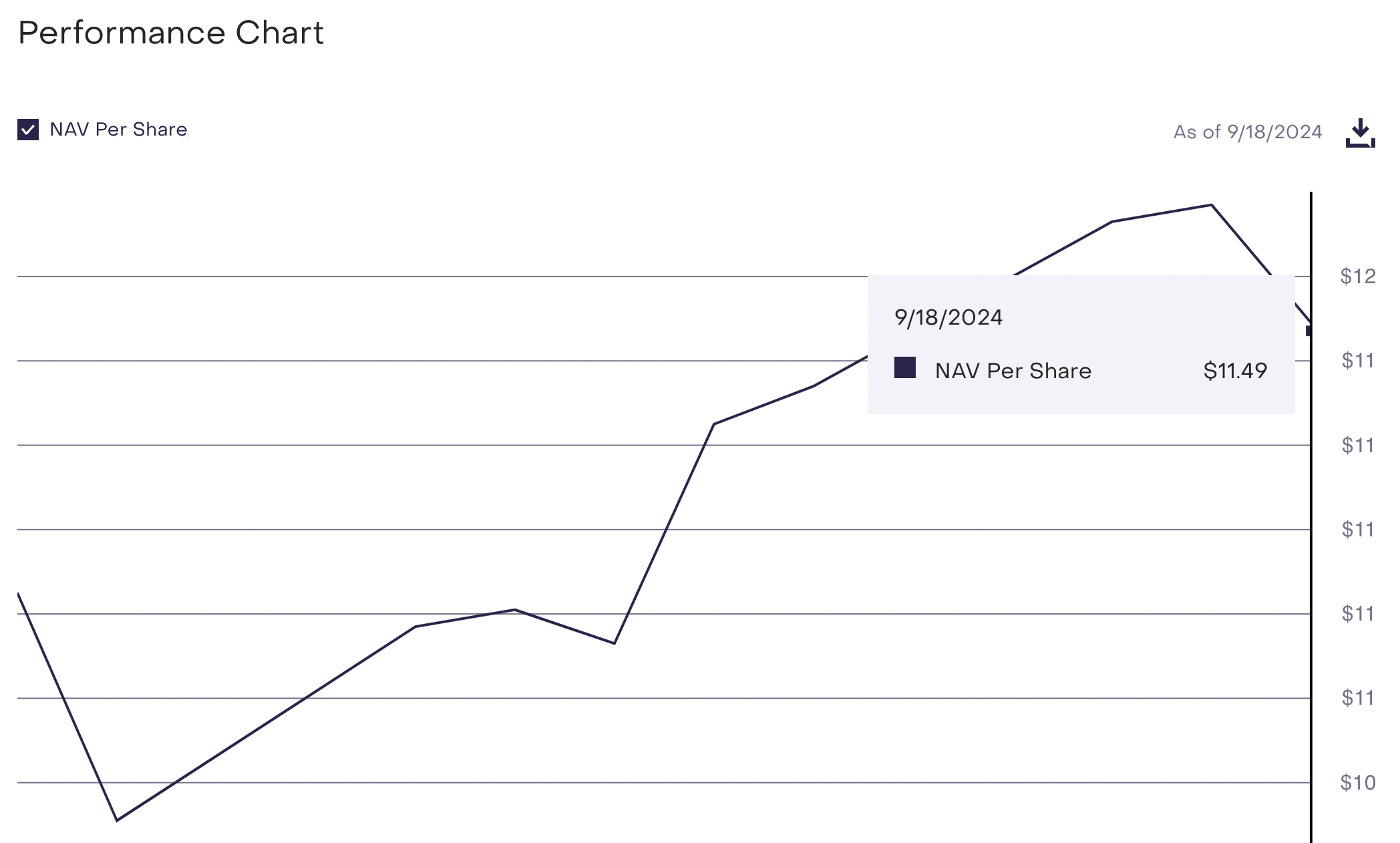

- Grayscale XRP Trust NAV rises to $11.49, indicating growing institutional demand for the asset.

Ripple (XRP) has gained 2.3% since the start of the week. The altcoin’s gains are likely due to key market drivers, including the stablecoin Ripple USD (RUSD), the performance of the Grayscale XRP Trust, and demand for the altcoin among institutional investors.

Grayscale XRP Trust’s net asset value (NAV), a measure of intrinsic value per share, is calculated at the end of each business day, according to its official website. Although NAV does not affect the price of the underlying asset, its trend helps identify the general direction in which the share price is moving. Investors use NAV to determine how the fund’s value has changed, which likely indicates demand among institutional investors.

In addition, the head of the Securities & Exchange Commission (SEC) said in a recent interview that cryptocurrencies are not “inconsistent” with existing securities law.

Daily Market Drivers Overview: XRP Could Rise on These Catalysts

- XRP is approaching the psychologically important $0.6000 level and is trading at $0.5843 early Thursday.

- Ripple, the cross-border payment transfer company, recently announced its plans to launch the Ripple USD (RUSD) stablecoin. The stablecoin aims to connect global financial firms and institutions and enable cross-border payments through its stablecoin on the XRP Ledger (XRPL) and Ethereum mainnet.

- XRP holders are awaiting a launch date for the stablecoin, and further regulatory clarity from the Securities & Exchange Commission is awaited for the launch of RUSD in the US.

- The second market driver is the performance of the Grayscale XRP Trust, Grayscale’s single-asset fund. The official website shows a net asset value of $11.49. The value rose to a high of $11.77 on Tuesday earlier this week.

NAV per share for Grayscale XRP Trust

- The SEC v. Ripple litigation is the third market driver. Although the litigation ended with an apparent partial victory for both parties, there is a likelihood that the regulator will appeal. There has been no comment from the SEC on the appeal. However, in a recent interview with CNBC on Wednesday, Chairman Gary Gensler reiterated the clarity provided by existing securities laws, saying that “this area is not inconsistent with the fundamental protections of the securities laws.”

- Although XRP is clearly legally classified as a non-security when transacted on secondary market platforms or crypto exchanges, it has been treated as a security when sold to institutions. In addition, if the SEC appeals Judge Analisa Torres’ July 2023 ruling, it could strip the altcoin of its non-security status. The “what if” questions have XRP traders on tenterhooks at every step the regulator takes.

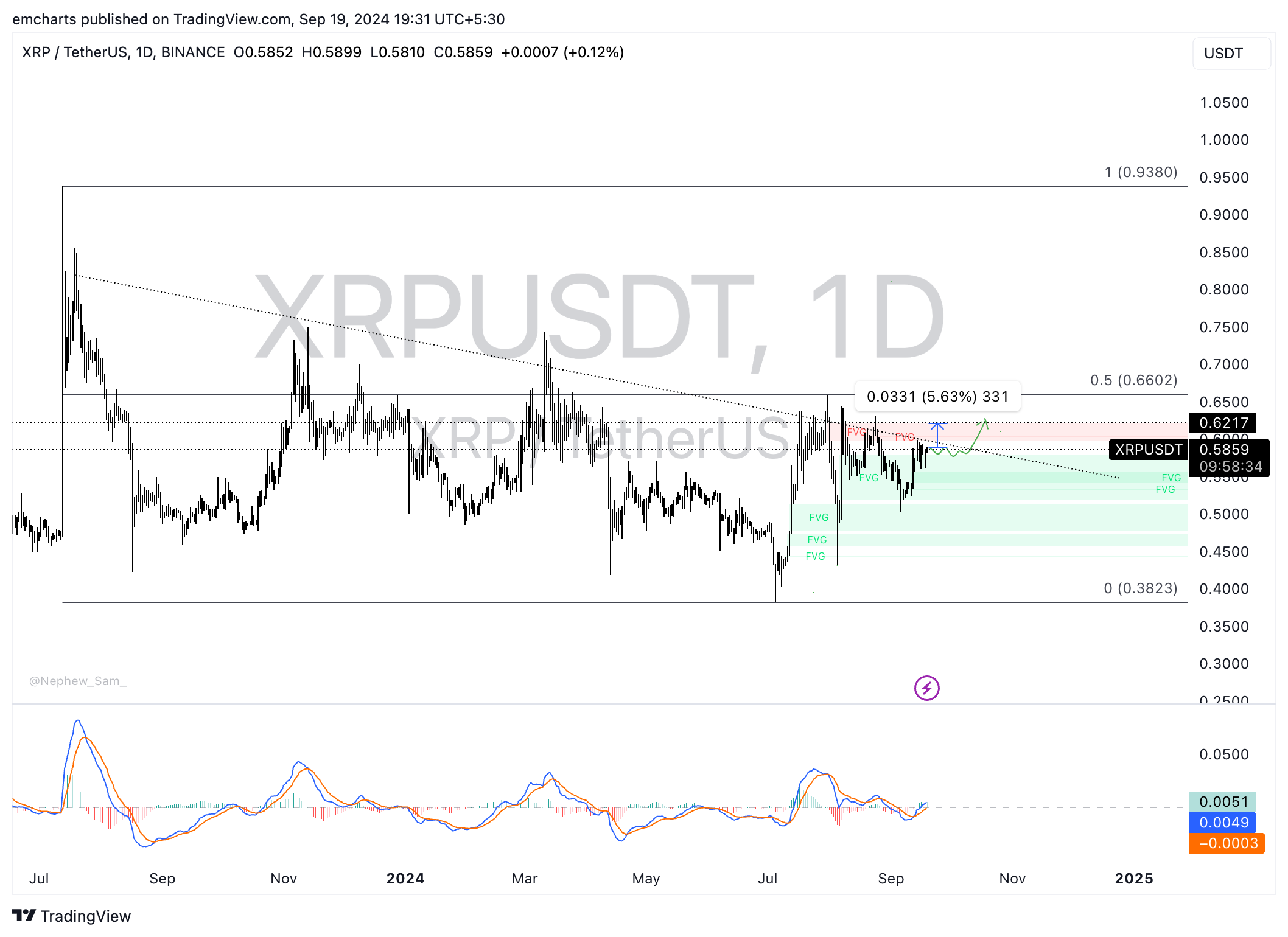

Technical Analysis: XRP Ready for Nearly 6% Gains If $0.5500 Support Holds

XRP made several unsuccessful attempts to break out of its downtrend in July, August, and September. The altcoin traded in a range between the August 7 high of $0.6434 and the September 6 low of $0.5026.

XRP has remained stable above the support at $0.5026 for almost 12 days. The asset has found support at $0.5500. If XRP holds above this level, a move to $0.6217 is likely. This would represent a gain of almost 6% for the altcoin.

The Moving Average Convergence Divergence (MACD) indicator supports the bullish thesis. Green histogram bars above the neutral line signal underlying positive momentum in the XRP price.

XRP/USDT daily chart

A daily candlestick close below $0.5500, a key support for the asset, could invalidate the bullish thesis. XRP could mobilize liquidity in the imbalance zone between $0.5413 and $0.5556.