David Iben put it well when he said, “Volatility is not a risk we care about. What we care about is avoiding permanent loss of capital.” So it seems that smart investors know that debt – which usually accompanies bankruptcies – is a very important factor when assessing the risk of a company. We find that The Israel Land Development Company Ltd. (TLV:ILDC) has debt on its balance sheet. The real question, however, is whether this debt makes the company a risk.

When is debt dangerous?

Generally, debt only becomes a real problem when a company cannot easily repay it, either by raising capital or through its own cash flow. A key part of capitalism is the process of “creative destruction,” in which failed companies are mercilessly liquidated by their bankers. A more common (but nonetheless costly) case, however, is when a company must issue stock at knockdown prices, permanently diluting shareholders’ interest, just to shore up its balance sheet. However, the most common situation is when a company manages its debt reasonably well—and to its own advantage. The first step in looking at a company’s debt levels is to look at its cash and debt together.

Check out our latest analysis on land development in Israel

What is Israel Land Development’s net debt?

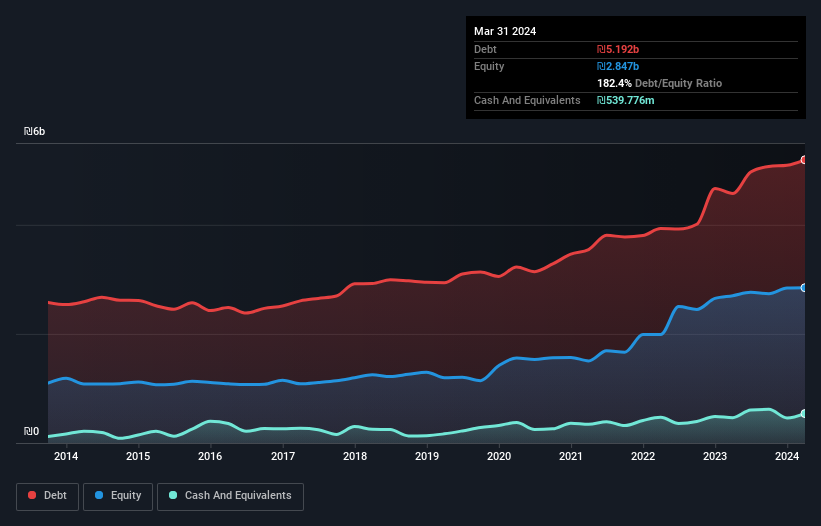

You can click on the chart below to see the historical numbers, but it shows that Israel Land Development had debt of ₪5.19 billion as of March 2024, an increase of ₪4.57 billion over a year. However, since the company has a cash reserve of ₪539.8 million, its net debt is less at about ₪4.65 billion.

A look at the liabilities of the Israel Land Development Authority

Looking more closely at the latest balance sheet data, we can see that Israel Land Development had liabilities of ₪1.41 billion due within 12 months and liabilities of ₪5.06 billion beyond that. Offsetting this, it had ₪539.8 million in cash and ₪210.6 million in receivables due within 12 months. So total liabilities exceed cash and short-term receivables by ₪5.71 billion, combined.

The deficit here weighs as heavily on the Rs 11,160,000-crore company itself as if a child were struggling under the weight of a huge backpack full of books, its sports equipment and a trumpet. So we would no doubt keep a close eye on its balance sheet. Ultimately, Israel Land Development would likely have to undertake a major recapitalization if its creditors demand repayment.

We measure a company’s debt load relative to its earnings power by dividing its net debt by its earnings before interest, taxes, depreciation, and amortization (EBITDA) and calculating how easily its earnings before interest and taxes (EBIT) covers its interest expenses (interest cover). This way, we take into account both the absolute amount of debt and the interest rates paid on it.

Israel Land Development shareholders are doubly affected: they have a high net debt to EBITDA ratio (15.5) and relatively weak interest coverage, given that EBIT is only 1.3 times interest expenses. So the debt burden is significant. Fortunately, Israel Land Development was able to grow its EBIT by 4.0% over the last year and slowly reduce its debt relative to earnings. Undoubtedly, we learn the most about debt from the balance sheet. But you can’t look at debt completely in isolation, given that Israel Land Development needs profits to service that debt. So if you want to learn more about its earnings, it might be worth looking at this graph of its long-term earnings trend.

After all, a company can only pay off its debt with cold hard cash, not accounting profits, so we always check how much of that EBIT is converted into free cash flow. Over the past three years, Israel Land Development has burned through a lot of cash. While investors no doubt expect this situation to reverse in due course, it clearly means using debt is riskier.

Our view

At first glance, Israel Land Development’s EBIT to free cash flow conversion made us skeptical about the stock, and the level of total liabilities was no more enticing than that one empty restaurant on the busiest night of the year. However, the company’s ability to grow its EBIT is not that big of an issue. After looking at the data points discussed, we believe Israel Land Development has too much debt. This kind of risk-taking is fine for some, but we are definitely not comfortable with it. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, any company can contain risks that exist off the balance sheet. Note that Israel Land Development 5 warning signals in our investment analysis and 2 of them are significant …

Of course, if you’re one of those investors who prefers to buy stocks without the burden of debt, you should discover our exclusive list of net cash growth stocks today.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.