According to a new study by BadCredit.org, many financial experts recommend paying no more than thirty percent of your gross income on rent. But is that still possible in 2024, when rents are rising almost daily?

BadCredit.org looked at two key variables – the median annual salary for singles and the average monthly rent cost in 100 major American cities – to determine how much money the typical American spends on rent across the country. Based on the percentage of income spent on rent over the past five years, the study determined the average rent-to-income ratio in each U.S. city.

Key findings:

- Rents are rising faster than incomes. The national rent-to-income ratio has increased by 2.7% in 5 years – from 27.5% in 2018 to 30.1% in 2022.

- Nationally, rents have increased by 32.6% over the past five years, while average income has increased by 20.8%.

- In Miami, rent is 54.9% of a person’s income – currently the highest rent-to-income ratio of any city studied. Over the past 5 years, this figure has increased by 11%.

- The lowest average rent-to-income ratio is in Wichita, Kansas (19.5%). Wichita is the only city analyzed where the average rent is still below $1,000 per month.

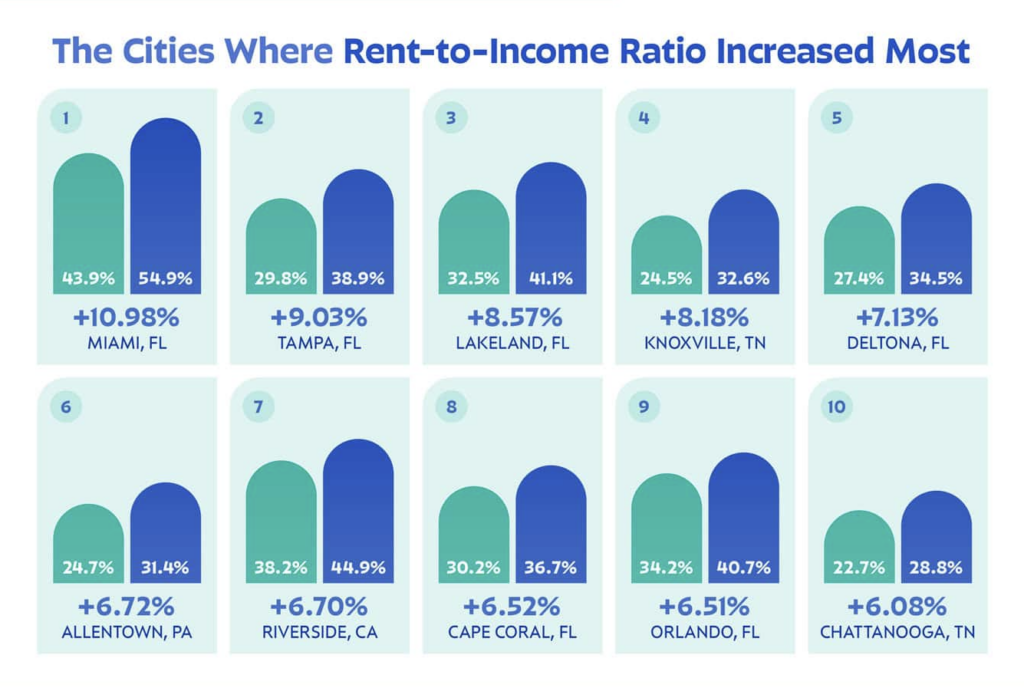

Study of US cities with the biggest changes in rent-to-income ratio

It should come as no surprise that monthly rent has increased by exactly 32.6% since 2018. The bigger problem is that the average American salary has only increased by 20.8% over the same period.

In Miami, rent increases have risen faster than wages, exacerbating inequality. In 2018, Miami residents paid an average of 43.9 percent of their total income on rent. Since then, that share has risen to a staggering 54.9 percent, with the average monthly rent coming in at about $2,600.

In six Florida cities, including Miami, the rent-to-income ratio has risen sharply. Miami, along with Tampa, Lakeland, Deltona, Cape Coral and Orlando, is one of the ten cities in the US where rents are rising faster than wages.

Florida isn’t the only state where these disparities have been noted, however. In Knoxville, Tennessee, the average rent is 32.6% of income. While that seems reasonable, it’s an 8.2% increase from the staggering 24.5% in 2018.

The share of renter income spent on housing has increased by about 6.7% in Allentown, PA, and Riverside, CA. Even though the average monthly rent in Allentown is still under $1,600, it has increased by 36.4% over the past five years. Median income has only increased by 7.2% during that time. In Riverside, CA, rent has increased by 45.7% while incomes have increased by 23.9%.

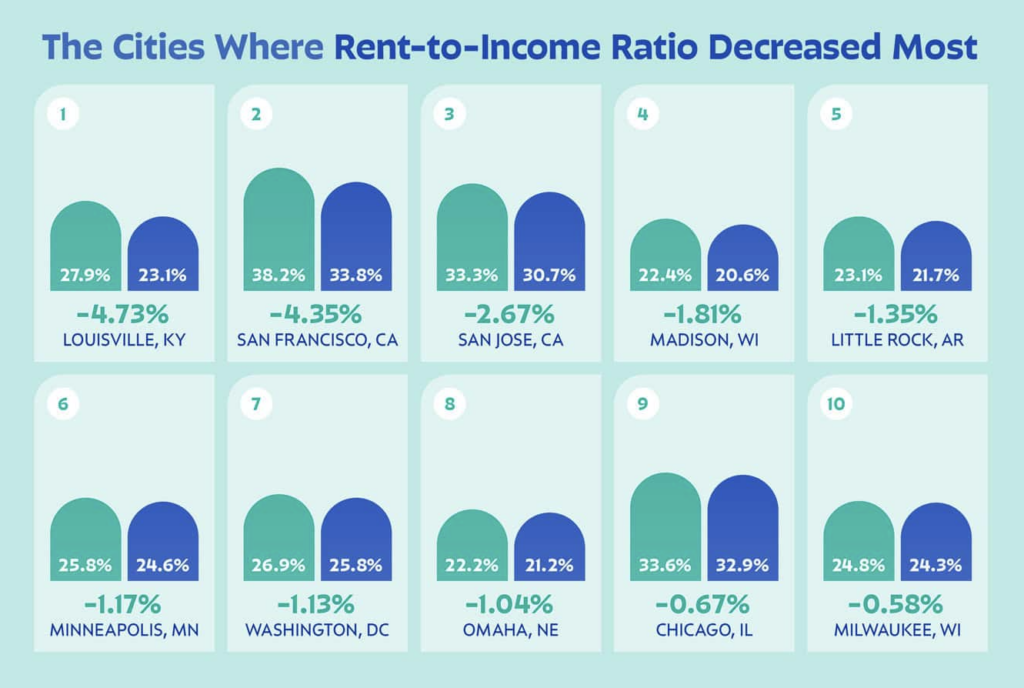

Cities with the smallest changes in rent-to-income ratios see little progress

However, the situation is not discouraging in all cities. In fact, the opposite is true in many regions of the country. Among the sixteen cities where income growth exceeded rent growth is Louisville, Kentucky. Rents increased by only 8.8%, while median income increased by 31.1%.

Although San Francisco and San Jose, California, are known for their high cost of living, the share of monthly income that renters pay for their homes and apartments has also declined there. While the median income in San Jose and San Francisco is $124,348 and $105,929, respectively, rent has risen to $2,986 and $3,176 per month, respectively.

Wichita, Kansas, has the lowest average rent-to-income ratio (19.5%). The only city in the analysis where the average monthly rent is still under $1,000 is Wichita.

Click here to read the full report with additional data, charts and methodology information.