Howard Marks put it well when he said, “The possibility of permanent loss is the risk that worries me… and that worries every practical investor I know.” When we think about how risky a company is, we always like to look at its level of debt, since excessive debt can lead to ruin. China Gas Holdings Limited (HKG:384) comes with debt, but the bigger question is: how much risk is associated with that debt?

When is debt dangerous?

Debt and other liabilities become risky for a company when it cannot easily meet those obligations, either through free cash flow or by raising capital at an attractive price. A key part of capitalism is the process of “creative destruction,” in which failed companies are mercilessly liquidated by their bankers. Although it doesn’t happen too often, we often see indebted companies permanently dilute their shareholders’ interest because lenders force them to raise capital at a fire-sale price. The advantage of debt, of course, is that it often represents cheap capital, especially when it replaces a company’s dilution with the ability to reinvest at high returns. When we examine debt levels, we first look at both cash and debt levels together.

Check out our latest analysis for China Gas Holdings

How high are the debts of the Chinese gas companies?

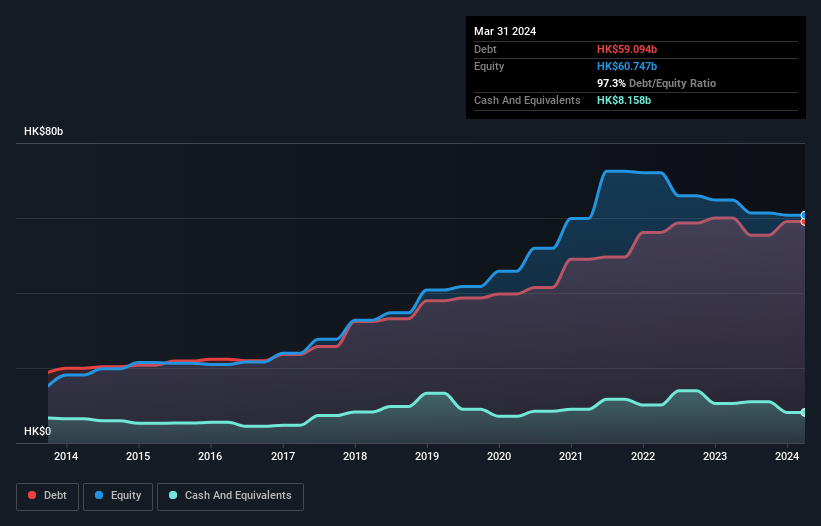

As you can see below, China Gas Holdings had HK$59.1 billion of debt as of March 2024, which is about the same as last year – you can click on the chart for more details. However, this compares to HK$8.16 billion in cash, resulting in net debt of about HK$50.9 billion.

How strong is China Gas Holdings’ balance sheet?

Taking a closer look at the latest balance sheet data, we can see that China Gas Holdings has liabilities of HK$50.4 billion due within 12 months and liabilities of HK$37.6 billion due beyond that. On the other hand, the company had cash of HK$8.16 billion and receivables of HK$24.7 billion due within a year. So, the company’s liabilities total HK$55.1 billion more than its cash and short-term receivables combined.

Considering that this shortfall exceeds the company’s market capitalization of HK$38.9 billion, one might be tempted to take a close look at the balance sheet. Hypothetically, extremely heavy dilution would be required if the company were forced to pay off its debt through a capital raising at the current share price.

We use two main ratios to inform us about debt to earnings. The first is net debt divided by earnings before interest, taxes, depreciation, and amortization (EBITDA), while the second tells us how much earnings before interest and taxes (EBIT) covers interest expenses (or interest cover for short). So we look at debt to earnings both with and without depreciation and amortization expenses.

China Gas Holdings has a fairly high debt to EBITDA ratio of 6.2, suggesting a significant debt load. However, its interest coverage of 3.2 is relatively strong, which is a good sign. Even more worrying is the fact that China Gas Holdings actually let its EBIT shrink by 5.8% over the last year. If this earnings trend continues, the company will have an uphill battle ahead of it to pay down its debt. The balance sheet is clearly the area to focus on when analyzing debt. But ultimately, the company’s future profitability will determine whether China Gas Holdings can strengthen its balance sheet over time. So if you want to know what the professionals think, you might find this free report on analyst earnings forecasts interesting.

Finally, while the tax authorities love retained earnings, lenders only accept cash. So we need to check whether that EBIT is also leading to a corresponding free cash flow. Over the last three years, China Gas Holdings’ free cash flow was 49% of its EBIT, which is less than expected. This weak cash conversion makes it difficult to manage debt.

Our view

At first glance, the level of China Gas Holdings’ total liabilities made us skeptical about the stock, and its net debt to EBITDA ratio was no more enticing than that one empty restaurant on the busiest night of the year. However, the company’s ability to convert EBIT to free cash flow is not such a big issue. We should also note that companies in the gas utility industry like China Gas Holdings often take on debt with ease. Overall, China Gas Holdings’ balance sheet seems to us to be quite a risk for the company. For this reason, we are quite cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analyzing debt levels, the balance sheet is the obvious place to start. However, not all investment risks lie in the balance sheet – quite the opposite. For example, we found that 1 warning signal for China Gas Holdings that you should know before investing here.

Ultimately, it’s often better to focus on companies that have no net debt. You can access our special list of such companies (all with a track record of earnings growth). It’s free.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.