The Board of Restaurant Brands International Inc. (NYSE:QSR) announced it will declare a dividend on October 4, with investors receiving $0.58 per share. This brings the annual payment to 3.3% of the share price, which is above what most companies in the industry pay.

Check out our latest analysis for Restaurant Brands International

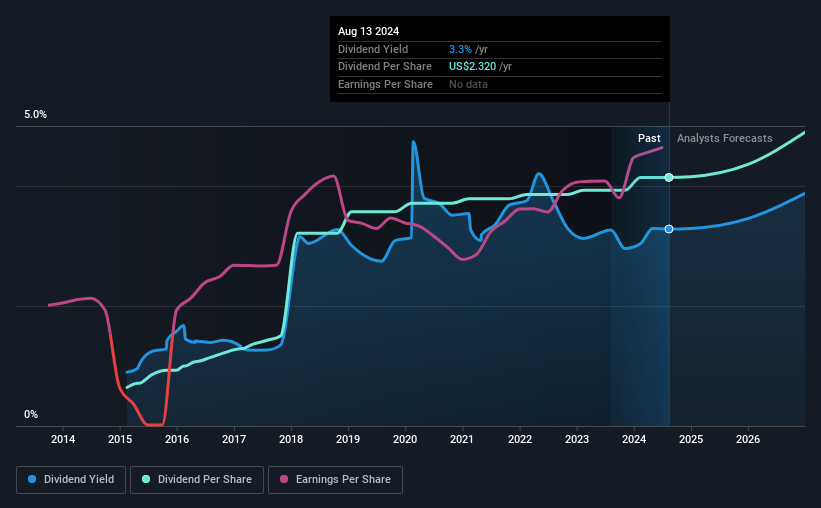

Restaurant Brands International’s earnings easily cover the distributions

We like to see solid dividend yields, but that doesn’t matter if the payment isn’t sustainable. Before this announcement, Restaurant Brands International was comfortably covering its dividend with earnings and paying out more than 75% of its free cash flow to shareholders. Paying out such a high proportion of its cash flow could suggest that the company has limited opportunities for investment and growth.

Next year, EPS is expected to grow by 14.7%. Assuming dividend payout remains the same as before, we believe the payout ratio next year could be 59%, which is in a fairly sustainable range.

Restaurant Brands International continues to build on its track record

Restaurant Brands International’s dividend has been fairly stable for some time, but we’ll continue to remain cautious until it has a few more years of proving itself. Since 2015, the dividend has increased from a total of $0.36 annually to $2.32. That means payouts have grown 23% annually during that time. Restaurant Brands International has been growing its dividend fairly quickly, which is exciting. However, its short payment history makes us doubt whether this trend will continue over a full market cycle.

The dividend is likely to increase

Investors who have held shares in the company over the past few years will be pleased with the dividends they have received. It is encouraging to see that Restaurant Brands International has grown earnings per share at 12% per year over the past five years. The company is paying shareholders a reasonable profit and growing its earnings at a decent rate, so we believe it could be a decent dividend stock.

In summary

Overall, we’re always happy to see dividend increases, but we don’t think Restaurant Brands International will be a good dividend stock. The low payout ratio is a positive, but overall we’re not too happy with Restaurant Brands International’s payments. We don’t think Restaurant Brands International is a good stock for your portfolio if your focus is on dividend payments.

Market movements show how much a consistent dividend policy is valued compared to a more erratic one. At the same time, there are other factors that our readers should be aware of before putting capital into a stock. Just as an example: We are on 2 warning signs for Restaurant Brands International You should be aware of these, and one of them is significant. Looking for more high-yield dividend ideas? Try our Collection of strong dividend payers.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.