Retail giant Walmart Inc WMT could give analysts and investors a better picture of how inflation is affecting consumer spending and shopping behavior when the company reports second-quarter financial results before the stock market opens on Thursday.

Earnings estimates: According to data from Benzinga Pro, analysts expect Walmart to report second-quarter revenue of $168.57 billion.

The company reported sales of $161.63 billion in the second quarter of last year. Walmart has now exceeded analysts’ sales estimates for 17 consecutive quarters.

Analysts expect Walmart to report earnings per share of 64 cents in the second quarter, compared to 61 cents per share in the second quarter last year. Walmart has beaten analysts’ earnings estimates in eight of the last 10 quarters. Walmart has beaten or met estimates in eight consecutive quarters.

Walmart expects earnings per share for the second quarter to be in the range of 62 to 65 cents.

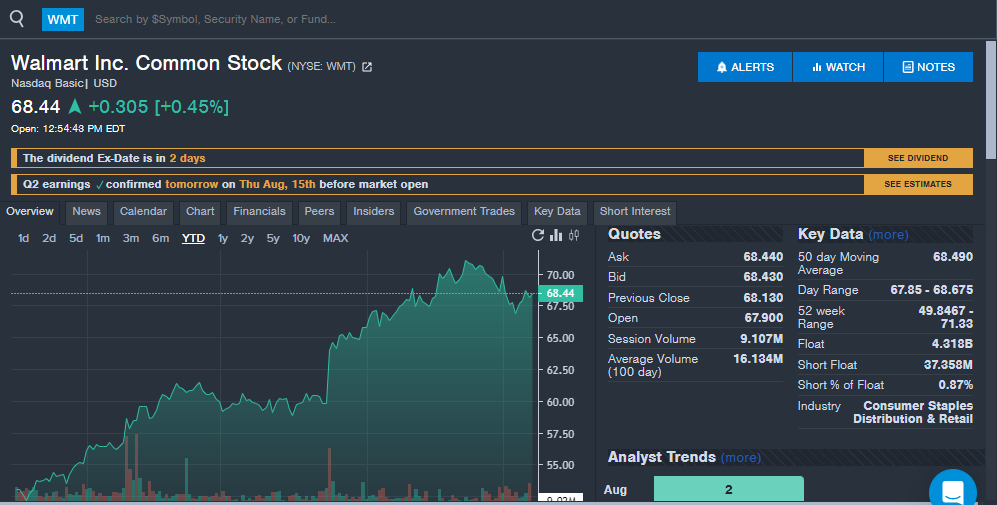

The earnings report includes a 30% year-to-date increase in Walmart shares, as shown in the Benzinga Pro chart below, outperforming many broad stock market indexes.

Also read: Benzinga’s Stock Whisper Index: 5 Stocks Investors Are Secretly Watching But Aren’t Talking About Yet

What experts say: Walmart could be a “safe haven in weak markets,” JPMorgan analyst Christopher Horvers said in a recent note to investors.

The analyst has an Overweight rating and a price target of $81. Walmart could beat earnings estimates and raise its forecast, something rare in the retail sector of late, Horvers said.

“Defense and offense win championships,” he added.

The analyst said Walmart investors are becoming increasingly concerned about a possible slowdown in consumption.

“Our mid-July Nielsen analysis suggested upside potential in U.S. grocery stores as value players continue to gain market share and grocery price differentials widen.”

Horvers said it’s possible Walmart was cautious about its sales forecast for the second half of 2024.

“WMT is probably one of the few stories in retail where prices are rising and beating expectations. The company continues to gain share and is a safe stock.”

Data from Placer.ai suggests potential for higher customer traffic in the second quarter: Compared to the same period last year, Walmart saw visits increase by 3.9% and Sam’s Club by 7.5%.

Jay Woods, chief global strategist at Freedom Capital Markets, highlighted Walmart as one of the most important earnings reports of the week when he outlined the stock’s technicals in his weekly newsletter.

“Walmart remains the crème de la crème in retail and consumer goods,” Woods said.

Woods said Walmart hopes to break the trend of stock prices exceeding profit margins and not see a new uptrend.

“The downside is that companies that miss their targets tend to crash quickly, testing key support areas.”

Important points to pay attention to: Walmart’s earnings report could reveal important insights into consumer shopping trends, including order size, shifts from name-brand to private label, and more.

With inflation concerns easing, Walmart might take a look to see if this means volume on higher-priced items has increased.

Another important point to keep an eye on could be Walmart’s e-commerce sales. The company reported a 21% increase in e-commerce sales in the first quarter.

Walmart also reported a 24% increase in advertising revenue in the first quarter, which could also be a key point in Thursday’s report.

WMT price promotion: Walmart shares are trading at $68.44 on Wednesday, compared with a 52-week trading range of $49.85 to $71.33.

Read more:

Market news and data provided by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.