Although fewer checks are written these days, check fraud is still common and on the rise, and many victims may not even know it has happened to them.

This was the case when the News4 I-Team recently knocked on the door of a man in Falls Church, Virginia.

“Oh, I’m becoming an expert,” he told investigative consumer reporter Susan Hogan. “I probably know as much about this crap as anyone.”

He agreed to speak to News4 on condition of anonymity as this was not the first time he had dealt with stolen checks.

“This blew me away,” he said.

How the check was stolen

Six of the man’s checks, which he wrote and mailed in July, were stolen and found for sale on the social media app Telegram, along with dozens of other checks from the Falls Church and Arlington areas.

“So it looks like the criminals targeted one or two specific mailboxes in those specific areas,” said David Maimon, director of the Evidence-Based Cybersecurity Research Group at Georgia State University.

His team recently discovered the stolen checks online.

“The team monitors hundreds of groups every day, trying to find interesting information for us to work with, as well as watching trends in the ecosystem to really understand what the criminals are working on, what sought-after commodities they have available and what they are offering for sale,” Maimon said.

He said the sheer number of stolen checks, all from the same area, and the private information blatantly displayed quickly caught his team’s attention.

“Not even the addresses and names of the victims were published – that was quite unusual in this ecosystem,” Maimon said.

When checks are stolen through the mail, identity theft experts say they are typically laundered and the ink removed, allowing criminals to change the payee’s name and the amount.

Checks are sold online to the highest bidder and are often bundled with other stolen information, said James Lee of the Identity Theft Resource Center.

“They’re not selling them so much on the dark web, but now on YouTube, Telegram and other channels that are openly accessible. The volume is so high that they don’t have to hide it, and they’re now linking it to a full set of credentials,” he said. “You can get checks, driver’s licenses, ID cards and debit cards all tied to the same identity – all tied to the same accounts.”

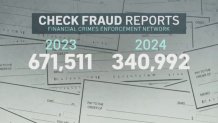

The I-Team found that banks filed nearly 700,000 suspicious activity reports for check fraud with the Financial Crimes Enforcement Network last year, and they have filed more than 340,000 reports so far in 2024.

The Falls Church homeowner said he was the third victim of check fraud.

“The first time this happened, about eight months ago, the check was forged. I think it was maybe a utility bill. So let’s say $200. And I think the check was worth over $100,000,” he said.

Fortunately, his banks noticed the suspicious activities.

“So far I haven’t lost any money, but I’ve had a lot of trouble,” he said.

The U.S. Postal Inspection Service, which investigates mail theft, would not confirm to the I-Team whether the case of the stolen checks in Falls Church was being investigated.

How to avoid becoming a victim of check fraud

The safest way to avoid check fraud is simply not to write checks, Lee said.

“If you have to write a check … do it in a way that you know when it’s going to be sent and can check it along the way. So if it’s that important, then have it tracked,” he said. “If not, check with the organization after a certain time to see if you received my check. That way you can track it if it doesn’t arrive on time.”

If possible, avoid putting checks in blue mailboxes, Lee advised.

The victim of the Falls Church check fraud said he has now started doing so.

“I don’t put anything in the mailbox anymore. I go straight to the post office,” he said.

However, this did not seem to prevent the recent financial frustration.

If you discover that your checks have been stolen, Lee advises you to:

- Notify your bank immediately

- apply for a new checking account number

- block your credit

- Sign up for alerts on your accounts to monitor activity

Reporting by Susan Hogan, produced by Rick Yarborough, shot by Lance Ing and Carlos Olazagasti, edited by Carlos Olazagasti.