On August 15, 2024, Philip Fracassa, Executive Vice President and Chief Financial Officer of The Timken Co (NYSE:TKR), sold 10,000 shares of the company’s stock at a price of $81.98 per share. The transaction was documented in an SEC filing. Following this sale, the insider now owns 95,541 shares of The Timken Co.

Timken Co., based in North Canton, Ohio, is a global leader in engineered bearings and power transmission products and services. The company’s offerings help improve the reliability and efficiency of machines and equipment around the world.

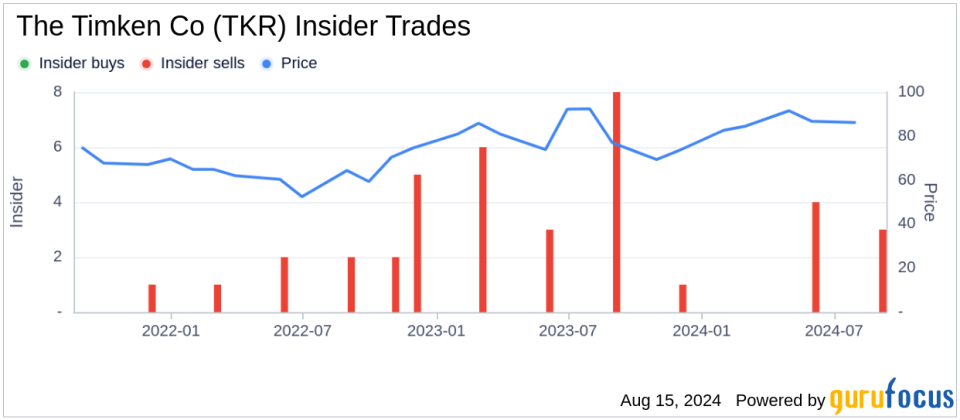

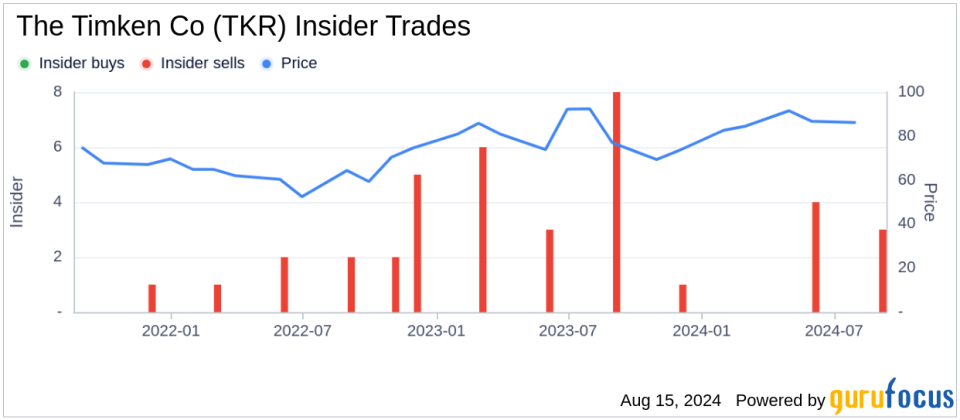

Over the past year, Philip Fracassa has sold a total of 30,000 shares of The Timken Co and made no purchases. This recent sale is part of a broader trend within the company, where there were 14 insider sales and no insider purchases over the past year.

The Timken Co’s shares were trading at $81.98 on the day of the sale, giving the company a market capitalization of around $5.814 billion. The stock’s price-to-earnings ratio is 16.99, below the industry average of 21.71, suggesting a potentially lower valuation compared to peers.

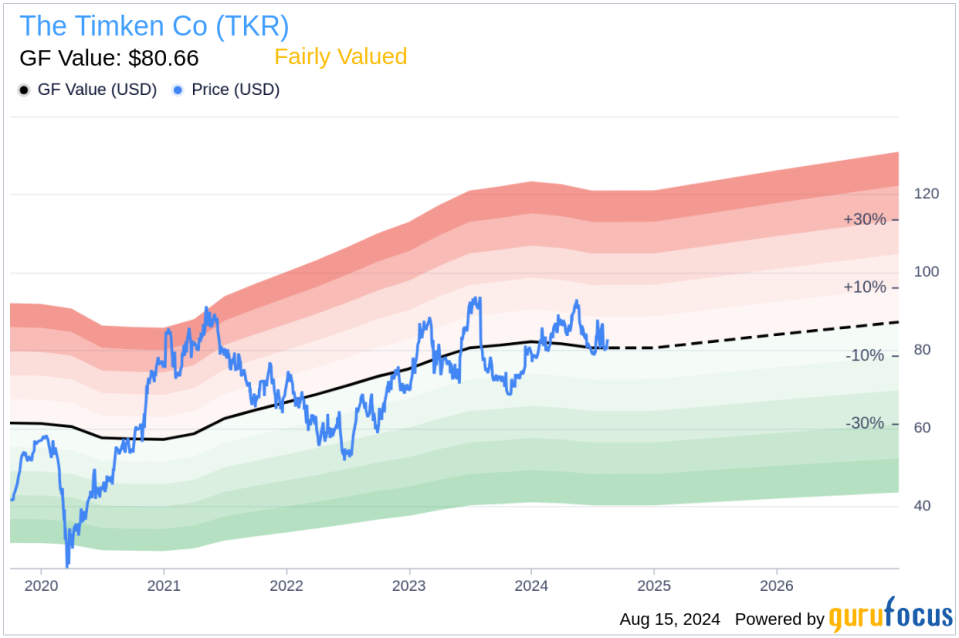

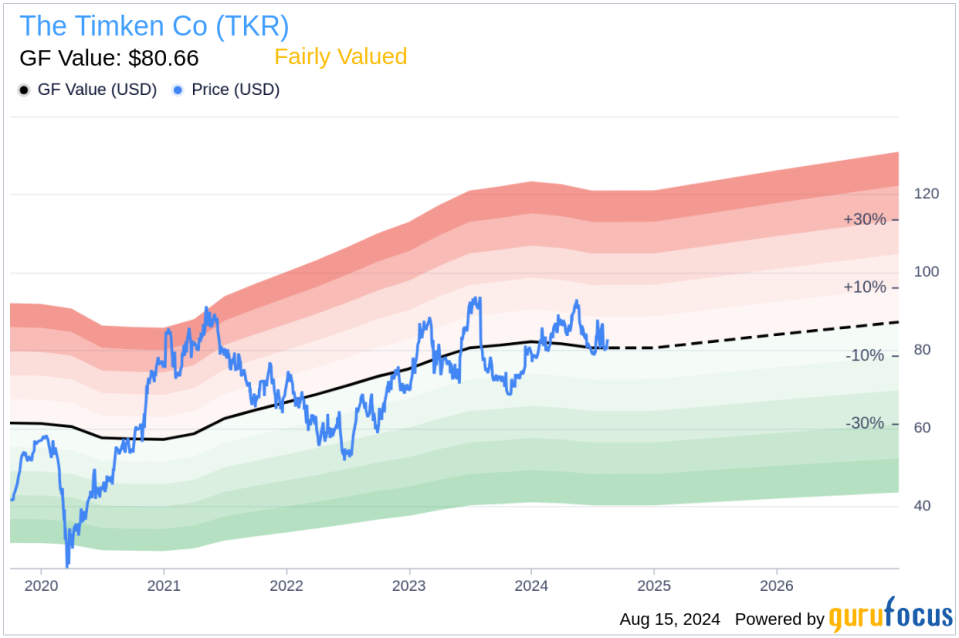

The stock is valued at $80.66 according to GF Value, resulting in a price to GF Value ratio of 1.02. This suggests that The Timken Co is fairly valued based on its GF Value, which takes into account historical trading multiples, an adjustment factor based on past performance, and estimates of future business development.

This insider activity and valuation analysis provides a snapshot of financial movements within Timken Co. and reflects ongoing adjustments to insider holdings and the market valuation of the company.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.