David Iben put it well when he said, “Volatility is not a risk we care about. What we care about is avoiding permanent loss of capital.” So it seems that smart investors know that debt – which usually accompanies bankruptcies – is a very important factor when assessing the risk of a company. As with many other companies Jiangsu Zhongtian Technology Co., Ltd. (SHSE:600522) is taking on debt. But should shareholders be concerned about the use of debt?

Why is debt risky?

Debt helps a company until it struggles to pay it back with either new capital or free cash flow. If things go really bad, lenders can take control of the company. However, a more common (but still painful) scenario is that new equity must be raised at a low price, permanently diluting shareholders. By replacing dilution, however, debt can be an extremely good tool for companies that need capital to invest in growth with high returns. When we think about a company’s use of debt, we first look at cash and debt together.

Check out our latest analysis for Jiangsu Zhongtian Technology

How much debt does Jiangsu Zhongtian Technology have?

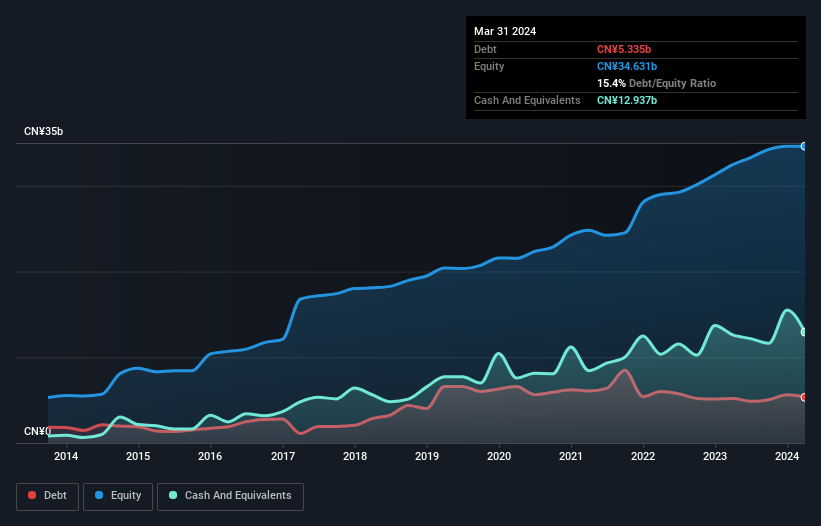

As you can see below, Jiangsu Zhongtian Technology had CN¥5.34 billion in debt as of March 2024, which is about the same as last year. You can click on the chart to see more details, but the balance sheet shows that the company holds CN¥12.9 billion in cash, so it actually has CN¥7.60 billion in net cash.

How healthy is Jiangsu Zhongtian Technology’s balance sheet?

According to the last balance sheet, Jiangsu Zhongtian Technology had CNY17.2 billion in liabilities due within 12 months and CNY2.12 billion in accounts payable due after 12 months. These liabilities were offset by CNY12.9 billion in cash and CNY15.9 billion in receivables due within 12 months. So the company actually has CNY9.47 billion in assets. more Liquid assets are greater than total liabilities.

This excess liquidity suggests that Jiangsu Zhongtian Technology is cautious with debt. Since the company has sufficient short-term liquidity, we do not expect it to have any problems with its lenders. In short, Jiangsu Zhongtian Technology has net cash, so it is fair to say that the company does not have a high debt burden!

On the other hand, Jiangsu Zhongtian Technology saw its EBIT decline by 8.5% over the last twelve months. Such a decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when analyzing debt. But it is future earnings, more than anything, that will determine whether Jiangsu Zhongtian Technology can maintain a healthy balance sheet going forward. So, if you’re focused on the future, you might want to look at free Report with analysts’ profit forecasts.

After all, a business needs free cash flow to pay off debt; retained earnings just aren’t enough to do that. While Jiangsu Zhongtian Technology has net cash on its balance sheet, it’s still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow to understand how quickly it builds (or burns through) that cash pile. Over the last three years, Jiangsu Zhongtian Technology’s free cash flow was 34% of its EBIT, less than we would have expected. This weak cash conversion makes it difficult to handle debt.

Summary

While it always makes sense to examine a company’s debt, in this case Jiangsu Zhongtian Technology has CN¥7.60b in net cash and a decent looking balance sheet. Therefore, we are not concerned with Jiangsu Zhongtian Technology’s debt load. We consider tracking how fast earnings per share are growing, if at all, to be more important than most other metrics. If you recognized that too, you’re in luck, because today you can check out this interactive graph of Jiangsu Zhongtian Technology’s earnings per share history for free.

Ultimately, it’s often better to focus on companies that have no net debt. You can access our special list of such companies (all with a track record of earnings growth). It’s free.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.