There is no doubt that you can make money by buying stocks in unprofitable companies. Software-as-a-service company Salesforce.com, for example, made losses for years while increasing its recurring revenue. However, anyone who held stocks since 2005 would have made a lot of money. The harsh reality, however, is that a great many loss-making companies burn through all their cash and go bankrupt.

The natural question for Deputy Surgery (NYSE:RBOT) shareholders are wondering if they should be concerned about its cash burn percentage. In this report, we will look at the company’s annual negative free cash flow, which will be referred to as its “cash burn”. We start by comparing cash burn to cash reserves to calculate cash runway.

Check out our latest analysis for Vicarious Surgical

How long will Vicarious Surgical’s liquidity reserve last?

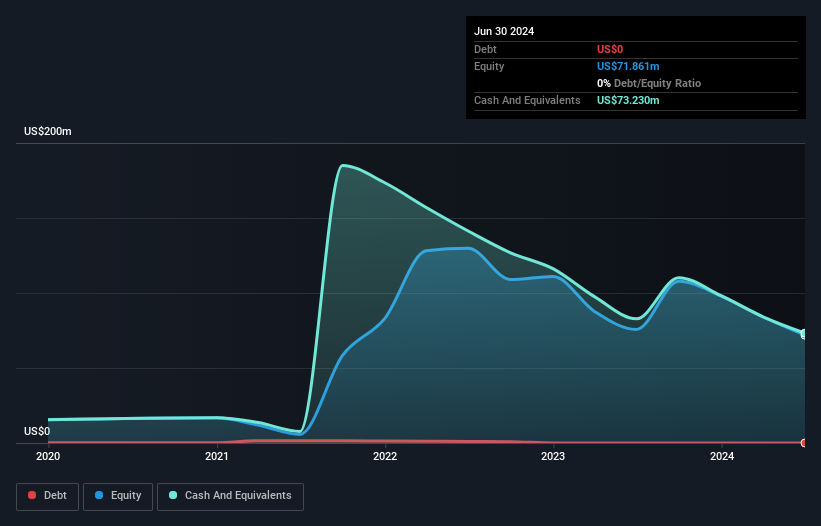

A company’s cash runway is calculated by dividing its cash balance by its cash burn. As of June 2024, Vicarious Surgical had cash of $73 million and no debt. Over the last year, its cash burn was $60 million. So as of June 2024, it had a cash runway of roughly 15 months. That’s not too bad, but it’s fair to say the end of the cash runway is in sight unless cash burn reduces drastically. In the image below, you can see how cash balance has changed over time.

How does Vicarious Surgical’s cash burn change over time?

Vicarious Surgical didn’t report any revenue over the last year, suggesting it’s an early-stage company still developing its business. So we can’t look to revenue to understand growth, but we can look at how cash burn is changing to understand how expenses are trending over time. In fact, the company’s cash burn is down 13% over the last year, suggesting management is maintaining a fairly stable business trajectory, albeit with slightly lower expenses. While it’s always worth studying the past, it’s the future that matters most, and for that reason it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Vicarious Surgical easily raise more money?

While Vicarious Surgical is showing a solid reduction in its cash burn, it’s still worth considering how easily the company could raise more cash, even if just enough to grow faster. Issuing new shares or taking on debt are the most common ways for a publicly traded company to raise more money for its business. Typically, a company will sell new shares to raise cash and fuel growth. By comparing a company’s annual cash burn to its total market capitalization, we can roughly estimate how many shares it would need to issue to keep the company running for another year (assuming the same burn rate).

Vicarious Surgical’s $60 million cash buy represents approximately 194% of its $31 million market cap. Given the size of this expenditure relative to the company’s market value, we believe there is an increased risk of financing issues and we would be very nervous holding the stock.

So should we be worried about Vicarious Surgical’s cash burn?

While we are a little concerned about the cash burn relative to market capitalization, we must mention that we found Vicarious Surgical’s reduction in cash burn to be relatively promising. Considering all the measures mentioned in this report, we believe the cash burn is quite risky and if we were holding shares, we would be watching like a hawk for any deterioration. Upon closer inspection, we discovered the following: 6 warning signs for Vicarious Surgical You should be aware of these, and three of them cannot be ignored.

Naturally, If you look elsewhere, you may find a fantastic investment. So take a look at the free List of companies with significant insider holdings and this list of growth stocks (according to analyst forecasts)

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.