Korea Gas Corporation (KRX:036460) shares have continued their recent run, posting a 26% gain in the last month alone. The latest month caps off a massive 109% increase over the last year.

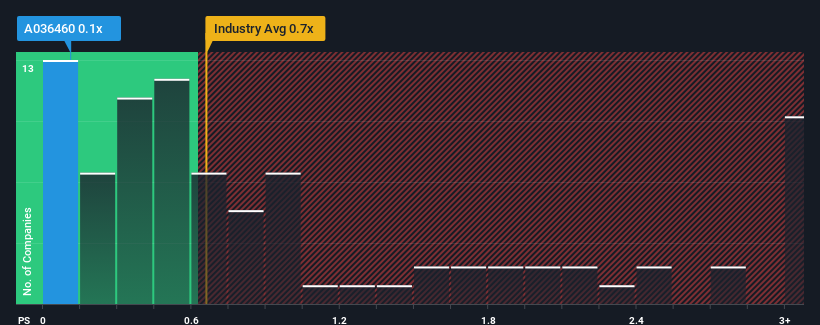

Despite the significant price increase, one might not be indifferent to Korea Gas’s P/S ratio of 0.1, as the median price-to-sales (or “P/S”) ratio for the gas utility industry in Korea is about the same. While this may not be surprising, if the P/S ratio is not justified, investors could miss out on a potential opportunity or ignore an impending disappointment.

Check out our latest analysis on Korea Gas

What is Korea Gas’s recent performance?

Korea Gas has been very sluggish recently, with revenue declining more than the industry average. Perhaps the market expects future revenue performance to be in line with the rest of the industry, which has prevented the P/S from declining. If you still believe in the company, you would much prefer to see the company grow its revenue. If not, existing shareholders may be a little concerned about the profitability of the share price.

If you want to know what analysts are predicting for the future, you should check out our free Report on Korea Gas.

What do the sales growth metrics tell us about the P/S?

A P/S ratio like Korea Gas’s is only safe if the company’s growth is closely in line with that of the industry.

Looking back, last year saw a frustrating 29% drop in sales. However, despite the last 12 months as a whole, sales have increased by an admirable 92% year-on-year. While shareholders would have liked to see the upswing continue, they would definitely welcome medium-term sales growth rates.

As for the outlook, the company is expected to grow at a rate of 0.09% per year over the next three years, according to estimates from nine analysts covering the company. With the industry forecast to grow at a rate of 4.2% per year, the company is likely to see a weaker top-line performance.

With this in mind, it is curious that Korea Gas’s price-to-earnings ratio is in line with most other companies. It seems that most investors ignore the fairly limited growth expectations and are willing to pay more to own the stock. These shareholders may be setting themselves up for future disappointment if the price-to-earnings ratio falls to a level more in line with the growth prospects.

What can we learn from Korea Gas’s P/S?

Korea Gas’s stock has gained a lot of momentum recently, bringing its price-to-sales ratio in line with the rest of the industry. Normally, we would caution against reading too much into the price-to-sales ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

Our look at analyst forecasts for Korea Gas’s revenue outlook has shown that the weaker revenue outlook is not having as much of a negative impact on the price-to-sales ratio as we would have expected. When we see companies with relatively weaker revenue outlooks compared to the industry, we suspect the share price could decline, driving the modest price-to-sales ratio down. A positive change is needed to justify the current price-to-sales ratio.

You always have to keep an eye on risks, for example: Korea Gas has 2 warning signals In our opinion, you should be aware of this.

If you like strong, profitable companies, then you should check this out free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

Valuation is complex, but we are here to simplify it.

Find out if Korea Gas could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.