Just because a company isn’t making money doesn’t mean the stock will fall. For example, although Amazon.com was loss-making for many years after it went public, if you had bought and held the stock since 1999, you would have made a fortune. But while history celebrates these rare successes, the failures are often forgotten; who remembers Pets.com?

Given this risk, we wanted to check whether Dada Nexus (NASDAQ:DADA) shareholders should be concerned about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends money to fund its growth; its negative free cash flow. First, we determine its cash runway by comparing its cash burn to its cash reserves.

Check out our latest analysis for Dada Nexus

How long is Dada Nexus’ cash runway?

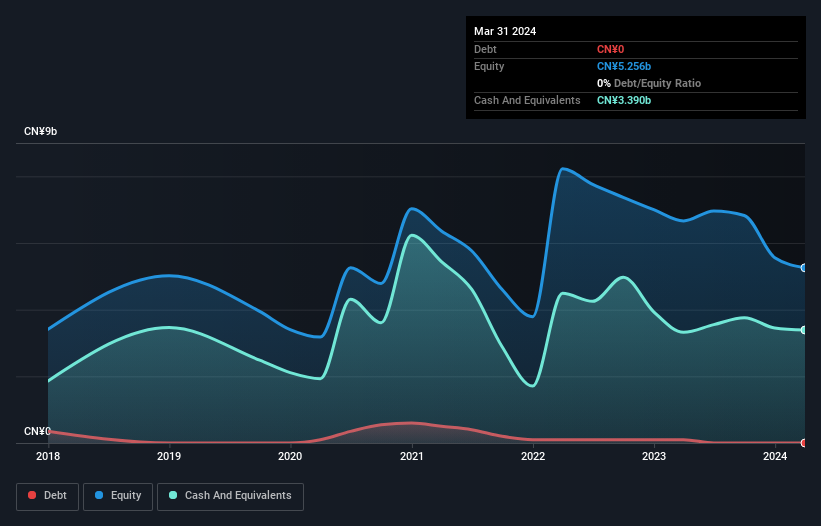

A company’s cash runway is the time it would take, at its current cash burn rate, to burn through its cash reserves. When Dada Nexus released its March 2024 balance sheet in May 2024, it had no debt and cash worth CNY3.4 billion. Over the last year, the company burned through CNY388 million. This means it had a cash runway of about 8.7 years through March 2024. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash holdings have changed over time in the image below.

How well does Dada Nexus grow?

We think it’s quite encouraging that Dada Nexus has been able to reduce its cash burn by 52% over the last year. And operating income has also grown by 5.5%. Taking the above factors into account, the company doesn’t fare too badly when assessing its performance over time. However, the key question is clearly whether the company will grow its business in the future. For this reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How difficult would it be for Dada Nexus to raise more money for growth?

While Dada Nexus appears to be in a decent position, we still think it’s worth considering how easily the company could raise more cash if it were to desire. Companies can raise capital either through debt or equity. One of the key advantages of publicly traded companies is that they can sell shares to investors to raise money and fund growth. By looking at a company’s cash burn relative to its market capitalization, we gain insight into the dilution that shareholders would face if the company had to raise enough cash to cover another year’s worth of cash burn.

Dada Nexus’ cash burn of CN¥388 million represents about 16% of its market capitalization of CN¥2.5 billion, so we believe the company could raise more cash for growth without much difficulty, albeit at the cost of some dilution.

So should we be worried about Dada Nexus’ cash burn?

You may already be aware that we are relatively happy with the way Dada Nexus is burning its cash. In particular, we think its cash runway is clear evidence that the company has a good handle on its expenses. In this analysis, its revenue growth was its weakest feature, but we are not worried about that. Based on the factors mentioned in this article, we think its cash burn situation deserves some attention from shareholders, but we do not think they should be concerned. It is important that readers are aware of the risks that may affect the company’s operations, and we have selected the following 1 warning sign for Dada Nexus what investors should know when investing in the stock.

If you would rather try another company with better fundamentals, don’t miss this free List of interesting companies with HIGH return on equity and low debt or this list of stocks forecast to grow.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.