Just because a company isn’t making money doesn’t mean the stock will fall. Biotech and mining companies, for example, often lose money for years before they have success with a new treatment or mineral discovery. But while the successes are well known, investors shouldn’t ignore the many unprofitable companies that simply burn through all their cash and collapse.

The natural question for Research boundaries (NASDAQ:REFR) shareholders should be concerned about cash burn. In this article, we define cash burn as annual (negative) free cash flow, which is the amount a company spends each year to finance its growth. We start by comparing cash burn to cash reserves to calculate cash runway.

Check out our latest analysis for Research Frontiers

How long is Research Frontiers’ cash runway?

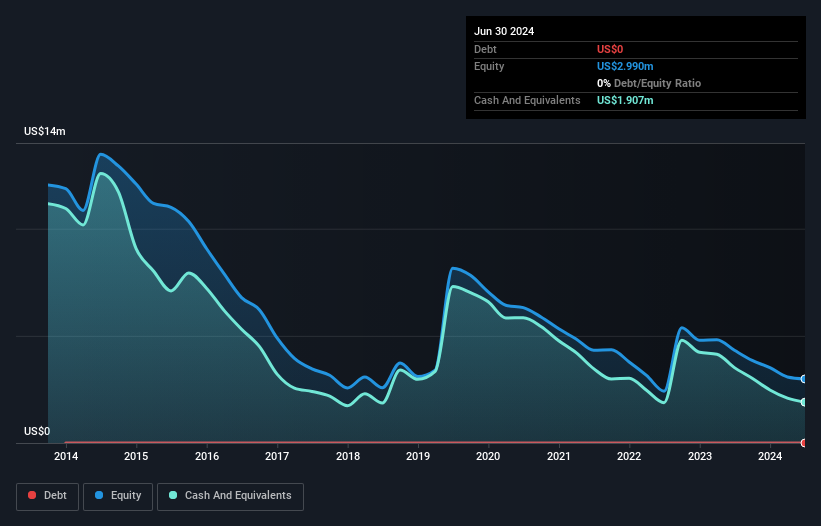

A company’s cash runway is calculated by dividing its cash balance by its cash burn. When Research Frontiers released its June 2024 balance sheet in August 2024, the company had no debt and cash worth $1.9 million. Last year, its cash burn was $1.7 million. So it had a cash runway of roughly 14 months from June 2024. That’s not too bad, but it’s fair to say the end of the cash runway is in sight unless cash burn is drastically reduced. The chart below shows how cash balance has changed over the past few years.

How does Research Frontiers’ cash burn change over time?

In our view, Research Frontiers is not yet generating meaningful operating revenue, as the company only reported US$1.3 million over the last twelve months. As such, we think it’s too early to focus on revenue growth, so we’ll limit ourselves to examining how cash burn changes over time. While this hardly paints a picture of imminent growth, the fact that the company reduced its cash burn by 29% over the last year suggests a certain level of prudence. Of course, we’ve only taken a quick look at the stock’s growth metrics here. You can see how Research Frontiers is growing its revenue over time by checking out this visualization of past revenue growth.

Can Research Frontiers easily raise more money?

While Research Frontiers sees a solid reduction in its cash burn, it’s still worth considering how easily the company could raise more cash, even if it were just to fuel faster growth. Issuing new shares or taking on debt are the most common methods for a publicly traded company to raise more money for its business. Many companies ultimately issue new shares to fund future growth. By comparing a company’s annual cash burn to its total market capitalization, we can roughly estimate how many shares it would need to issue to keep the company running for another year (assuming the same burn rate).

Research Frontiers has a market cap of $68 million and has burned through $1.7 million in the last year, representing 2.4 percent of the company’s market value. That means the company could easily issue a few shares to fund further growth and might also be able to borrow cheaply.

So should we be concerned about Research Frontiers’ money burn?

The good news is that we believe Research Frontiers’ cash burn situation gives shareholders real reason for optimism. Not only has the cash burn reduction been quite good, but the cash burn to market capitalization ratio has been really positive. Although we are the kind of investors who are always a little concerned about the risks associated with cash-burning companies, the metrics we have discussed in this article make us relatively confident about Research Frontiers’ situation. Readers need to have a solid understanding of business risks before investing in a stock, and we have found 3 warning signs for Research Frontiers that potential shareholders should consider before investing money in a stock.

Naturally, If you look elsewhere, you may find a fantastic investment. So take a look at the free List of companies with significant insider holdings and this list of growth stocks (according to analyst forecasts)

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.