Southwest Gas Holdings, Inc. (NYSE:SWX) Shareholders are likely a little disappointed as shares fell 3.5% to $71.23 in the week following the release of its latest quarterly results. All in all, it looks like a pretty poor result. Although revenues of $1.2 billion were in line with analyst forecasts, statutory earnings fell far short of estimates, missing estimates by 44% to come in at $0.25 per share. This is an important time for investors as they can track a company’s performance in its report, look at what experts are forecasting for next year, and see if expectations for the company have changed. With that in mind, we’ve compiled the latest statutory forecasts to see what analysts are expecting for next year.

Check out our latest analysis for Southwest Gas Holdings

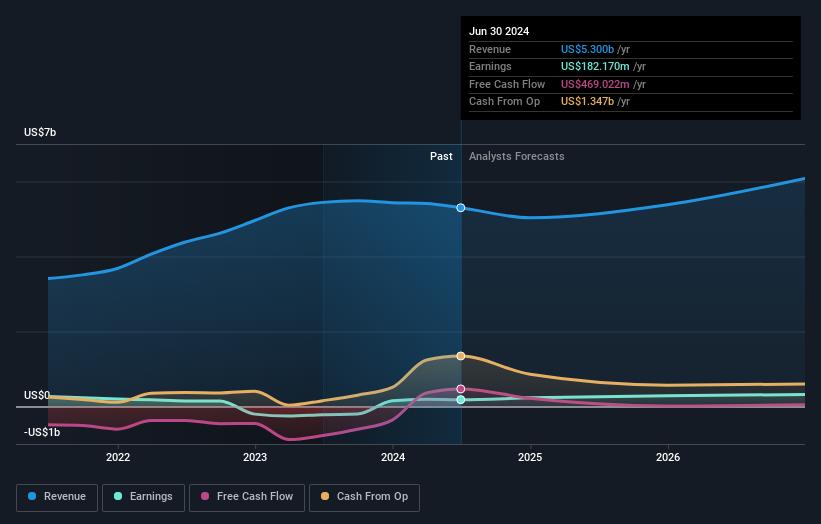

Following the latest results, the consensus among Southwest Gas Holdings’ three analysts is for revenues of $5.03 billion in 2024, a notable 5.1% year-over-year decline in sales. Statutory earnings per share are expected to increase 28% to $3.25. However, prior to the release of the latest results, analysts had been expecting revenues of $5.39 billion and earnings per share (EPS) of $3.38 in 2024. It’s pretty clear that pessimism has set in following the latest results, leading to a weaker revenue forecast and a marginal downgrade of earnings per share estimates.

Despite the cuts in earnings estimates, there was no real change to the $80.00 price target. This shows that analysts do not believe the changes have a meaningful impact on intrinsic value. However, there is another way to think about price targets and that is by looking at the range of price targets suggested by analysts, as a wide range of estimates can suggest a different view of possible outcomes for the company. The most optimistic analyst for Southwest Gas Holdings has a price target of $89.00 per share, while the most pessimistic puts it at $76.00. Even so, such a narrow range of estimates suggests that analysts have a pretty good idea of what they think the company is worth.

Now looking at the bigger picture, one of the ways we can understand these forecasts is to compare them to past performance and industry growth estimates. We’d like to highlight that revenue trajectory is expected to reverse, with a forecast decline of 9.9% on an annualized basis by the end of 2024. That’s a notable change from the historical growth of 15% over the past five years. Compare this to our data, which suggests other companies in the same industry are expected to grow revenue by 7.7% per year overall. So while revenue is forecast to decline, there is no silver lining to this cloud – Southwest Gas Holdings is expected to underperform the industry.

The conclusion

The biggest concern is that analysts have been cutting their earnings per share estimates, suggesting that Southwest Gas Holdings may be facing business difficulties. On the negative side, they have also cut their revenue estimates, and forecasts suggest that it will underperform the wider industry. There has been no real change in the consensus price target, suggesting that the company’s intrinsic value has not changed much with the latest estimates.

Continuing with this thought, we believe the company’s long-term prospects are much more relevant than next year’s earnings. We have estimates – from multiple Southwest Gas Holdings analysts – out to 2026, and you can see them for free here on our platform.

We don’t want to spoil the fun too much, but we also found 2 warning signs for Southwest Gas Holdings (1 is significant!) that you need to consider.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.