It looks like China Gas Holdings Limited (HKG:384) will trade ex-dividend for the next 3 days. The ex-dividend date is one business day before a company’s record date on which the company determines which shareholders are entitled to a dividend. The ex-dividend date is important because trading takes at least two business days each time a share is bought or sold. This means you would need to buy China Gas Holdings shares before August 23rd to receive the dividend, which will be paid on October 4th.

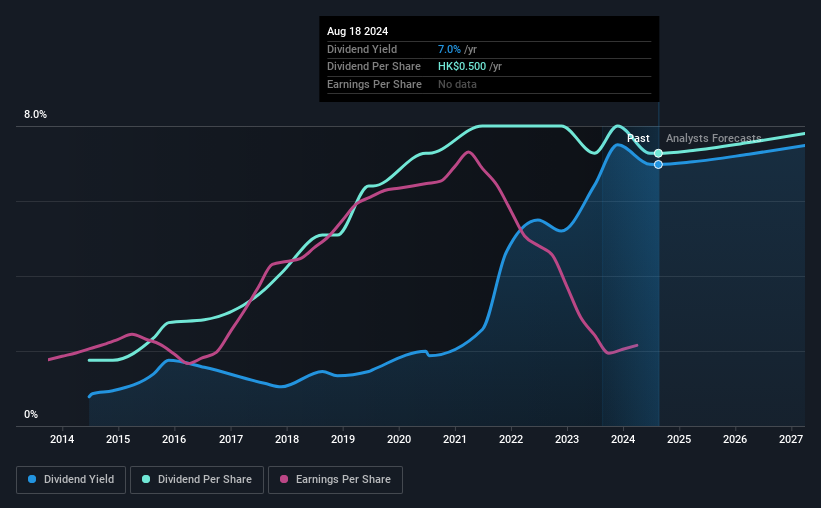

The company’s next dividend payment will be HK$0.35 per share. Over the last 12 months, the company paid a total of HK$0.50 per share. Looking at the last 12 months’ distributions, China Gas Holdings has a yield of about 7.0% on the current share price of HK$7.17. Dividends are an important source of income for many shareholders, but the health of the company is critical to maintaining these dividends. We need to see if the dividend is covered by earnings, and if it is growing.

Check out our latest analysis for China Gas Holdings

If a company pays out more in dividends than it earns, the dividend may become unsustainable – far from an ideal situation. The dividend payout ratio is 85% of profits, meaning the company is paying out the majority of its earnings. The relatively limited profit reinvestment could slow future earnings growth. We would be concerned if earnings started to decline. A useful second check can be to evaluate whether China Gas Holdings generated enough free cash flow to afford its dividend. Over the last year, it paid out more than half (56%) of its free cash flow, which is in the average range for most companies.

It’s positive to see that China Gas Holdings’s dividend is covered by both profits and cash flow, as this is generally a sign that the dividend is sustainable, and a lower payout ratio usually means a greater margin of safety before the dividend gets cut.

Click here to see the company’s payout ratio as well as analyst estimates of its future dividends.

Have earnings and dividends increased?

Companies with declining profits are tricky from a dividend perspective. If the business goes into crisis and the dividend is cut, the value of the company could fall rapidly. China Gas Holdings’ earnings per share have fallen by about 18% annually over the past five years. When earnings per share fall, the pie from which dividends can be paid ultimately shrinks.

Another important way to gauge a company’s dividend prospects is to measure its historical dividend growth rate. China Gas Holdings has averaged 15% dividend growth per year over the past 10 years. That’s fascinating, but the combination of growing dividends despite falling earnings can usually only be achieved by paying out a larger percentage of earnings. China Gas Holdings already pays out 85% of its earnings, and with falling earnings, we think it’s unlikely that this dividend will rise quickly in the future.

To sum it up

Does China Gas Holdings have what it takes to maintain its dividend payments? It’s never good when earnings per share are falling, but at least dividend payout ratios seem reasonable. However, we are aware that the dividend could be at risk if earnings continue to fall. From a dividend perspective, it’s not the most attractive proposition, and we’d probably avoid it for now.

So if you are still interested in China Gas Holdings despite its weak dividend qualities, you should be well informed about some of the risks of this stock. To help you with this, we have found out 1 warning signal for China Gas Holdings that you should know before investing in their stocks.

If you are looking for strong dividend payers, we recommend Check out our selection of the highest dividend stocks.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.