Number of renters in the USA is growing three times faster than the number of homeowners

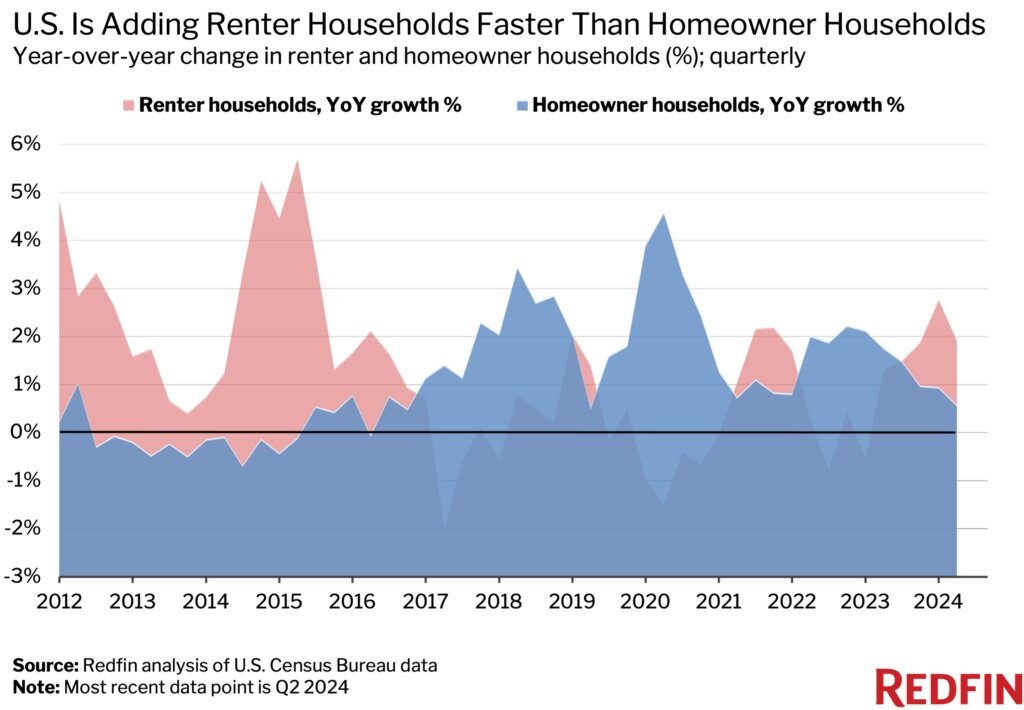

The number of renter households in America rose 1.9% year over year to a record 45.2 million in the second quarter, according to new data from Redfin. That’s more than three times faster than the number of homeowner households, which rose 0.6% to a record 86.3 million.

The number of renter households grew at the second fastest rate since 2021, while the number of homeowner households grew at the slowest rate since 2019.

Growth in the number of renter households peaked at 2.8% in the first quarter of 2024. This was the largest increase since 2015.

This is based on a Redfin analysis of U.S. Census Bureau data going back to 1994. A renter household is defined as one where the head of the household tells the Census Bureau that they rent the property, while a homeowner household is one where the head of the household reports that they own the property. The number of homeowner and renter households are both at record highs as the U.S. population is at a record high.

For three consecutive quarters, renter households have formed faster than homeowner households, partly because the cost of buying a home has risen much faster than rents.

The average apartment rent rose less than 1% in June compared to a year ago, while the average monthly mortgage payment rose about 5%. Rents were 23% above pre-pandemic levels (June 2019), while mortgage payments were 90% above pre-pandemic levels. Mortgage payments rose because home prices hit record highs and mortgage rates, while below their recent peak, were more than double the all-time low reached during the pandemic. Although the cost of buying a home fell somewhat in July, that hasn’t yet swayed buyers.

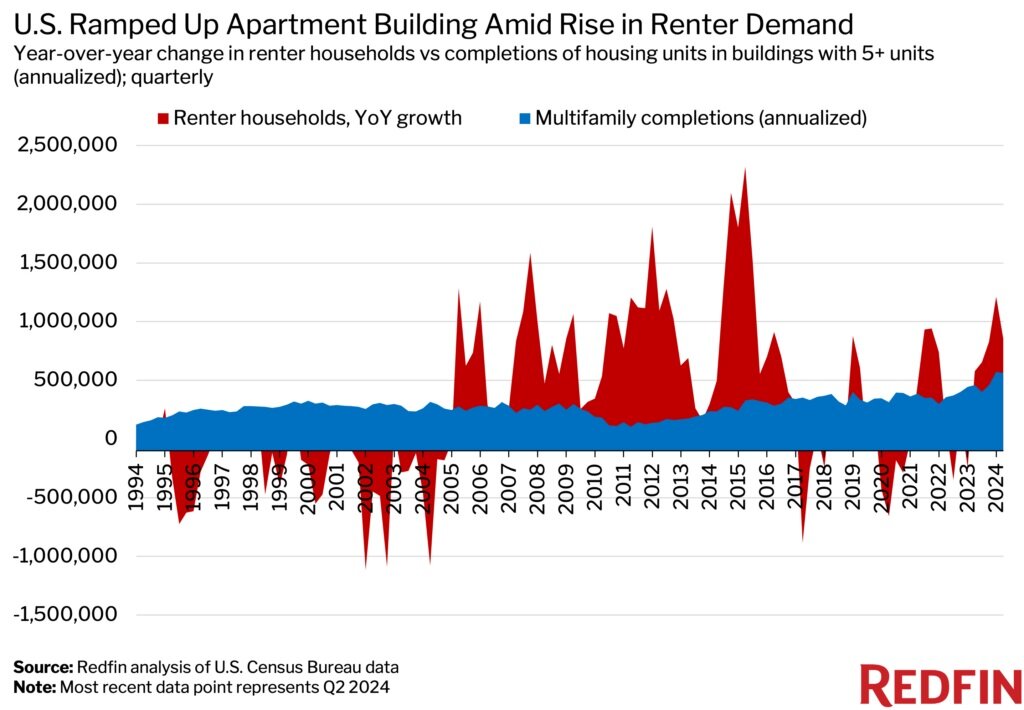

“The cost of renting and buying a home has skyrocketed in recent years, but the affordability crisis isn’t quite as severe in the rental market. That’s because America has built a lot of housing to keep up with strong demand from renters,” said Sheharyar Bokhari, senior economist at Redfin. “The country’s policymakers should heed this lesson as they think about how to improve affordability in the housing market: When there’s more housing available, prices don’t rise as quickly.”

It’s important to note that while rents aren’t rising as fast as the cost of buying a home, finding affordable housing is still a challenge for many renters. The U.S. median asking rent in June of $1,654 was the highest since October 2022 and was just $46 below the all-time high. Nearly two in five renters don’t think they’ll ever own a home.

Renters may still be able to find bargains in Austin, Texas, and many parts of Florida, where rents are falling, but Florida faces increasing risks from natural disasters and an insurance crisis.

There is a boom in the construction of multi-family homes in America, but this could soon come to an end

America added a lot of renter households last year—855,000, to be exact. But it also boosted construction, which helped accommodate that increase in demand and limit rent growth. The country is building 563,000 new multifamily homes annually (as of the second quarter)—the second-fastest pace since records began in 1994. The highest pace was recorded in the first quarter of 2024.

America still has a housing shortage, but the recent boom in multifamily construction has helped fill the gap. Multifamily completions are at an all-time high, as many projects started during the pandemic-induced construction boom are just now being completed. However, it’s worth noting that building permits and housing starts for multifamily have dropped significantly, which could cause asking rents to rise again in the coming years.

Over half of households in Los Angeles live in rented accommodation – the highest rent rate in the USA

Nationally, just over a third (34.4%) of households in the U.S. are renters—a number that has remained relatively constant over time. The proportion is much higher in coastal metropolitan areas, where buying a home is expensive.

Los Angeles has a rent rate of 53%—the highest among the 75 largest metropolitan areas in the U.S. It’s followed by San Diego (52.4%), New York (50.1%), Fresno, CA (49%), and Austin, TX (46.3%). Fresno is the outlier in the group; it’s nowhere near as expensive as, say, Los Angeles or San Diego. But over 20% of Fresno County residents live below the poverty line—nearly double the statewide rate—making it difficult for many people to own a home.

In the parts of the country where buying a home is more affordable, rents are lower than average. In Worcester, MA, 23.2% of households are renters – the lowest share among the major cities analyzed by Redfin. This is followed by North Port, FL (23.3%), Albany, NY (25.6%), Rochester, NY (25.7%), and Syracuse, NY (26.2%).