There is no doubt that you can make money by owning shares in unprofitable companies. For example, although Amazon.com made losses for many years after it went public, you would have made a fortune if you had bought and held the stock since 1999. But while history celebrates these rare successes, the failures are often forgotten. Who remembers Pets.com?

Given this risk, we wanted to check whether Vincerx Pharma (NASDAQ:VINC) shareholders should be concerned about its cash burn. In this report, we will look at the company’s annual negative free cash flow, which will be referred to as its “cash burn.” We start by comparing cash burn to cash reserves to calculate cash runway.

Check out our latest analysis for Vincerx Pharma

How long is Vincerx Pharma’s cash runway?

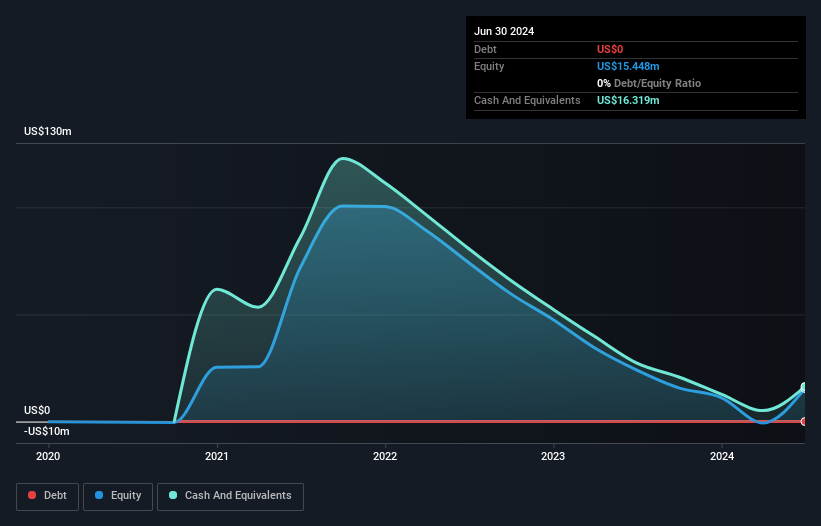

A cash runway is the amount of time it would take a company to run out of cash if it continued to spend at its current cash burn rate. When Vincerx Pharma reported its last balance sheet in August 2024 for June 2024, it had no debt and cash of US$16 million. Importantly, its cash burn over the trailing twelve months was US$28 million. So it had a cash runway of roughly 7 months from June 2024. Frankly, that kind of short runway makes us nervous because it suggests the company needs to significantly reduce its cash burn or otherwise raise cash shortly. You can see how its cash levels have changed over time in the image below.

How does Vincerx Pharma’s cash burn change over time?

Vincerx Pharma did not report any revenue over the last year, suggesting that it is an early-stage company that is still developing its business. Nevertheless, we can look at the evolution of its cash burn as part of our assessment of its cash burn situation. Given the length of its cash runway, we would interpret the 48% reduction in cash burn over twelve months as prudent, if not necessary, for capital preservation. While it is always worth studying the past, it is the future that matters most. For this reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How difficult would it be for Vincerx Pharma to raise more money for growth?

While Vincerx Pharma is seeing a solid reduction in its cash burn, it’s still worth considering how easily the company could raise more cash, even if it were just to fuel faster growth. Issuing new shares or taking on debt are the most common ways for a publicly traded company to raise more money for its business. Typically, a company will sell new shares to raise money and fuel growth. By looking at a company’s cash burn relative to its market capitalization, we gain insight into how diluted shareholders would be if the company had to raise enough money to cover another year’s worth of cash burn.

Vincerx Pharma’s $28 million cash buy represents approximately 124% of its $23 million market cap. Given the size of this expenditure relative to the company’s market value, we believe there is an increased risk of funding constraints and we would be very nervous holding the stock.

Is Vincerx Pharma’s cash burn a cause for concern?

It’s no wonder we find Vincerx Pharma’s cash burn concerning. In particular, we believe its cash burn relative to its market capitalization suggests the company is not in a good position to continue funding growth. But the bright spot was its cash burn reduction, which was encouraging. After looking at the data discussed in this article, we are not very confident that its cash burn rate is reasonable, as it looks like it may need more cash soon. Upon closer inspection, we found 7 warning signs for Vincerx Pharma You should be aware of these, and three of them cannot be ignored.

Naturally Vincerx Pharma may not be the best stock to buy. You may want to see this free Collection of companies with high return on equity or this list of stocks with high insider ownership.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.