Consumers continue to spend, but there are also signs that purchases are slowing. In the restaurant sector, popular chains such as Starbucks And McDonald’s In the US, they saw a decline in sales in comparable stores as consumers balked at higher prices.

The travel industry is also beginning to feel the effects. Disney recently announced that popular theme parks were seeing a decline in visitor traffic, while airlines and hotels pointed to a slowdown in leisure demand.

One company that is not affected by a possible slowdown in consumption is the retail giant Walmart (NYSE: WMT).

Strong earnings and outlook for the second quarter

Walmart reported strong first-quarter figures. Sales rose 5% to $169.3 billion and adjusted earnings per share (EPS) rose 10% to $0.67. Walmart thus exceeded the analyst consensus, which had expected sales of $168.6 billion and adjusted earnings per share of $0.65.

In the US, Walmart store sales rose 4% to $115.3 billion, while comparable store sales rose 4.2%. The gains resulted from a 3.6% increase in transaction volume and a 0.6% increase in average transaction value. E-commerce sales, meanwhile, rose 22%.

Walmart+ memberships grew double-digits as customers appreciate the convenience of having their items delivered directly to their homes in about three hours. General merchandise sales rose for the first time in 11 quarters, while health and wellness categories benefited from sales of GLP-1 drugs.

Internationally, Walmart’s sales rose 7% to $29.6 billion, or over 8% at constant exchange rates. The company benefited from Walmex (Mexico), China and Flipkart (e-commerce in India). International e-commerce sales rose 18%.

Sam’s Club US, its big-box store concept, saw revenue rise nearly 5% to $22.9 billion. Store sales excluding fuel rose 5.2%. Transactions rose 6.1%, while the average receipt fell 0.8% and memberships rose more than 14% year-over-year. The company said its “Scan and Go” initiative is resonating well with customers, with adoption now at more than 30%. The technology is now in use at 380 locations.

Looking ahead, Walmart forecasts third-quarter sales growth of between 3.25% and 4.25% and adjusted earnings per share of between $0.51 and $0.52.

For the full year, the company raised its revenue forecast to growth of 3.75 percent to 4.75 percent. The retailer also raised its full-year adjusted EPS forecast to a range of $2.35 to $2.43.

|

Metric |

Old instructions |

New guidelines |

|---|---|---|

|

Sales growth (currency adjusted) |

3% to 4% |

3.75% to 4.75% |

|

Growth in adjusted operating profit |

4% to 6% |

6.5% to 8% |

|

Adjusted earnings per share |

$2.23 to $2.37 |

$2.35 to $2.43 |

Why Walmart wins

Walmart’s second-quarter results again showed that the company is succeeding in the retail sector. Inflationary pressures over the past few years have caused prices to skyrocket in many areas as customers look for value for money. This has even led many high-income earners (over $100,000) to shop at Walmart, and it seems they are happy with their experience.

The retailer has long been a price leader because its size and scale gives it purchasing power that it passes on to its customers. At the same time, the company is trying to attract higher-income and younger customers, for example through its Walmart+ membership, which offers customers great convenience in addition to industry-leading prices. Walmart is also the largest grocer in the U.S. and has expanded its offerings in recent years by offering fresh produce, higher-quality meat and fresh produce.

So while Walmart will likely continue to benefit from the current trade-down effect, there’s also a good chance it will retain these new, higher-income customers even in a robust economy. That makes the company a winner in any environment.

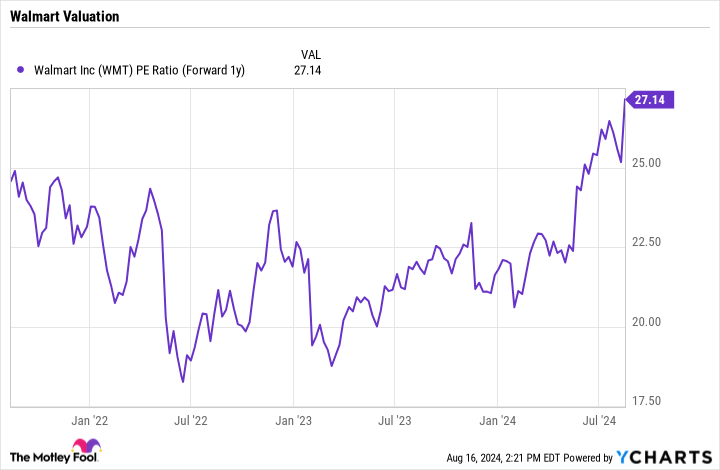

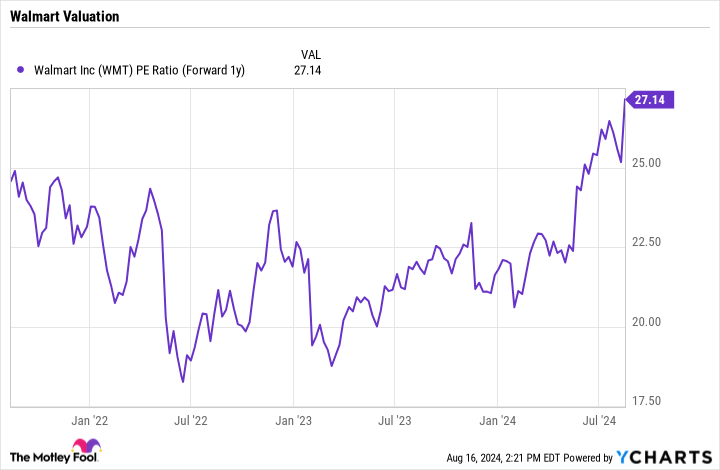

WMT P/E ratio (Forward 1 year) data from YCharts

With a price-to-earnings (P/E) ratio of about 27 times analyst estimates for next year, the stock isn’t exactly cheap at first glance. However, sometimes you have to pay a little more for a company with the growth and defensive qualities that Walmart possesses. Therefore, I think Walmart stock will continue to be a long-term winner.

Should you invest $1,000 in Walmart now?

Before you buy Walmart stock, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors to buy now… and Walmart wasn’t among them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $779,735!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Geoffrey Seiler does not own any stocks mentioned. The Motley Fool owns and recommends Starbucks, Walmart, and Walt Disney. The Motley Fool has a disclosure policy.

Walmart is emerging as a winner despite signs of a slowdown in consumer spending. Is it time to buy the stock? was originally published by The Motley Fool