Ukraine’s invasion of Russia’s Kursk region earlier this month rocked the European natural gas market, sending prices soaring above 40 euros per megawatt hour amid fears that Russian gas supplies to the EU could be disrupted. But prices have since fallen again, and Goldman’s Samantha Dart told clients on Monday that the The price rally is largely “exaggerated.”

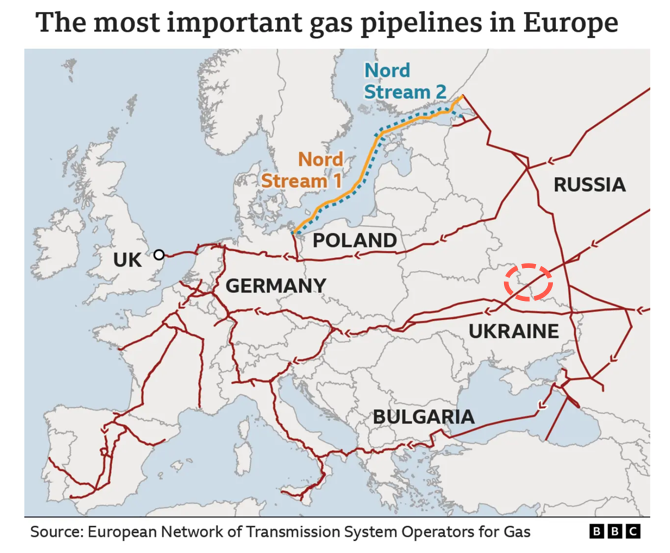

Last week, Ukraine’s president claimed troops were in control of the Russian town of Sudzha, about 10 kilometers into Russian territory. The town is home to a key gas metering station through which natural gas from West Siberian gas fields flows through pipelines that run through Sudzha and Ukraine and then to utilities in Austria, Slovakia and Hungary.

Despite the heavy fighting and alleged Ukrainian control over Sudzha and the metering station, Russian state-owned energy giant Gazprom recently said that natural gas supplies from Sudzha to Ukraine had not been interrupted. Network operators in Austria and Hungary also confirmed that there were no disruptions.

Against this backdrop, Goldman’s Dart believes that the price increase, which rose from EUR 30-35/MW to EUR 40/MW due to concerns about pipeline supply, has largely run its course.

“In our view, this increase in gas prices is exaggerated for three main reasons,” she told the customers.

Here are the three main reasons:

FirstAs Russian gas continues to flow through Ukraine, there has been no actual physical tightening of the balance and we maintain our view that these flows will only cease from 25 January, when the existing gas transit agreement between Ukraine and Russia expires.

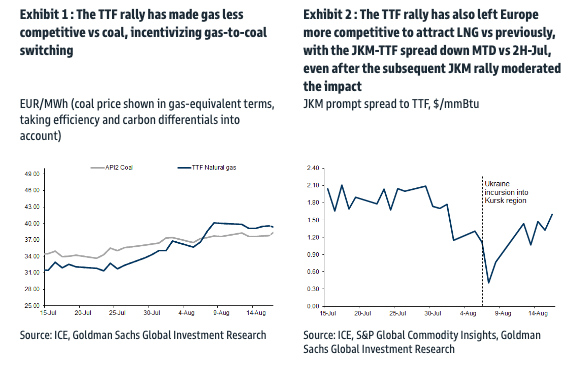

SecondEven though there have been no disruptions to pipeline supplies, the longer these higher European gas prices relative to European coal and Asian LNG prices persist (Figure 1 and Figure 2), the lower gas demand will be (due to the switch from gas to coal) and the higher (potentially) European LNG imports will be, especially once the current heatwave in Northeast Asia subsides, contributing to clouding the forecast for Europe’s future gas balance.

Thirdeven if current gas flows to Ukraine were disrupted, we would not expect this to translate into a 1:1 shortage in the North West European balance. This is because other suppliers can step in to offset the gas loss, such as higher gas flows from Algeria to Italy as we saw during a previous disruption in the region, and higher gas flows to Hungary via Turkey, in line with a gas trade agreement announced earlier this year. From January 25, when the Russian gas transit agreement through Ukraine expires, we expect German pipeline exports to Central and Eastern Europe to increase by an average of 16 million cubic metres per day as a result, which is already factored into our balances.

Looking to the future, Dart predicts Europe’s natural gas storage facilities will be “95% full” by the end of October.

She concluded:

That is, the The TTF rally shows how sensitive the market is to any tightening risks, even in winterand we agree that winter TTF price risks remain on the upside compared to our forecast of 35 EUR/MWh.

Austria, Hungary and Slovakia still get their natural gas from the Russian pipeline. The looming danger is if the war continues and Moscow uses energy supplies to Europe as a weapon in the middle of winter.

From Zerohedge.com

More top articles from Oilprice.com

- Oil production threatened as political unrest in Libya worsens

- Australia gives green light to ambitious $13.5 billion solar power export project

- 25% of Britons are thinking about turning off the heating in winter

Read this article on OilPrice.com

This story originally appeared on Oilprice.com