Following the recent decline in oil prices, the U.S. Energy Information Administration (EIA) expects falling global inventories to push prices up through the end of 2024 before falling victim to lower consumption next year.

According to the EIA forecast, global liquid fuel consumption will increase by 1.1 MMbbl/d in 2024 and 1.6 MMbbl/d in 2025. This is below the previous forecast of 1.8 MMbbl/d as slower economic growth in China reduces diesel consumption.

The EIA’s August 6 Short-Term Energy Outlook also predicts slightly milder weather in August, which will reduce the use of natural gas for electricity generation. The EIA forecasts that electricity generation will consume 46 Bcf/d in August, a 2% decline from the “very hot July.”

“Due to declining consumption and stagnant production, we expect the Henry Hub price to remain relatively low, below $2.50/MMBtu through October,” the EIA said. “However, we expect seasonal increases in consumption for space heating, as well as an increase in liquefied natural gas (LNG) exports from new plants in Texas and Louisiana, to drive the Henry Hub price to an average of about $3.10/MMBtu from November through March.”

A report from Macquarie Group’s sales and trading division on August 7 said the threat of a recession and the possibility of a global economic slowdown had reduced demand for U.S. crude oil abroad, leading to inventory buildup.

The EIA reported a 3.7 million barrel decline in commercial crude oil inventories and a 1.1 million barrel decline in jet fuel inventories for the week of August 5.

“However, an increase in Cushing crude inventories of 600,000 barrels, gasoline of 1.3 million barrels and distillate of 900,000 million barrels runs counter to Macquarie’s expectations of small additions in crude and jet fuel, while gasoline sees a healthy decline and distillate inventories decline slightly,” wrote Macquarie analyst Walt Chancellor.

The relative strength of crude oil prices was due to weak implied supply, which was offset by weak implied demand, which in turn contributed to the relative weakness of products, Chancellor said.

Crude oil balances were close to Macquarie’s expectations, with net imports slightly higher than expected – up 100,000 bbl/d. Implied domestic supplies, with production adjustments and transportation, recorded a “soft” 13.4 MMbbl/d, with the average over the past four weeks falling to 13.4 MMbbl/d in nominal terms.

“These numbers appear somewhat higher when adjusted for third-party estimated water flows, but they are still disappointing at this point,” he said.

Demand reduction

Demand for gasoline, distillates and jet fuel was 14.4 MMbbl/d, below Macquarie’s expectations of 14.8 MMbbl/d. The average over the last four weeks was 14.5 MMbbl/d, compared to 14.5 MMbbl/d over the same period last year.

“Similarly, the total disappearance, implied demand plus exports, for the three products mentioned above was below our expectations of 17 MMbbl/d, as we had expected approximately 17.4 MMbbl/d, with a four-week moving average of 17 MMbbl/d versus 17 MMbbl/d in the same four weeks last year,” he said.

Crude oil production fell by 100,000 barrels per day during the same period compared to the previous year.

For next week, Macquarie sees potential for a commercial build in US crude oil inventories of 3.3 million barrels, with an increase of 100,000 barrels per day and a recovery in nominal implicit supply of 500,000 barrels per day.

The company also expects higher net imports of 600,000 barrels per day in nominal terms and a slightly larger increase in strategic oil reserves stocks of 800,000 barrels.

US exports are declining

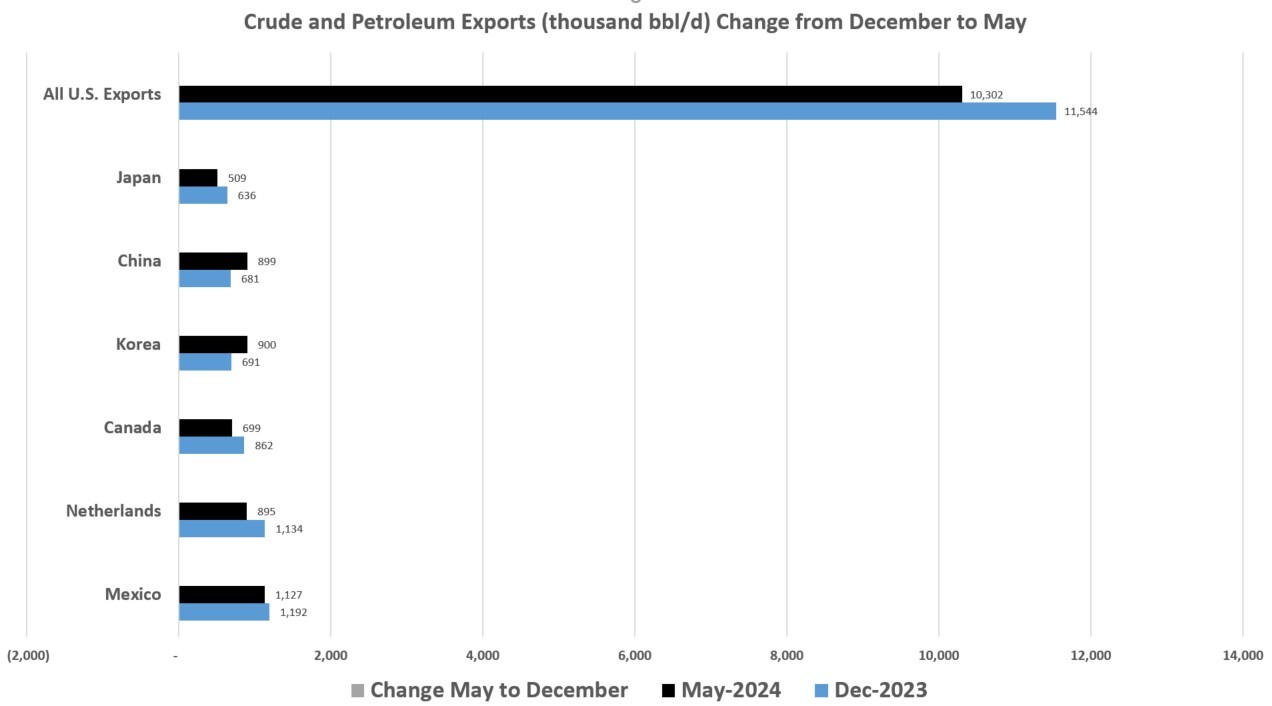

U.S. exports have declined through the first five months of 2024. In May, total U.S. exports of crude oil and petroleum products averaged 10.3 MMbbl/d, a decrease of 1.24 MMbbl/d — 11% — from December 2023, according to EIA data. The U.S. exported a total of 11.54 MMbbl/d in December.

The most drastic export declines during the same period were seen in Italy (-59%), France (-52%), Great Britain (-34%), Taiwan (-25%) and Singapore/Netherlands (-21%).

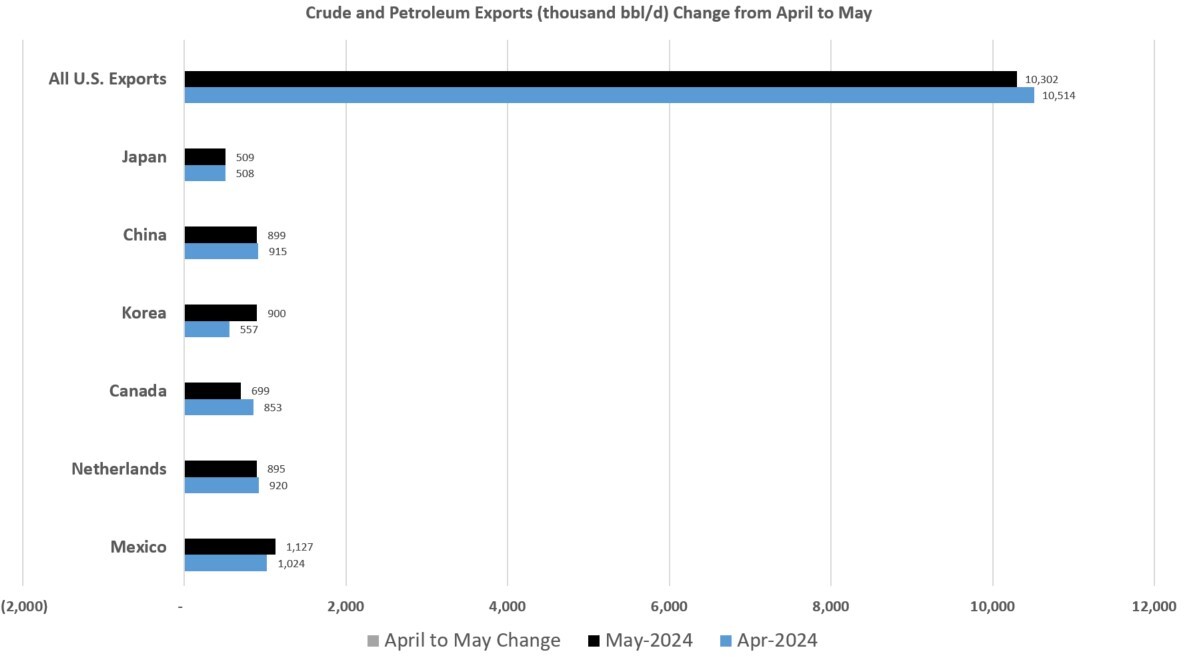

However, the EIA reported that the sharp decline in U.S. crude oil exports is gradually moderating. In April 2024, total U.S. crude oil exports were 10.51 MMbbl/d. In May 2024, oil exports declined slightly to 10.3 MMbbl/d, a 2% decline.

The largest month-on-month declines in US oil were recorded in the UK (-49%), Taiwan (-29%), Brazil (-28%), Canada (-18%) and India (-12%).

On the other hand, large increases were reported in April-May from Peru (80%), Korea (62%), Singapore (49%), France (19%) and Mexico (10%).