Paramount is taking more time before an official handshake with Skydance and is using the additional 15 days granted in the merger agreement to consider another offer – a surprising last-minute offer from Edgar Bronfman Jr., which the heir to the Seagram liquor fortune has just sweetened.

The special committee of Paramount’s board that has been overseeing the sale process confirmed in a statement that it had received Bronfman’s offer and extended the go-shop deadline — for Bronfman only — to September 5. For all other potential bidders, it expires tonight at 11:59 p.m. ET.

More from Deadline

“There is no guarantee that this process will result in a better proposal. The company does not intend to announce further developments unless it determines that such announcement is appropriate or otherwise necessary,” the committee said.

The committee had apparently tried to generate a little more interest by stating that during the go-shop phase, “representatives of the Special Committee contacted more than 50 third parties to determine whether they would be interested in making a bid to acquire Paramount.”

Bronfman originally made a $4.3 billion offer on Monday night, but the updated version includes $1.7 billion to pay off some of Paramount’s shareholders.

Bronfman’s offer includes the $400 million transfer fee demanded by Skydance in the event that Paramount chooses another bidder.

The decision to extend the contract was made just hours before the midnight deadline. PAR’s special committee, which met several times today, will now take a very close look at the offer from the heir to the Seagram spirits company and former media manager.

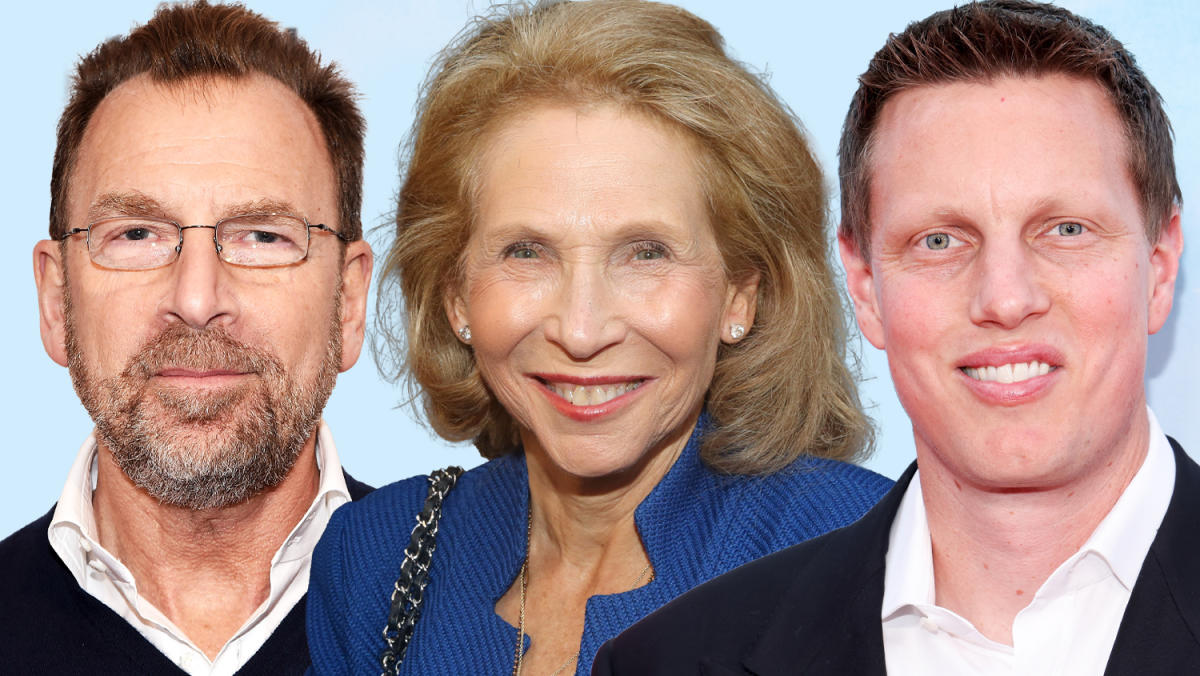

Bronfman gathered around 20 investors, ranging from funds to high-net-worth individuals and financiers, for a $4.3 billion package. Former child actor and current crypto magnate Brock Pierce and Kazakh businessman Nurali Aliyev, who were part of the original consortium, are no longer part of the group.

The deadline is running, but there was enough substance to merit consideration, especially after the favorable terms.

Charles Phillips, chairman of the special committee of Paramount’s board charged with evaluating offers, is said to have pushed Bronfman’s offer. It is the latest frustration for Skydance, as the roughly $8 billion merger agreement with Paramount, unveiled on July 7, included a 15-day extension to consider a competing offer and another 15 days to finalize the offer.

If it comes to that, Skydance would have the right to strike back. Structurally, however, the two deals are very different.

Both Skydance and Bronfman have agreed to pay Shari Redstone $2.4 billion for her majority stake in Paramount in the form of special Class A voting stock. Both parties also plan to invest $1.5 billion to help Paramount rebuild its finances and pay off debt. If Bronfman ultimately emerges victorious, he will owe Skydance a $400 million settlement.

One big difference is that David Ellison’s Skydance plans to spend $4.5 billion to buy up the few Class A holders other than Redstone and about half of the much more numerous Class B shares at $23 and $15 per share, respectively. That’s a premium to the current stock price, and shareholders like that.

Bronfman has now also added funds for Class A shareholders at $24 per share and for a smaller number of Class B shareholders at $16. Interestingly, according to Deadline, he made it clear in his revised offer that he prefers the additional $1.7 billion to go to shareholders, leaving the details of the issue to Paramount’s discretion.

A key structural element in Skydance-Paramount is an actual merger: Para is buying Skydance in a $4.75 billion all-stock deal. Shareholders are not happy about this, calling it a very high valuation for Skydance that will dilute their shares.

But they acknowledge that Paramount will ultimately be a new, larger company with more extensive content and more technology, backed by Oracle co-founder Larry Ellison, one of the richest men in the world. Gerry Cardinale’s RedBird Capital is also a major investor. Jeff Shell would run the combined company under Ellison.

Wall Street is somewhat baffled by Bronfman’s seemingly losing battle.

“This narrative runs counter to the desire to leave Paramount in the safe hands of a family that has the balance sheet to maintain and appropriately invest in Paramount’s assets for decades to come,” said Rich Greenfield of Lightshed Partners.

Chaotic fusion process

Redstone began considering various M&A options in late 2023, when the need to finance a major streaming company while managing a portfolio full of troubled TV and film assets became clear. Paramount stock had also fallen to less than a third of its value in December 2019, when the Viacom-CBS merger was completed and Paramount Global was created.

The process of finding a buyer has been a rocky one in the nine months or so since serious talks first began. A number of major players, from Warner Bros. Discovery’s David Zaslav to Barry Diller to private equity giant Apollo Global Management and Sony Pictures Entertainment, joined the hunt. After Skydance and Paramount announced their planned merger in July, most of the suitors dropped their efforts.

Paramount’s dual-class structure and the fact that Redstone controls nearly 80% of the Class A shares but only 10% of the company’s total equity caused headaches for the dealmakers. Skydance revised its offer several times and was about to announce an agreement with Paramount in June, but Redstone withdrew on June 11.th Hour.

As the company moved toward a new corporate structure, running the company also proved a more complex undertaking. Bob Bakish, a former favorite of Redstone’s who was named CEO of Viacom in 2015 and led Paramount from 2019, fell out with her over his concerns about the Skydance deal and was fired last April. An “Office of the CEO” consisting of veteran executives George Cheeks, Chris McCarthy and Brian Robbins was set up. The trio then announced drastic cuts, including $500 million in annual cost reductions and the layoff of 15 percent of the company’s U.S. workforce.

In addition to the cost-cutting, Paramount also acknowledged a fundamental shift in the media empire it had built over decades since Shari’s father, Sumner Redstone, ran the company. Paramount took a $6 billion writedown on its cable networks, acknowledging the impact of cable cancellations and changing viewer habits. Its flagship streaming service, Paramount+, posted a profit last quarter and has set a goal of being profitable full-year by 2025. However, the broadcaster also lost 2.8 million subscribers in the quarter as a “hard bundle” deal in South Korea ended, highlighting the challenge of building a global direct-to-consumer service that can compete with Netflix.

The co-CEOs told Wall Street analysts on the quarterly earnings call that despite the merger saga, it’s “business as usual” at the top level. They have said they will be given the latitude to make strategic transactions during this transition period. On the international level in particular, leadership will take a “thoughtful approach,” McCarthy said on the call. Options, he said, include “strategic partnerships with platforms that may already have tremendous reach and a platform. In that case, we’ll reduce our costs because we don’t need our own platform.”

Another scenario could be “a joint venture with one or more SVOD providers, where we could achieve greater scale, increase long-term value and generate higher profits.” The company is already a partner with NBCUniversal on Sky Showtime, a joint venture that operates in more than a dozen territories across Europe.

The best of Deadline

Sign up for the Deadline newsletter. For the latest news, follow us on Facebook, Twitter and Instagram.