Sales in comparable stores increased by 1.2% in July compared to the previous year

NEWARK, NJ, Aug. 8, 2024 (GLOBE NEWSWIRE) — NRSInsights, a provider of sales data and analytics from retail transactions processed through National Retail Solutions’ (NRS) point-of-sale (POS) platform, today announced comparable same-store sales results for July 2024.

As of July 31, 2024, the NRS retail network included approximately 32,100 active terminals nationwide scanning purchases at independent retailers, including bodegas, convenience stores, liquor stores, grocery stores, tobacco and convenience stores across the country, serving predominantly urban consumers.

Retail sales highlights in July

(Store revenue, unit sales, transactions and average price data in this publication are as of July 2024 unless otherwise noted. All comparisons are provided on a “per calendar day” basis to exclude variations in the number of days in a month.)

- Sales in comparable stores increased by 1.2% compared to the previous year (July 2023). In the previous month (June 2024), sales in comparable stores increased by 5.1% compared to June 2023.

- Like-for-like sales decreased by 1.9% compared to the previous month (June 2024). In June 2024, like-for-like sales increased by 1.6% compared to the previous month (May 2024).

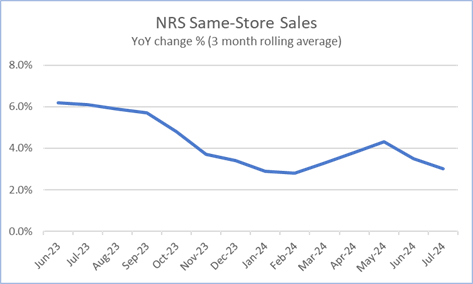

- In the three months ended July 31, 2024, sales in existing stores increased by 3.0% compared to the three months ended July 31, 2023.

- The number of units sold increased by 2.2% compared to the previous year (July 2023). In the previous month (June 2024), the number of items sold increased by 5.5% compared to June 2023.

- The average number of transactions per store decreased by 0.6% compared to the previous year (July 2023). In the previous month (June 2024), the average number of transactions increased by 2.8% compared to June 2023.

- The dollar-weighted average price of the 500 best-selling items in July 2024 increased 2.5% year-over-year, an increase from the 1.1% increase recorded in June 2024.

Comparative retail data

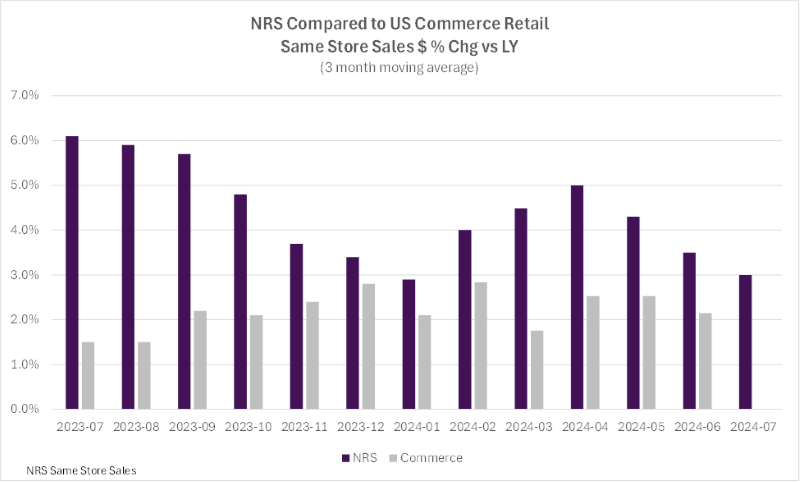

The following table provides a historical comparison with the U.S. Department of Commerce’s preliminary monthly retail sales data in non-food stores:

Over the past 12 months, the NRS network’s three-month average comparable-store sales exceeded the U.S. Department of Commerce’s preliminary monthly retail sales data (excluding food services) by an average of 2.3 percentage points.

The NRSInsights data in the graph above has not been adjusted to account for inflation, demographic distributions, seasonal buying patterns, item substitutions, days per month, or other factors that might facilitate comparison to other time periods, to other same-store retail sales data, or to U.S. Department of Commerce retail sales data.

Comment by Suzy Silliman (SVP, Data Strategy and Sales at NRS)

“The growth rate of like-for-like sales moderated across the NRS network in July, continuing a trend that has been ongoing for several years. The nominal year-on-year increase has fallen from over 6% for the three months to July 2023 to 3% for the same period this year. Inflation, measured by the weighted unit price of our 500 best-selling items, meanwhile remained relatively low at 2.5%, although it has risen over the past two months from lows seen earlier in the year.

“July nationwide results were slightly impacted by Hurricane Beryl, which caused double-digit sales declines compared to July 2023 in coastal and southeast Texas markets, including Corpus Christi and Houston. Beryl, which disrupted distribution in affected regions, also caused widespread, extended-term power outages.

“As in previous months, we continued to see significant growth in July in sales of tequila, ready-to-drink cocktails, smokeless tobacco and non-alcoholic beer, while sales of energy drinks, chocolate and confectionery, vape and sweet snacks such as packaged brownies, doughnuts, cakes and pies all declined.

“Although the U.S. continued to suffer from persistent heat waves throughout the month, the unusually robust packaged nonalcoholic beverage sales we recorded in June could not be sustained for a second month. In July, sales of carbonated soft drinks, bottled water and sports drinks all returned to their respective trend lines.”

NRSInsights Reports

NRSInsights’ monthly Same-Store Retail Sales reports are designed to provide current sales data reflecting sales across NRS’s network of independent, predominantly urban retail stores.

Same-store data comparisons for July 2024 and July 2023 are based on approximately 194 million transactions processed across the approximately 18,700 stores on the NRS network that scanned transactions in both months. Same-store data comparisons for July 2024 and June 2024 are based on approximately 248 million transactions processed across approximately 26,700 stores.

Comparisons of same-store data for the three months ended July 31, 2024 with the three months of the prior year are based on approximately 549 million scanned transactions processed through stores that were part of the NRS network in both quarters.

NRS POS Network

The NRS network includes approximately 32,100 active POS terminals operating in approximately 27,800 independent retail stores. Its platform primarily serves small, independent retail stores, including convenience stores, bodegas, liquor stores, grocery stores, tobacco and general stores. The network includes retailers in all 50 states plus the District of Columbia and 200 of the 210 designated market areas (DMAs) in the United States. NRS POS terminals processed $19.4 billion in revenue through approximately 1.4 billion transactions during the twelve months ended July 31, 2024.

About National Retail Solutions (NRS):

National Retail Solutions operates the nation’s largest point-of-sale (POS) terminal platform and digital payment processing service for independent retailers. Retailers use NRS’s offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms and advertisers access the terminal’s digital display network to reach these retailers’ predominantly urban, multicultural shopper base and leverage transaction data-driven insights to identify growth opportunities and measure execution and return on marketing investments. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All of the foregoing statements that do not relate solely to historical facts, including, but not limited to, statements in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “seek” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current view of what may happen in the future, actual results may differ materially from those expressed or implied by such statements as a result of numerous important factors. Our filings with the SEC contain detailed information regarding such statements and risks and should be consulted together with this release. To the extent permitted by applicable law, IDT undertakes no obligation to update any forward-looking statements.

NRSInsights Contact:

Suzy Silliman

SVP, Data Strategy and Sales at NRS

National retail solutions

[email protected]

Contact IDT Corporation:

Bill Ulrey

[email protected]

# # #

-

National retail solutions

-

National retail solutions