Key findings

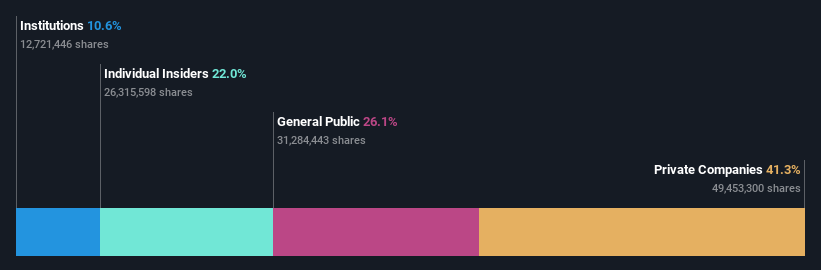

- The significant private ownership of Guangdong Huate Gas suggests that key decisions are influenced by shareholders from the larger public sector.

- A total of 5 investors own the majority of the company with 53%

- 22% of Guangdong Huate Gas is held by insiders

A look at the shareholders of Guangdong Huate Gas Co., Ltd (SHSE:688268) tells us which group is the most powerful. We see that private companies own the lion’s share of the company at 41%. That means the group benefits the most when the stock rises (or loses the most when there is a downturn).

With market capitalization falling to 4.9 billion Chinese yen last week, private companies suffered the highest losses compared to all other shareholder groups in the company.

Let’s take a closer look at what the different types of shareholders can tell us about Guangdong Huate Gas.

Check out our latest analysis for Guangdong Huate Gas

What does institutional ownership tell us about Guangdong Huate Gas?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it’s included in a major index. We would expect most companies to have some institutions on their registry, especially if they’re growing.

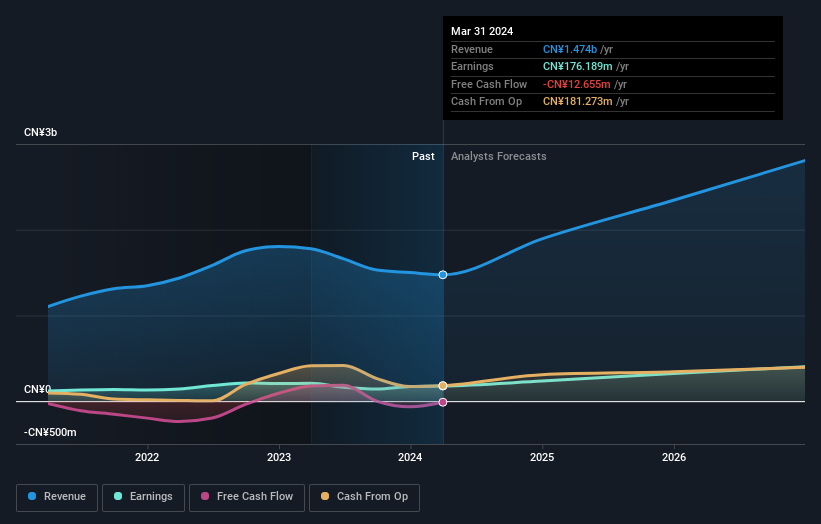

There are already institutions on the Guangdong Huate Gas share registry. In fact, they own a sizeable share of the company. This means that the analysts at these institutions have looked at the stock and they like it. But like everyone else, they can be wrong. It is not unusual for the share price to fall sharply if two large institutional investors try to sell a stock at the same time, so it is worth checking out Guangdong Huate Gas’s past earnings history (see below). Of course, you should remember that there are other factors to consider as well.

Guangdong Huate Gas is not owned by hedge funds. Guangdong Huate Investment Management Co., Ltd. is currently the largest shareholder with 22% of the outstanding shares. Tianjin Huahong Investment Management Partnership Enterprise (Limited Partnership) and Pingxiang Shi are the second and third largest shareholders with 10% and 9.9% of the outstanding shares respectively. Pingxiang Shi, the third largest shareholder, also happens to be the chairman of the board. In addition, the company’s CEO, Zhuhong Fu, directly holds 0.8% of the total outstanding shares.

Our research also revealed that approximately 53% of the company is controlled by the top five shareholders, suggesting that these owners have significant influence over the business.

While studying institutional ownership of a company can enrich your research, it is also a good practice to research analyst recommendations to get a deeper understanding of a stock’s expected performance. There are a considerable number of analysts covering the stock, so it could be useful to find out their overall view on the future.

Insider ownership of Guangdong Huate Gas

The definition of corporate insiders can be subjective and varies by jurisdiction. Our data reflects individual insiders and includes at least board members. Company management is accountable to the board, which should represent the interests of shareholders. Notably, top executives are sometimes on the board themselves.

Most people consider insider ownership to be a positive because it can indicate that the board is well aligned with other shareholders. However, sometimes too much power is concentrated in this group.

Our latest data shows that insiders own a significant amount of Guangdong Huate Gas Co., Ltd. Insiders own CNY1.1 billion worth of shares in the CNY4.9 billion company. It’s great to see that insiders have invested so much in the company. It might be worth checking to see if these insiders have been buying shares recently.

Public property

With an ownership share of 26%, the public, which consists mostly of individual investors, has some influence over Guangdong Huate Gas. While this ownership size is significant, it may not be enough to change company policy if the decision does not coincide with that of other major shareholders.

Private company ownership

According to our data, private companies hold 41% of the company’s shares. This might be worth investigating further. If related parties, such as insiders, have an interest in one of these private companies, this should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It is always worth thinking about the different groups that own shares in a company. But to better understand Guangdong Huate Gas, we need to consider many other factors. Think, for example, of risks. Every company has them, and we have found 1 warning sign for Guangdong Huate Gas You should know about this.

If you prefer to know what analysts are predicting regarding future growth, don’t miss this free Report on analyst forecasts.

NB: The figures in this article are calculated using the last twelve months’ data, which refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the figures in the annual report.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.