Key findings

- The significant ownership of individual investors in Toho Gas suggests that collectively they have a greater say in the company’s management and strategy.

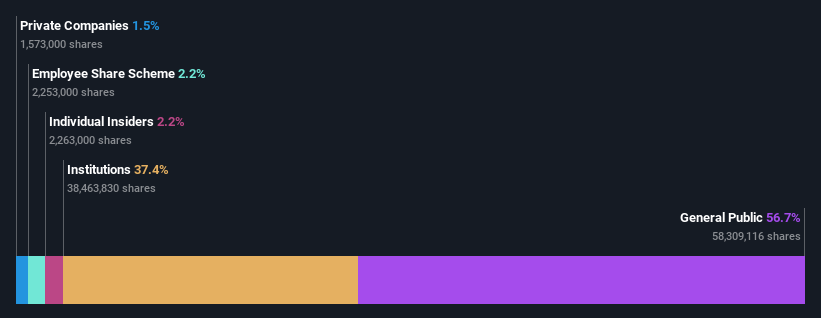

- 42% of the company is owned by the 25 largest shareholders

- Institutions own 37% of Toho Gas

Any investor in Toho Gas Co., Ltd. (TSE:9533) should know which shareholder groups are the most powerful. And the group that holds the largest piece of the pie is individual investors with 57% shares. In other words, this group stands to gain the most (or lose the most) from their investment in the company.

Institutions now make up 37% of the company’s shareholders. Insiders often own a large portion of younger, smaller companies, while large companies are more likely to have institutions as shareholders.

In the table below we zoom in on the different ownership groups of Toho Gas.

Check out our latest analysis for Toho Gas

What does institutional ownership tell us about Toho Gas?

Many institutions measure their performance against an index that is similar to the local market, so they tend to pay more attention to companies listed in major indices.

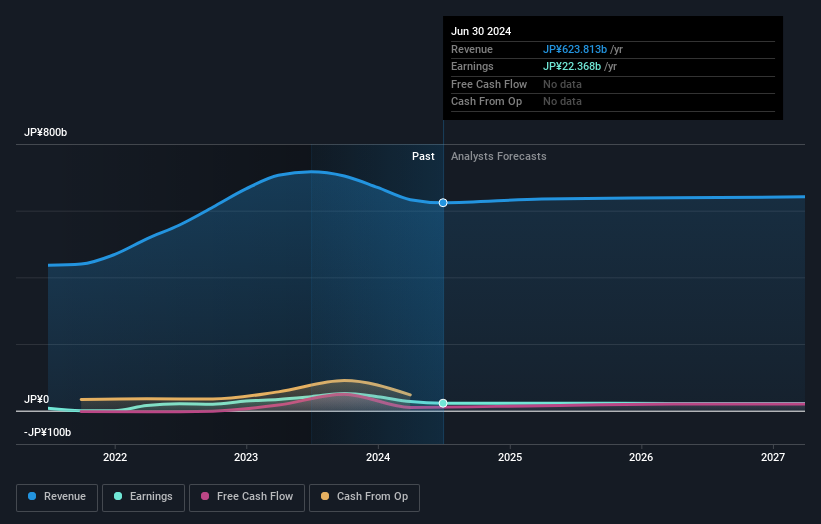

As you can see, institutional investors own a significant amount of Toho Gas. This means that the analysts at those institutions have looked at the stock and they like it. But like everyone else, they can be wrong. It’s not unusual for the share price to fall sharply if two large institutional investors try to sell a stock at the same time, so it’s worth checking out Toho Gas’s past earnings history (see below). Of course, you should remember that there are other factors to consider as well.

We note that hedge funds do not have significant investments in Toho Gas. The company’s largest shareholder is Nissay Asset Management Corporation with a 6.4% stake. Sumitomo Mitsui Financial Group Inc., asset management arm, is the second largest shareholder with 3.2% of the common stock, and The Vanguard Group, Inc. holds about 3.1% of the company’s stock.

A closer look at our ownership data shows that the top 25 shareholders collectively own less than half of the register, suggesting that this is a large group of small shareholders, with no single shareholder having a majority.

Studying institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be done by studying analyst opinions. There are a few analyst reports on the stock, but it might become more popular with time.

Insider ownership of Toho Gas

The definition of corporate insiders can be subjective and varies by jurisdiction. Our data reflects individual insiders and captures at least board members. Management is ultimately accountable to the board. However, it is not uncommon for managers to be board members, especially if they are founders or CEOs.

I think insider ownership is generally a good thing. However, in some cases it makes it harder for other shareholders to hold the board accountable for decisions.

Our latest data shows that insiders own some shares in Toho Gas Co., Ltd. This is a large company, so it’s good to see this alignment. Insiders own JP¥9.9 billion worth of shares (at the current price). It’s good to see this level of investment by insiders. You can check here to see if these insiders have been buying recently.

Public property

The general public, including retail investors, owns 57% of Toho Gas. This stake allows retail investors to collectively participate in decisions that affect shareholder returns, such as dividend policy and director appointments. They can also exercise their voting rights in acquisitions or mergers that may not improve profitability.

Next Steps:

While it is worth considering the different groups that own a company, there are other factors that are even more important. Note that Toho Gas 2 warning signals in our investment analysis and one of them may be serious…

If you’re like me, you might want to think about whether this company will grow or shrink. Luckily, you can check out this free report showing analyst forecasts for the future.

NB: The figures in this article are calculated using the last twelve months’ data, which refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the figures in the annual report.

Valuation is complex, but we are here to simplify it.

Find out if Toho Gas could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.