On August 23, 2024, T Uchida, Chief Financial Officer of Palomar Holdings Inc (NASDAQ:PLMR), sold 1,750 shares of the company at a price of $99 per share. This transaction was reported in a recent SEC filing. Following this sale, the insider now owns 20,594 shares of Palomar Holdings Inc.

Palomar Holdings Inc. is a specialty insurance company focused on providing insurance solutions to residential and commercial customers requiring specialty products such as earthquake, wind and flood insurance.

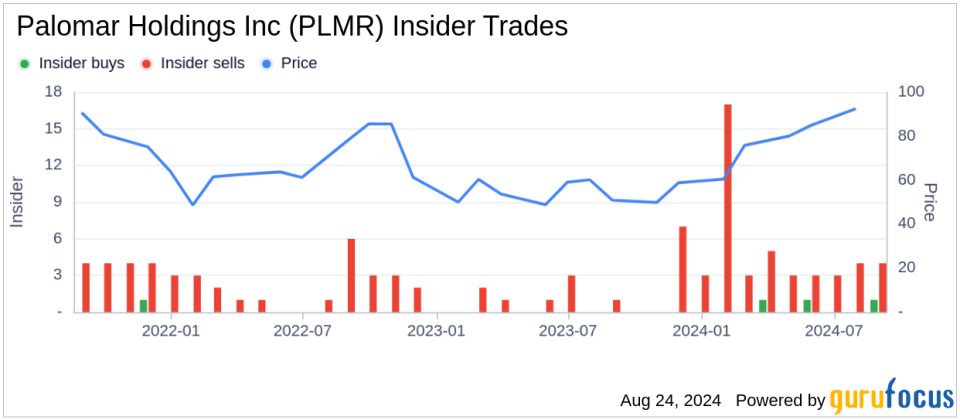

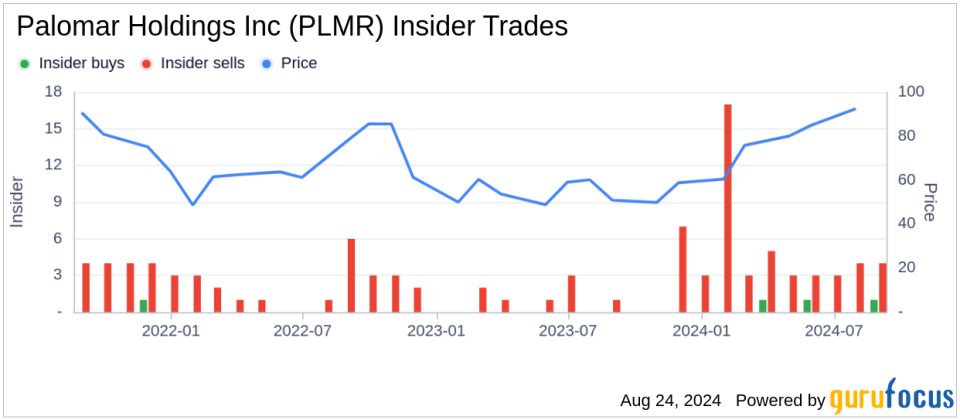

Over the past year, T Uchida has sold a total of 26,059 shares and purchased no shares. This latest sale is part of a broader trend within the company, where there were 52 insider sales and only 3 insider purchases over the past year.

Palomar Holdings Inc. shares were trading at $99 on the day of the sale, giving the company a market capitalization of approximately $2.596 billion. The company’s price-to-earnings ratio is 25.69, which is higher than the industry average of 11.46.

The GF Value of the stock is calculated at $95.80, which indicates that the stock is fairly valued with a Price to GF Value ratio of 1.03.

The GF value is determined by taking into account historical trading multiples such as price-to-earnings ratio, price-to-sales ratio, price-to-book ratio and price-to-free cash flow together with a GuruFocus adjustment factor based on past earnings and growth as well as Morningstar analysts’ estimates of future business performance.

This insider sale may be of interest to current and potential investors, as insider transactions can provide insight into management’s assessment of the stock’s valuation and future prospects.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.