Warren Buffett once said, “Volatility is far from being synonymous with risk.” So it’s obvious that debt needs to be taken into account when thinking about how risky a particular stock is, because too much debt can ruin a company. As with many other companies Fujitsu-Systems (TSE:6702) uses debt, but should shareholders be concerned about the use of debt?

Why is debt risky?

Debt helps a company until it struggles to pay it back with either fresh capital or free cash flow. If the company can’t meet its legal obligations to pay off debt, shareholders could end up empty-handed. More common (but still costly), however, is that a company must issue shares at bargain prices, permanently diluting shareholders’ equity, just to shore up its balance sheet. By replacing dilution, however, debt can be an extremely good tool for companies that need capital to invest in high-return growth. When considering how much debt a company has, you should first look at its cash and debt together.

Check out our latest analysis for Fujitsu

How much debt does Fujitsu have?

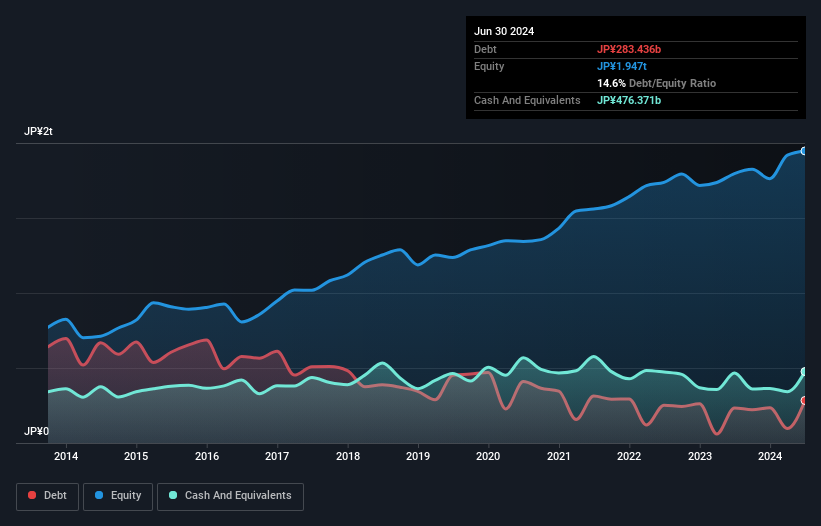

The image below, which you can click on for more details, shows that Fujitsu had JP¥283.4 billion in debt as of June 2024, up from JP¥233.9 billion a year earlier. However, the balance sheet shows that the company holds JP¥476.4 billion in cash, so it actually has JP¥192.9 billion net.

How strong is Fujitsu’s balance sheet?

According to the last reported balance sheet, Fujitsu had liabilities of JP¥1.23 trillion due within 12 months and liabilities of JP¥289.8 billion due after more than 12 months. On the other hand, the company had cash of JP¥476.4 billion and receivables of JP¥826.0 billion due within one year. So its liabilities exceed the sum of its cash and (short-term) receivables by JP¥212.6 billion.

Given Fujitsu’s massive market capitalization of JP¥4.72 trillion, it’s hard to imagine these liabilities posing much of a threat. However, we think it’s worth keeping an eye on the strength of its balance sheet, as it may change over time. Despite its sizeable liabilities, Fujitsu has net cash, so it’s fair to say the company doesn’t have a heavy debt load!

In fact, Fujitsu’s saving grace is its low debt, with its EBIT having slumped 27% over the last twelve months. When a company experiences a decline in profits, it can sometimes find its relationships with its lenders deteriorating. The balance sheet is clearly the area to focus on when analyzing debt. But ultimately, the company’s future profitability will determine whether Fujitsu can strengthen its balance sheet over time. So, if you’re focused on the future, you can look at free Report with analysts’ profit forecasts.

Finally, while the taxman loves net profits, lenders only accept cold hard cash. Fujitsu may have net cash on the balance sheet, but it’s still interesting to see how well the company converts its earnings before interest and tax (EBIT) into free cash flow, as this affects both its need for debt and its ability to manage it. Looking at the last three years, Fujitsu recorded free cash flow of 37% of its EBIT, which is weaker than expected. This weak cash conversion makes it difficult to manage debt.

Summary

We could understand if investors were worried about Fujitsu’s liabilities, but the fact that the company has net cash flow of JP¥192.9 billion gives us peace of mind. Therefore, we are not worried about Fujitsu’s use of debt. We think it is more important than most other metrics to track how fast earnings per share are growing, if at all. If you have recognized this too, you are in luck, because today you can see this interactive graph of Fujitsu’s earnings per share history for free.

If, after all that, you’re more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.