Shares in St James’s Place plunged 30% today after the once-major member of the insurance establishment set aside £426 million for potential refunds to customers.

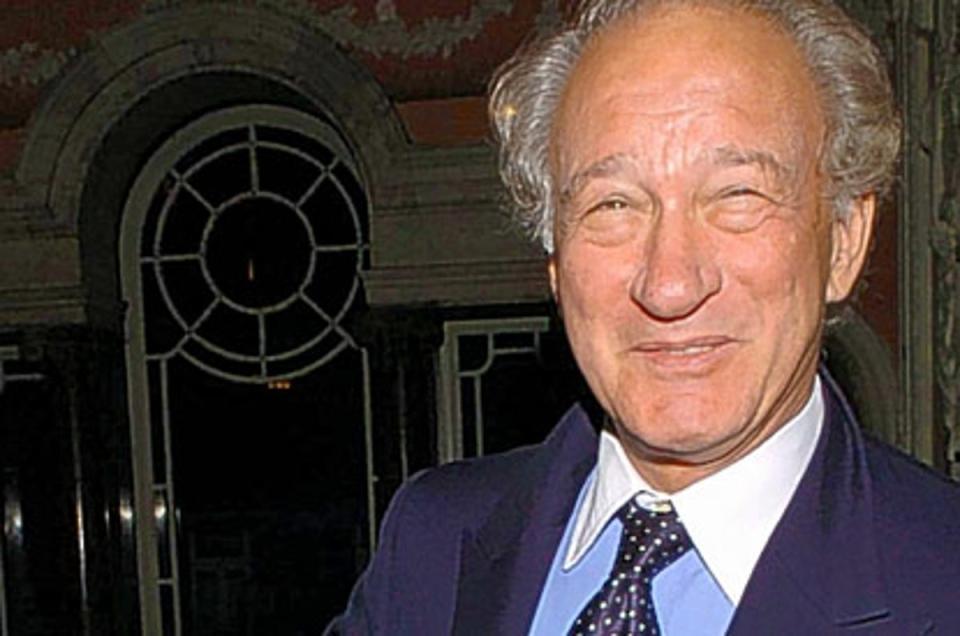

SJP was founded in 1991 by Sir Mark Weinberg with the support of Jacob Rothschild, the financier who died a few days ago at the age of 87.

The company had established itself as a provider of first-class financial advice to wealthy clients, but was consistently confronted with accusations that its fees were excessive.

Over the years, regulatory inspections and the number of customer complaints have increased.

Today SJP reported a loss of £9.9 million, compared to a profit of £407 million last time. The dividend has been more than halved and now stands at 23.83p, with future payouts clearly at risk.

The £426 million provision was “established for potential refunds to customers in connection with the proof and provision of ongoing services”.

CEO Mark FitzPatrick said in his first earnings presentation since taking over the top job in December: “We recognize that this is a disappointing result for everyone.”

In 2003, SJP was fined £250,000 by the City of London regulator for “serious” accounting deficiencies.

Critics say little has changed and that SJP’s problems are part of a broader move away from traditional financial services providers with high fees that come at the expense of customer returns.

Yesterday, Abrdn, the merged company of Aberdeen Asset Management and Standard Life, suffered a £6 million loss as customers withdrew £17.6 billion. Numis said in a note: “From our perspective, it is disappointing to see yet another piecemeal warning/major negative development in the investment story rather than seeing these issues comprehensively addressed all at once.”

Back in 2019, fourteen former football players sued SJP for £15 million because they allegedly received poor advice on tax and investment matters.

SJP opened an office in Dubai last year.

City luminaries such as Paul Manduca remain chairman of the board.

Today’s statement to the city continues: “A combination of the provision we have made and an expected decline in earnings growth over the next few years as we transition to our new fee structure reduces our ability to invest in long-term growth of our business over the next few years.”

Fitzpatrick says the outlook for his industry is “challenging.”

As shares plunged 32% to 422p, he added: “It has been a difficult environment for UK savers and investors but it is in times like these that advice really does make a difference and helps people stay on track to achieve their long-term financial goals. Against this backdrop, the hard work of everyone in our SJP community to continue to look after our clients has resulted in a resilient business performance where we have delivered sustained strong net inflows, underpinned by high client retention, strong investment performance and record funds under management.”

SJP has been criticized for years for using aggressive sales tactics, offering consultants generous incentives ranging from Montblanc pens and Mulberry bags to all-expenses-paid vacations.

The top partners received diamond-studded cufflinks and brooches.