Some say that volatility, not debt, is the best way to think about risk as an investor, but Warren Buffett once said, “Volatility is far from synonymous with risk.” So it may be obvious that you need to consider debt when thinking about how risky a particular stock is, because too much debt can ruin a company. As with many other companies Atmos Energy Corporation (NYSE:ATO) is taking on debt. But is this debt a cause for concern for shareholders?

Why is debt risky?

Debt and other liabilities become risky for a company when it cannot easily meet those obligations, either through free cash flow or by raising capital at an attractive price. In a worst-case scenario, a company can go bankrupt if it can’t pay its creditors. A more common (but still costly) situation, however, is that a company must dilute shareholders at a cheap share price just to get debt under control. As a substitute for dilution, however, debt can be an extremely good tool for companies that need capital to invest in high-return growth. When considering how much debt a company has, you should first look at its cash and debt together.

Check out our latest analysis for Atmos Energy

How much debt does Atmos Energy have?

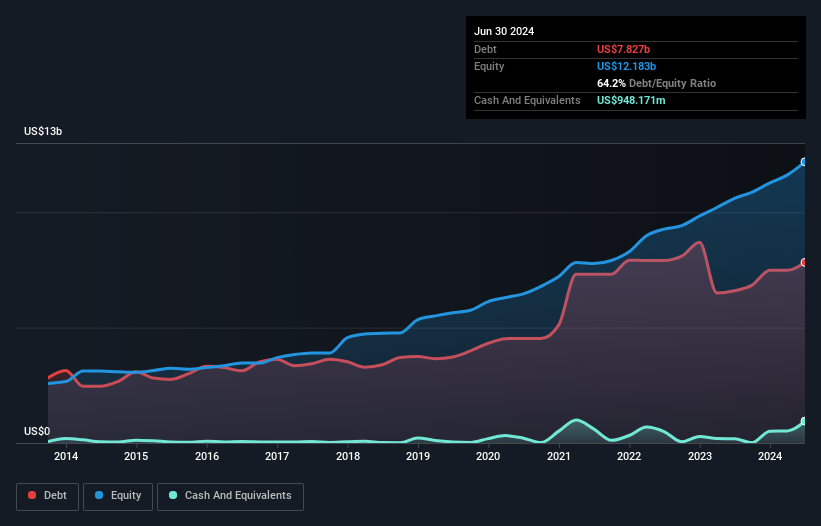

The image below, which you can click on for more details, shows that Atmos Energy had $7.83 billion in debt as of June 2024, which is an increase of $6.60 billion in one year. On the other hand, the company has $948.2 million in cash, which results in net debt of about $6.88 billion.

A look at Atmos Energy’s liabilities

If we take a closer look at the latest balance sheet data, we can see that Atmos Energy has liabilities of $984.9 million with a maturity of 12 months and accounts payable of $11.7 billion with a maturity beyond that. On the other hand, the company had cash of $948.2 million and accounts receivable of $391.6 million with a maturity of one year. So, the company’s liabilities are $11.4 billion more than the combination of cash and short-term receivables.

Atmos Energy has a very high market capitalization of $20.2 billion, so it could very likely raise cash to improve its balance sheet if needed. But it’s clear that we should take a close look at whether the company can manage its debt without dilution.

We measure a company’s debt load relative to its earnings power by dividing its net debt by its earnings before interest, taxes, depreciation, and amortization (EBITDA) and calculating how easily its earnings before interest and taxes (EBIT) covers its interest expenses (interest cover). So we look at debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 3.5, Atmos Energy has a fairly sizeable debt load. But its high interest coverage of 7.7 suggests that the company can easily service that debt. Importantly, Atmos Energy grew its EBIT by 30% over the last twelve months, and this growth will make it easier for it to manage its debt. There’s no doubt that we learn the most about debt from the balance sheet. But ultimately, the company’s future profitability will determine whether Atmos Energy can strengthen its balance sheet over time. So if you want to know what the professionals think, you might find this free report on analyst profit forecasts interesting.

After all, a company needs free cash flow to pay off debt; retained earnings simply aren’t enough to do that. So the logical step is to look at the portion of that EBIT that corresponds to actual free cash flow. Over the past three years, Atmos Energy has burned through a lot of cash. While that may be a result of spending on growth, it makes debt significantly riskier.

Our view

Neither Atmos Energy’s ability to convert EBIT to free cash flow nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But its EBIT growth rate tells a very different story, suggesting some resilience. We should also note that companies in the gas utilities industry like Atmos Energy often take on debt with ease. We think Atmos Energy’s debt makes the company a little risky when we consider the above data points together. That’s not necessarily a bad thing, as debt can boost return on equity, but it’s something to be aware of. The balance sheet is clearly the area to focus on when analyzing debt. But ultimately, every company can contain risks that exist off the balance sheet. Case in point: We found 3 warning signals for Atmos Energy You should be aware.

If, after all that, you’re more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.