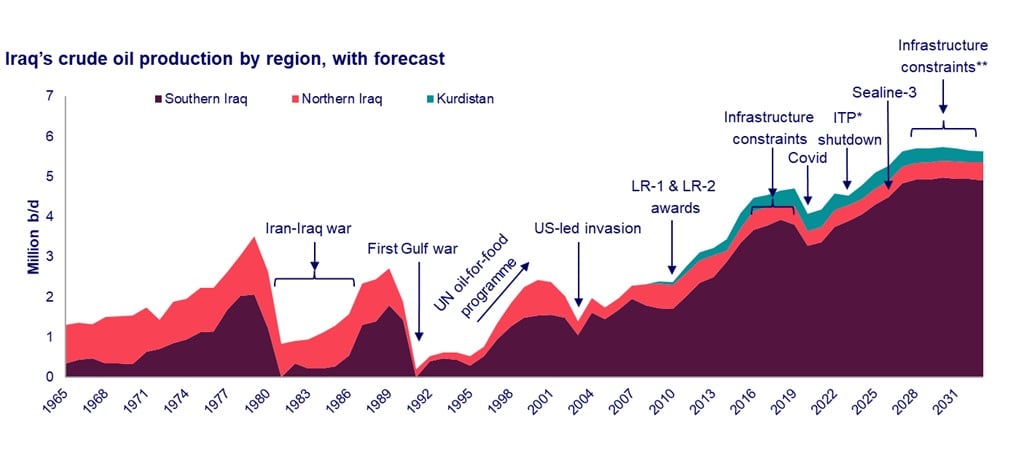

Production is expected to increase, but investment, infrastructure and exploration remain a challenge

Iraq’s upstream sector is undergoing rapid change, with the business ecosystem becoming increasingly diverse and significant investments being made to boost oil and gas production. However, key infrastructure issues still need to be overcome and the lack of exploration activity remains a challenge.

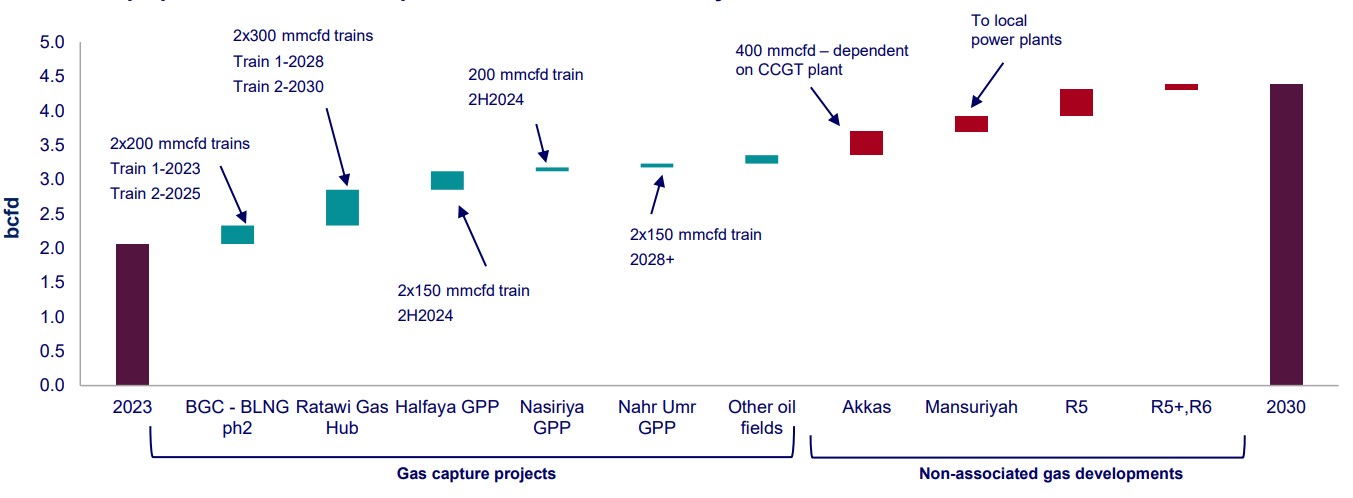

According to Wood Mackenzie’s report “Iraq’s upstream opportunities: a review,” Iraq’s gas production could more than double to 4.4 billion cubic feet per day by 2030. Oil production could reach 5.5 million barrels per day over the same period.

“Iraq’s upstream industry is changing dramatically and has the resources to significantly increase oil and gas production,” said Alexandre Araman, director at Wood Mackenzie. “Corporate interest is increasing as there are numerous opportunities to enter the market at scale. Many of the major corporations are rethinking their presence – given the low returns offered by historically tight fiscal conditions – and have ready buyers in the Southeast Asian NOCs and the state-backed Chinese players.”

Source: Wood Mackenzie Lens. *Iraq-Turkey pipeline. **Excluding Sealines-4 and 5. Sealines are planned subsea pipelines connecting the Fao terminal with the Al Basra oil terminal and are part of the export infrastructure expansion projects in southern Iraq.

According to the report, most of the potential growth will come from the major oil fields in the south, such as Rumaila, West Qurna, Zubair and Majnoon.

However, the report also highlights that many challenges remain.

“Operators currently have to overcome several obstacles if they want to increase their production, especially in terms of infrastructure, as there is currently insufficient capacity for export pipelines and terminals and water injection,” said Araman. “There are also financial problems as it is difficult to extract value from barrels.”

The tough fiscal conditions have hampered both foreign investment and exploration activities. According to Wood Mackenzie, only five exploration wells have been drilled in Iraq since 2013, despite more than 150 billion barrels of oil reserves.

However, recent licensing rounds in 2024 have seen significant interest from Chinese companies, demonstrating growing interest from Asian investors. This also highlights how Iraq’s corporate ecosystem has evolved and expanded over time, as more players from more diverse regions, but particularly Asia, have been attracted to Iraq’s upstream opportunities. However, this attention has been focused on discovered resources rather than exploration potential.

“Iraq’s tax environment remains one of the least competitive in the Middle East and much more needs to be done to increase interest in exploration,” said Araman. “If this issue is resolved, we will likely see more activity from Asian players as the corporate landscape in Iraq shifts from west to east. With improvements in tax conditions and critical infrastructure, a window of opportunity should emerge for more M&A activity and future production growth.”

Araman continued: “The country’s ambitious goal of doubling gas production, ceasing flaring and ending import dependence is supported by 100 trillion cubic feet of resources and political will, which also presents new investment opportunities. Due to the nature of the fiscal conditions, these gas opportunities are in some cases more commercially attractive than oil production. So we are now seeing some of the major players turning their attention more to gas-related opportunities.”

Iraq – planned gradual increase in gas production for key hubs and fields

Source: Wood Mackenzie Lens.