Some say that volatility, not debt, is the best way to think about risk as an investor, but Warren Buffett once said, “Volatility is far from synonymous with risk.” So it may be obvious that you need to consider debt when thinking about how risky a particular stock is, because too much debt can ruin a company. We find that Hapag-Lloyd Aktiengesellschaft (ETR:HLAG) has debt on its balance sheet. The real question, however, is whether this debt makes the company a risk.

Why is debt risky?

Debt and other liabilities become risky for a company when it can’t easily meet those obligations, either through free cash flow or by raising capital at an attractive price. If things go really badly, lenders can take control of the company. A more common (but still costly) case, however, is when a company must issue stock at bargain prices, permanently diluting shareholder ownership, just to shore up its balance sheet. However, the most common situation is when a company manages its debt reasonably well — and to its own benefit. When considering how much debt a company has, you should first look at its cash and debt together.

Check out our latest analysis for Hapag-Lloyd

How much debt does Hapag-Lloyd have?

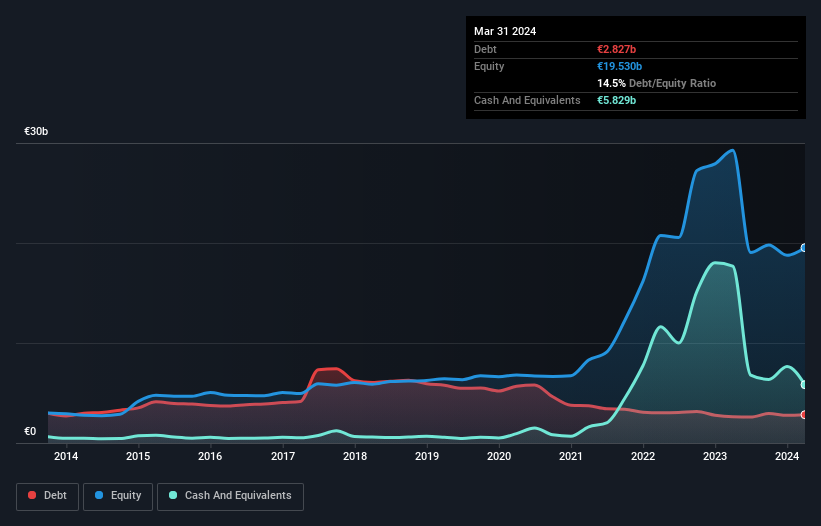

The image below, which you can click on for more details, shows that Hapag-Lloyd had debt of €2.83 billion in March 2024, up from €2.62 billion in the previous year. On the other hand, the company also has €5.83 billion in cash, resulting in a net cash position of €3.00 billion.

A look at Hapag-Lloyd’s liabilities

The latest balance sheet data shows that Hapag-Lloyd has liabilities of EUR 6.12 billion due within one year and liabilities of EUR 4.67 billion due after that. These liabilities are offset by cash of EUR 5.83 billion and receivables of EUR 2.16 billion due within 12 months. In total, liabilities are EUR 2.80 billion higher than the sum of cash and short-term receivables.

Given Hapag-Lloyd’s massive market capitalization of €27.0 billion, it’s hard to imagine that these liabilities pose a major threat. Nevertheless, it’s clear that we should continue to monitor the company’s balance sheet to make sure it doesn’t change for the worse. Despite the sizeable liabilities, Hapag-Lloyd has a net cash balance, so it’s fair to say that the company doesn’t have a heavy debt burden!

The modest debt load could become crucial for Hapag-Lloyd if management cannot prevent a repeat of last year’s 92% EBIT collapse. Falling profits (if the trend continues) could ultimately make even modest debt quite risky. There is no doubt that we learn the most about debt from the balance sheet. But it is above all future earnings that will determine whether Hapag-Lloyd can maintain a healthy balance sheet in the future. So if you want to know what the professionals think, you might find this free report on analysts’ profit forecasts interesting.

However, our final consideration is also important because a company can’t pay off its debts with accounting profits; it needs cold hard cash. While Hapag-Lloyd has net cash on its balance sheet, it’s still worth taking a look at its ability to convert earnings before interest and tax (EBIT) into free cash flow to understand how quickly it builds (or burns) that cash pile. Fortunately for all shareholders, Hapag-Lloyd actually generated more free cash flow than EBIT over the past three years. That kind of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summary

While Hapag-Lloyd has more debt than cash, it also has net cash flow of €3.00 billion. And best of all, 103% of that EBIT was converted into free cash flow, generating €1.0 billion. So we are not worried about Hapag-Lloyd’s debt load. The balance sheet is clearly the area to focus on when analyzing debt. But ultimately, any company can have risks that exist outside the balance sheet. These risks can be difficult to identify. Every company has them, and we have identified them. 3 warning signals for Hapag-Lloyd (2 of which are potentially serious!) that you should know about.

If, after all that, you’re more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we are here to simplify it.

Find out if Hapag-Lloyd is undervalued or overvalued with our detailed analysis. Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.