Good news for AT&T (T) today as the telecom giant has signed a new deal with Nokia (NOK) after losing a previous deal to Ericsson. The new deal will give AT&T new fuel and significantly expand its reach, sending AT&T up over 1.5% in Tuesday afternoon trading.

The deal in question comes after some recent pushes and counter-pushes; Nokia had previously lost a contract with AT&T to Ericsson. AT&T had originally hired Ericsson to help build a new telecommunications network that would cover 70% of AT&T’s mobile traffic by the end of 2026.

Now Nokia is stepping in and signing a five-year fiber optic coverage contract with AT&T. While Nokia did not disclose a price for the deal, it noted that the deal represents “a significant milestone.” By comparison, the Ericsson deal, which also ran for five years, was worth around $14 billion. If the Nokia deal is comparable, it suggests a price in that range.

Work problems

Meanwhile, AT&T has a new problem: labor issues. The Communications Workers of America union recently withdrew from mediation talks with AT&T, saying AT&T is using the mediation process as “…another delaying tactic.” That means over 17,000 workers — from technicians to customer service — will continue their strike that began last month.

AT&T, for its part, responded by declaring that “…no progress is possible without a willingness to compromise.” That’s true, and so far the impact has been relatively minimal. AT&T also stated that it will continue to have contingency plans in place to ensure that all areas are covered and service continues without interruption.

Should I buy, sell or hold AT&T?

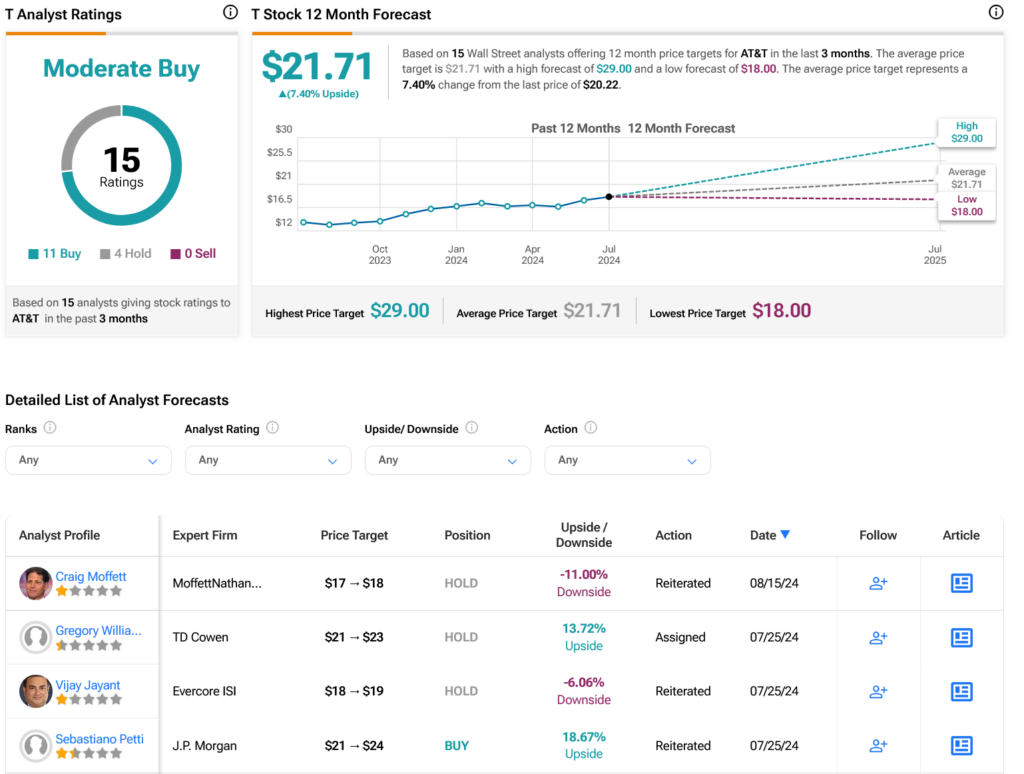

As for Wall Street, analysts have issued a Moderate Buy consensus rating for T stock, based on 11 Buy recommendations and four Hold recommendations over the past three months, as shown in the chart below. After a 49.45% increase in the stock over the past year, the average price target of $21.71 per share implies 7.4% upside potential.

View more T-analyst ratings

notice