Northern Oil and Gas, Inc. (NYSE:NOG) dividend will increase to $0.42 compared to the year-ago period payment on October 31. Based on this payment, the company’s dividend yield will be 4.4%, which is fairly typical for the industry.

Check out our latest analysis for Northern Oil and Gas

Northern Oil and Gas dividend is well covered by earnings

We are not particularly impressed with dividend yields unless they can be sustained over a long period of time. Northern Oil and Gas easily earns enough to cover its dividend, but suffers from weak cash flows. Since the company is not earning any money, paying out to shareholders will become difficult at some point.

Next year, earnings per share are expected to grow by 48.4%. Assuming the dividend stays the same, the payout ratio next year could be 19%, which is in a fairly sustainable range.

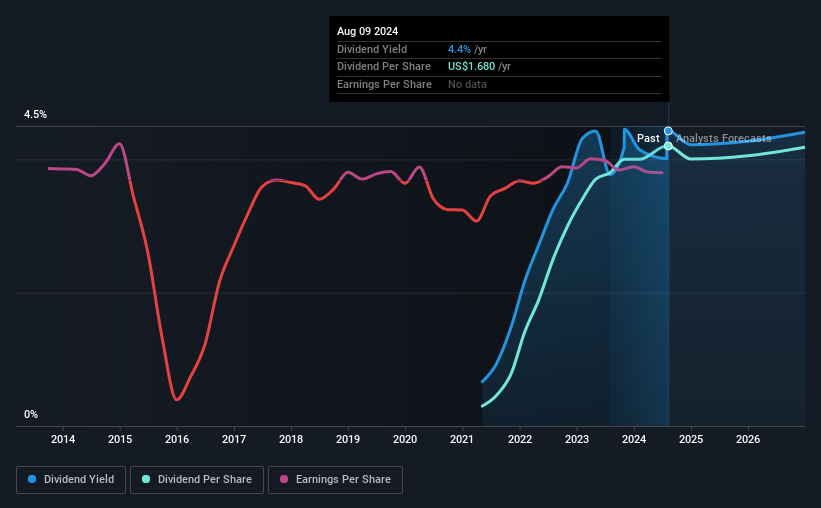

Northern Oil and Gas continues to build on its track record

The dividend has been pretty stable in retrospect, but the company hasn’t been paying a dividend for very long. That makes it difficult to gauge how it would perform over a full economic cycle. As of 2021, the annual payment was $0.12 then, compared to the last full-year payment of $1.68. That represents a compound annual growth rate (CAGR) of roughly 141% per year over that period. Northern Oil and Gas has been increasing its dividend fairly quickly, which is exciting. However, the short payment history makes us doubt whether that performance will continue over a full market cycle.

Northern Oil and Gas may struggle to increase dividend

Investors who have held shares in the company over the past few years will be pleased with the dividend income they have received. Earnings have grown at about 3.1% per year over the past five years, which is not huge but still better than seeing them shrink. Although EPS growth is quite low, Northern Oil and Gas has the opportunity to increase its payout ratio to return more money to shareholders.

Our thoughts on Northern Oil and Gas’s dividend

Overall, this is probably not a great dividend stock, even if the dividend is currently being increased. Given the lack of cash flows, it is hard to see how the company can sustain a dividend payment. We do not believe Northern Oil and Gas is a great stock for your portfolio if your focus is on dividend payment.

Investors generally prefer companies with a consistent, stable dividend policy over companies with an irregular dividend policy. However, investors must consider other aspects when analyzing stock performance. A typical example: We have 5 warning signs for Northern Oil and Gas (1 of which is potentially serious!) that you should know about. Looking for more high-yield dividend ideas? Try our Collection of strong dividend payers.

Valuation is complex, but we are here to simplify it.

Find out if Northern Oil and Gas is undervalued or overvalued with our detailed analysis. Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.