Hitek Global Inc. (NASDAQ:HKIT) shareholders will not be happy to see that the stock price has had a very bad month, falling 27% and erasing the positive performance of the prior period. For all long-term shareholders, last month ended a year to forget, as the stock price fell 92%.

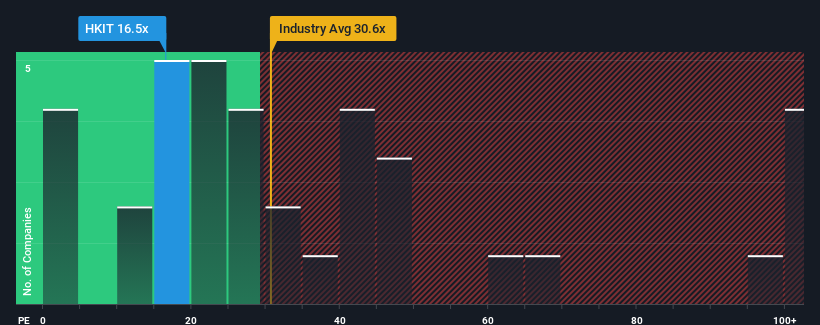

Even after such a sharp price drop, there may not be many who think Hitek Global’s price-to-earnings (or “P/E”) ratio of 16.5 is worth mentioning when the median P/E in the United States is similarly high, at around 17. While that may not be surprising, if the P/E is not justified, investors could miss out on a potential opportunity or ignore a looming disappointment.

For example, Hitek Global’s falling earnings recently should give cause for concern. It could be that many expect the company to put its disappointing earnings performance behind it in the coming period, which has prevented its P/E ratio from falling. If you like the company, you’d at least hope that this is the case so you can potentially buy some shares while it’s not in demand.

Check out our latest analysis for Hitek Global

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free Hitek Global earnings, revenue and cash flow report.

Is there growth for Hitek Global?

There is a fundamental assumption that a company should adjust to the market for P/E ratios like Hitek Global’s to be considered reasonable.

First, if we look back, the company’s earnings per share growth over the last year hasn’t been particularly exciting as it recorded a disappointing decline of 39%. This means that the company has also experienced a decline in earnings over the long term as earnings per share have declined by a total of 53% over the last three years. Therefore, it’s fair to say that earnings growth has been undesirable for the company lately.

When compared to the market, which is forecast to grow by 15 percent over the next twelve months, the company’s downward momentum based on its recent medium-term earnings figures paints a sobering picture.

With this in mind, it is somewhat worrying that Hitek Global’s P/E ratio is in line with most other companies. It seems that many of the company’s investors are far less pessimistic than its recent history would suggest and are not prepared to offload their shares at this time. There is a good chance that existing shareholders are setting themselves up for future disappointment if the P/E ratio falls to a level more in line with recent negative growth rates.

The conclusion on Hitek Global’s P/E ratio

After Hitek Global’s share price plunge, the P/E ratio is now at the average market P/E ratio. It is not useful to use the price-to-earnings ratio alone to determine whether you should sell your shares, but it can be a handy guide to the company’s future prospects.

We have noted that Hitek Global is currently trading at a higher than expected P/E ratio because recent earnings have been declining over the medium term. When we see earnings declining and falling short of market forecasts, we suspect the share price could decline, which in turn drives the modest P/E ratio lower. If recent medium-term earnings trends continue, shareholders’ investments are at risk and potential investors risk paying an unnecessary premium.

Before you take the next step, you should know about the 4 warning signs for Hitek Global (1 is significant!) that we uncovered.

If you are interested in P/E ratiosyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we are here to simplify it.

Find out if Hitek Global could be undervalued or overvalued with our detailed analysis, Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.