Mundial SA – Produtos de Consumo (BVMF:MNDL3) Shareholders will not be happy to see that the share price has had a very rough month, falling 29%, erasing the positive performance of the previous period. The fall over the last 30 days has capped off a rough year for shareholders, with the share price falling 15% in that time.

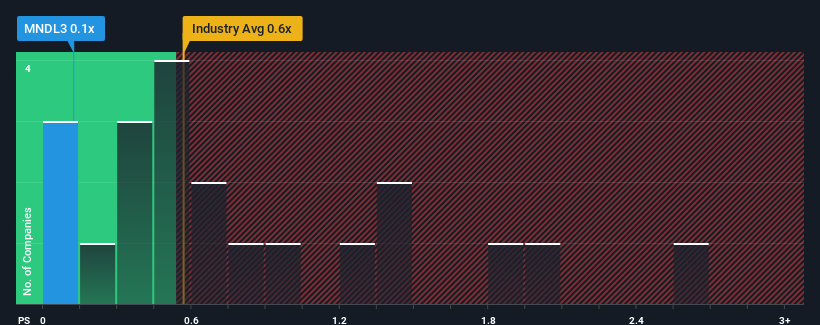

Even after such a sharp price drop, it is not an exaggeration to say that Mundial – Produtos de Consumo’s price-to-sales ratio (or “P/S”) of 0.1 seems pretty “average” right now, compared to the Consumer Goods industry in Brazil, where the median P/S ratio is around 0.6. However, it is not wise to simply ignore the P/S without explanation, as investors may miss a special opportunity or a costly mistake.

Check out our latest analysis for Mundial – Produtos de Consumo

What is the recent performance of Mundial – Produtos de Consumo?

Mundial – Produtos de Consumo has been doing a good job of growing its revenue at a solid pace recently. Many may be expecting the respectable revenue performance to fade, which has prevented the P/S increase. If you like the company, you’d hope that doesn’t happen so you can potentially buy some shares while it’s not in demand.

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on Mundial – Produtos de Consumo will help you shed light on the company’s historical performance.

Is a certain sales growth forecast for Mundial – Produtos de Consumo?

Mundial – Produtos de Consumo’s P/S ratio would be typical of a company that is expected to deliver only moderate growth and, importantly, perform in line with the industry.

First, if we look back, we can see that the company was able to increase its revenue by a remarkable 10% last year. Over the last three-year period, total revenue also increased by an excellent 41%, thanks in part to short-term performance. So, first of all, we can see that the company has done an excellent job of increasing revenue during this time.

This contrasts with the rest of the industry, where growth of 19% is expected for next year, well above the company’s recent medium-term annualized growth rates.

With this in mind, we find it interesting that Mundial – Produtos de Consumo’s P/S is comparable to its industry peers. It seems that most investors are ignoring the fairly low growth rates of late and are willing to pay more to own the stock. They could be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What can we learn from the P/S of Mundial – Produtos de Consumo?

With its share price plummeting, Mundial – Produtos de Consumo’s price-to-earnings ratio appears to be in line with the rest of the Consumer Staples industry. Normally, we would caution against reading too much into the price-to-sales ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

Our research into Mundial – Produtos de Consumo found that the weak three-year revenue trends are not translating into a lower P/S as we expected, as they look worse than the current industry outlook. At the moment, we are unhappy with the P/S as this revenue trend is unlikely to support more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline becomes quite high, putting shareholders at risk.

You should always think about the risks. A typical example: We have 3 warning signs for Mundial – Produtos de Consumo You should be aware of these, and two of them are cause for some concern.

If this Risks make you rethink your opinion of Mundial – Produtos de Consumoexplore our interactive list of high-quality stocks to get a sense of what else is out there.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.