Unfortunately for some shareholders Nexteer Automotive Group Limited (HKG:1316) has fallen 33% over the past 30 days, extending recent losses. For all long-term shareholders, last month ended a year to forget as the share price fell 51%.

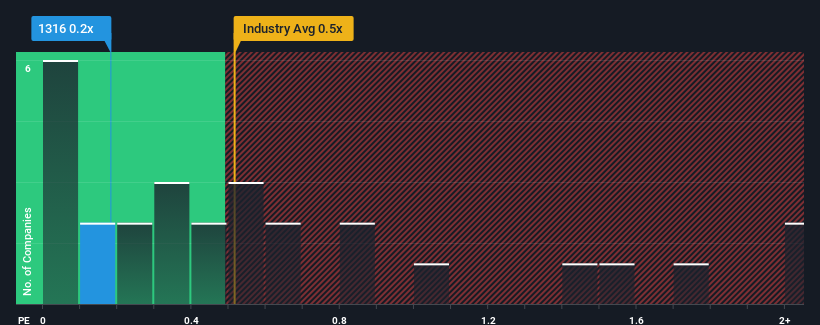

Despite the sharp price decline, it is not an exaggeration to say that Nexteer Automotive Group’s price-to-sales (or “P/S”) ratio of 0.2 seems pretty “average” right now, compared to the auto parts industry in Hong Kong, where the median P/S ratio is around 0.5. However, investors could be missing a clear opportunity or a potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Nexteer Automotive Group

What does Nexteer Automotive Group’s P/S mean for shareholders?

Nexteer Automotive Group could be doing better because its revenue has grown less recently than most other companies. Perhaps the market is expecting future revenue growth, which has prevented the price-to-sales decline. However, if that doesn’t happen, investors could be falling into a trap and overpaying for the stock.

If you want to know what analysts are predicting for the future, you should check out our free Report on the Nexteer Automotive Group.

What do the sales growth metrics tell us about the P/S?

Nexteer Automotive Group’s price-to-sales ratio would be typical of a company that is expected to deliver only moderate growth and, importantly, perform in line with the industry.

If we look at last year’s revenue, the company delivered a result that showed little variation from the previous year. Nevertheless, the last three-year period was better as it delivered a decent overall revenue increase of 18%. So, it seems to us that the company has had a mixed result in terms of revenue growth during this period.

As for the outlook, the company is expected to grow at a rate of 4.3% per year over the next three years, as estimated by analysts covering the company. With the industry forecast to grow at a rate of 17% per year, the company will have to expect a weaker top-line performance.

Given this information, we find it interesting that Nexteer Automotive Group trades at a fairly similar price-to-earnings ratio compared to the industry. It seems that most investors are ignoring the fairly limited growth expectations and are willing to pay more to own the stock. These shareholders could be setting themselves up for future disappointment if the price-to-earnings ratio falls to a level more in line with the growth prospects.

The last word

Nexteer Automotive Group’s declining share price has brought its price-to-sales ratio back into a similar region to the rest of the industry. Generally, we prefer to use the price-to-sales ratio only to determine what the market thinks about the overall health of a company.

Our look at analyst forecasts for Nexteer Automotive Group’s revenue outlook has shown that the weaker revenue outlook is not having as much of a negative impact on the P/S as we would have expected. When we see companies with relatively weaker revenue outlooks compared to the industry, we suspect that the share price could decline, driving down the modest P/S. This puts shareholders’ investments at risk and potential investors risk paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning signal for Nexteer Automotive Group that we uncovered.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we are here to simplify it.

Discover whether Nexteer Automotive Group could be under- or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.