To the annoyance of some shareholders Edvance International Holdings Limited (HKG:1410) shares have fallen a whopping 35% over the past month, continuing the company’s terrible run. For any long-term shareholders, last month ends a year to forget, with the share price falling 73%.

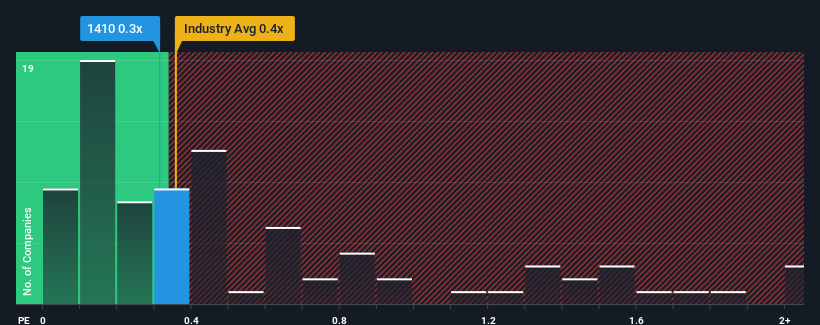

Although the price has dropped significantly, you could be forgiven for being indifferent to Edvance International Holdings’ P/S ratio of 0.3, as the median price-to-sales (or “P/S”) ratio for the Hong Kong Electronics industry is also 0.4. However, it is not wise to simply ignore the P/S without explanation, as investors may miss a special opportunity or a costly mistake.

View our latest analysis for Edvance International Holdings

What does Edvance International Holdings’ P/S mean for shareholders?

Edvance International Holdings has done a good job of growing its revenue at a solid pace recently. Many may expect the respectable revenue performance to fade, which has prevented the P/S increase. If you like the company, you hope that doesn’t happen so you can potentially buy some shares while it’s not in demand.

Although there are no analyst estimates for Edvance International Holdings, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

Is Edvance International Holdings forecast to grow revenue?

A P/S like that of Edvance International Holdings is only safe if the company’s growth closely corresponds to that of the industry.

Looking back, last year saw the company grow its revenue by a decent 8.3%. This was backed up by an excellent period prior to that, with revenue increasing by 52% over the last three years. So, first of all, we can say that the company has done a great job of growing its revenue during that time.

Comparing recent medium-term sales trends with the industry’s one-year growth forecast of 25%, it becomes clear that this segment is significantly less attractive.

With that in mind, we find it interesting that Edvance International Holdings’ P/S is comparable to its industry peers. It seems that many of the company’s investors are less pessimistic than its recent history would suggest and are not willing to offload their shares at this time. Maintaining these prices will be difficult, as a continuation of recent revenue trends will likely weigh on shares at some point.

The most important things to take away

With its share price plummeting, Edvance International Holdings’ price-to-sales ratio appears to be in line with the rest of the Electronics industry. While the price-to-sales ratio shouldn’t be the deciding factor in whether or not you buy a stock, it is a fairly useful indicator of sales expectations.

We found that Edvance International Holdings’ average P/S is somewhat surprising given that its recent growth over the past three years is below the industry forecast. At the moment, we are unhappy with the P/S as this revenue trend is unlikely to support more positive sentiment for long. If recent medium-term revenue trends continue, the likelihood of a share price decline becomes quite high, putting shareholders at risk.

You should also inform yourself about these 4 warning signs we noticed about Edvance International Holdings (including 1, which is a little worrying).

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

Valuation is complex, but we are here to simplify it.

Discover whether Edvance International Holdings could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.