Headquartered in San Francisco, California Airbnb, Inc. ABNB has been operating as a company for 26 years and was founded on August 11, 2008. This community-based vacation rental company is an online platform for listing and renting homes in the area. Here is a quick look back at the company’s origins and history as a publicly traded company and how investment-worthy the stock was.

The beginning: The hackneyed phrase of humble beginnings applies to Airbnb as Brian Cheskyone of the co-founders, came up with an ingenious way to finance the rent of his house in affluent San Francisco. The cash-strapped wannabe entrepreneur and his co-founder Joe Gebbiaoffered “air, bed and breakfast” – a package of three air mattresses, breakfast, Wi-Fi and a desk for attendees of an industrial design conference who could not reserve a hotel room and needed accommodation over the weekend.

The duo was joined by a graduate of Harvard University Nathan Blecharczyk in February 2008, and the website Airbedandbreakfast.com launched on August 11, 2008. As business faltered, the co-founders sold cereal boxes to the former president Barack Obama And John McCainwho ran against him in the 2008 presidential election.

The company subsequently successfully raised capital from several venture capital firms, including Y-combinator, Youniversity Ventures Partners, Sequoia Capital, Greylock Partners And TPG Capital.

International advances and acquisitions: The company launched in Europe in May 2011 through the acquisition of Accoleo and international expansion progressed rapidly. By the end of 2012, the company was already present in South America, Asia and Australia.

After the 2012 Summer Olympics, Airbnb acquired its London-based competitor CrashPadderwhich added 6,000 international listings to its inventory. Its other acquisitions included NabeWise, a city guide that aggregated curated information for specific locations, and Localmind, a location-based question-and-answer platform that allows users to ask questions about specific locations online.

See also: How to buy Airbnb shares (ABNB)

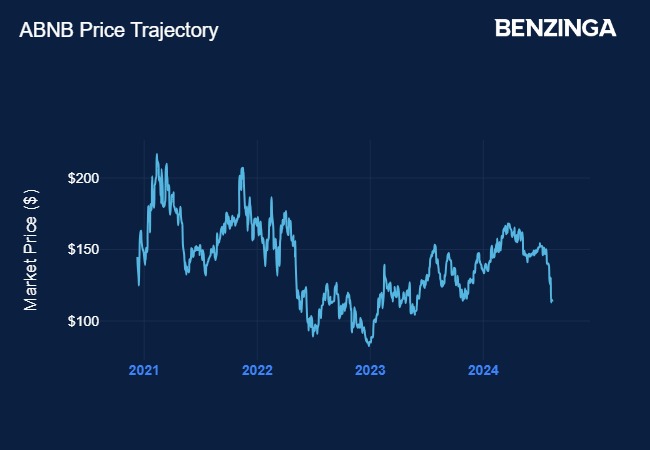

Airbnb IPO: In August 2020, Airbnb announced that it had confidentially filed for its IPO, and two months later, it filed a prospectus on Form S-1 with the SEC. The company offered 51.32 million shares to the public at a price of $68 apiece. The stock opened at $146 in the debut session (December 10, 2020) and closed at $144.71.

After trading in a wide range over the following year, the stock declined along with the overall market in 2022, falling to an all-time low of under $82 in late 2022. It recovered by March 2024, peaking at over $170, but has been declining since then.

Source: Benzinga

Key Airbnb metrics: The fourth quarter 2023 financial report released in mid-February showed revenue of $9.9 billion, up 18% year-over-year, and net income of $4.8 million. Adjusted EBITDA was $3.7 billion and free cash flow was $3.8 billion.

Among operating metrics, gross booking value increased 16% to $73.3 billion in 2023 and the number of room nights and experiences booked increased 14% to $448.2 million. The company noted accelerating growth in underserved markets.

Returns from Airbnb: If an investor had invested a hypothetical amount of $1,000 in Airbnb when the first session’s closing price was $144.71, they would own 6.91 shares. Those shares would now be worth $785.2, a negative return of about $215, or a negative 22% in percentage terms.

According to TipRanks, analysts’ average price target for Airbnb next year is $130.38, representing an upside of about 18 percent from current levels.

Following the release of second-quarter results earlier this month, Needham analyst Bernie McTernan reiterated its “hold” rating on the stock. Quarterly results and forecasts will keep investors on tenterhooks, according to analysts, as key operating metrics showed a slowdown in growth in the second quarter. The company hinted that further slowdown will occur in the future.

“We expect investors to push ABNB harder to expand beyond its core business, although this does not appear to be in the near-term plans,” he said. “The stock is in a difficult position as it has had significant success in TAM and margin expansion over the past four years and there is an undefined catalyst path from here.”

Airbnb shares closed Monday’s session $1.27 lower at $113.62, according to data from Benzinga Pro.

Read more:

Image via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.