Investment objectives vary depending on investment horizon and risk tolerance, but most well-diversified investors are likely looking for a balance between growth, income and value stocks.

When scouring the market for high-dividend stocks, don’t just focus on yield. Instead, invest in quality companies that have the potential to grow their earnings and dividends. After all, a company with no growth prospects could significantly underperform the market – and you’d be better off investing in other stocks or a high-yield savings account to generate income.

Walmart (NYSE: WMT), Goal (NYSE:TGT)And Clorox (NYSE: CLX) have increased their dividends every year for decades. In addition, all three companies have the potential to increase their earnings and value over time – so the investment thesis is not just about passive income.

If you invest $2,000 in each stock, you should earn at least $150 in dividend income annually. Here’s why all three dividend stocks are worth buying right now.

Walmart could continue to post above-average profits

As of Friday’s close, Walmart had a yield of just 1.2% – by far the lowest yield of any stock on this list. But Walmart is a victim of its own success.

When a stock’s price exceeds dividend increases, its yield falls. Walmart is up more than 29% year-to-date, making it the best-performing part of the Dow Jones Industrial Average – better than Microsoft, Appleand other growth stocks.

Walmart is a dividend king, having increased its dividend for over 50 consecutive years. In February, the company raised its dividend by 9%, and there is reason to believe that the pace of dividend increases will continue to accelerate.

Walmart’s outlook for fiscal 2025 is decent, but not great. Consolidated net sales are expected to grow at least 4%, consolidated adjusted operating income is expected to grow at least 6%, and adjusted earnings per share (EPS) is expected to be at least $2.37. If Walmart earns that much at the end of fiscal 2025 on Jan. 31, today’s stock price would give a price-to-earnings (P/E) ratio of 28.7.

However, earnings per share can be misleading when a company has unusually high, one-time expenses that reduce profits, which is exactly the case with Walmart. Capital expenditures (capex) soared as the company made long-term investments in store remodeling, improving its Walmart+ e-commerce delivery program, and more. These expenses won’t translate directly into profits. However, we could see capital expenditures become a smaller percentage of sales starting next fiscal year, which should boost margins.

Short-term investors may find Walmart’s payout ratio of just 33% ridiculous and wonder why the company doesn’t invest more of its earnings in dividends. While Walmart could afford a much higher dividend, it could benefit investors even more in the long term by using its capital effectively. Over the past 12 months, Walmart has spent $20.85 billion on investments — three times its dividend payout. Walmart is in growth mode, so buying the stock depends more on where the company (and thus its dividend) is headed than where it is today.

Walmart is not an exciting company, but this is an interesting time to invest in Walmart, especially if the company can continue to make progress in curbside pickup and delivery.

Target finds its way

In June, Target increased its dividend for the 53rd consecutive year, to $1.12 per share per quarter. However, this was only a 1.8% increase from the previous quarterly dividend. When companies barely increase their dividend to maintain a winning streak, it can be a sign that growth is slowing.

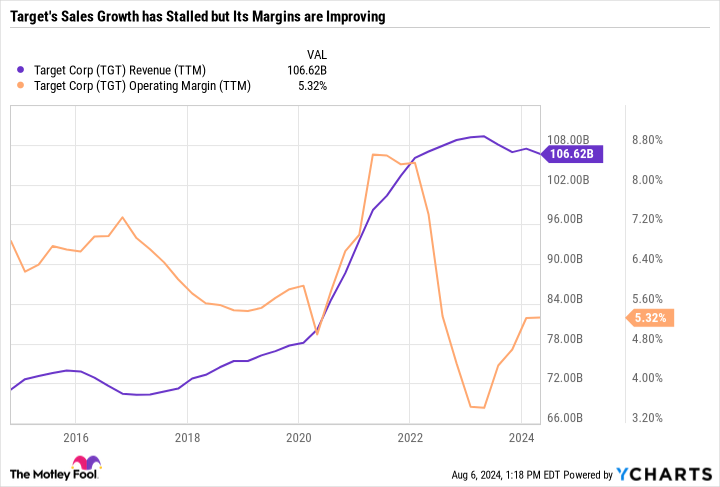

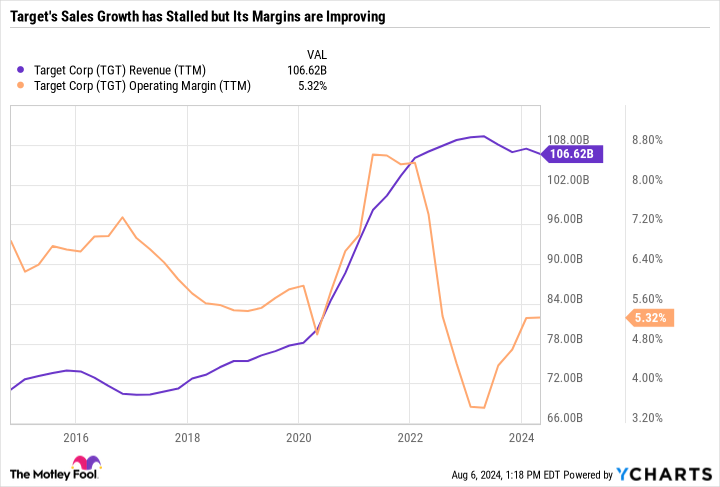

In Target’s case, a small dividend increase was probably the right decision. This chart gives some clues as to why.

In the fiscal year ended January 30, 2021, Target reported record earnings per share of $14.10 as consumer spending surged during the worst of the COVID-19 pandemic. Following the strong year, Target increased its dividend by 20% in June 2022, which in hindsight was a bit overzealous. Target endured one of the most disappointing years in its recent history as supply chain issues combined with overestimated demand led to underperformance.

Since then, sales growth has stagnated and margins have fallen. Target has recovered from the worst of the margin decline, but the company is not running at full speed. For the full year, Target is forecasting only 0 to 2 percent sales growth in stores and earnings per share of $8.60 to $9.60. On average, that would correspond to earnings growth of less than 2 percent.

Target hasn’t been a consistent company in recent years. Its volatile share price reflects fluctuations in investor sentiment. But looking ahead, Target stands out as a high-quality value stock to buy now. Its payout ratio is under 50%, suggesting Target can easily afford its dividend. Its dividend yield is a whopping 3.3% – much higher than Walmart, for example. While Target isn’t growing at the pace investors have come to expect, its price-to-earnings ratio is just 15.2, which is dirt cheap.

Overall, Target is a solid dividend stock to buy now, especially if the company can continue to post more consistent growth.

Clorox gets its costs under control

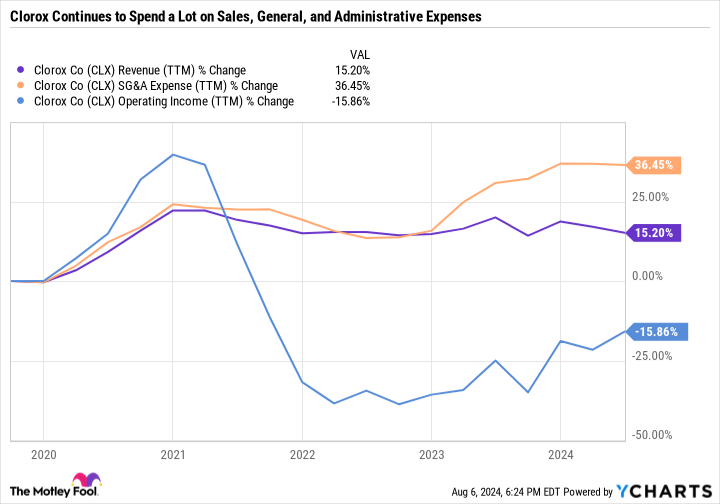

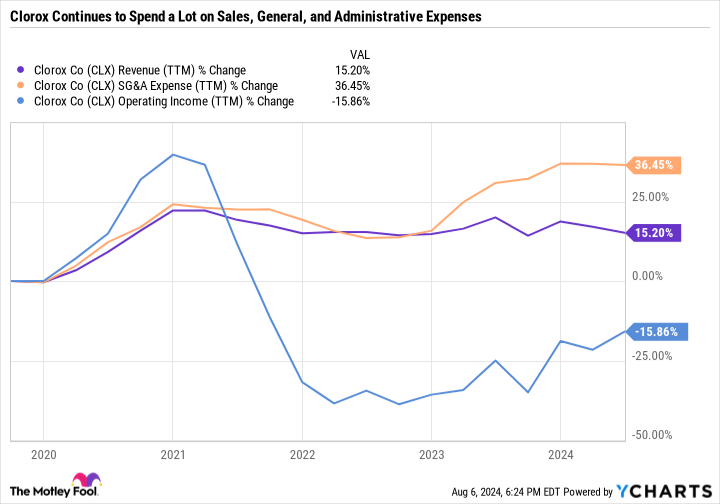

Like Target, Clorox has been in recovery mode for several years. Clorox experienced a surge in demand at the beginning of the pandemic. Management was confident that its sanitation practices would remain in place post-pandemic. But things didn’t quite go according to plan. Clorox grossly overestimated demand, was hit by supply chain issues, inflation, and then – to top it all off – a cyberattack that hit the company hard in 2023. Needless to say, things have been anything but normal for Clorox.

As you can see in the chart, Clorox’s selling and administrative expenses have been growing faster than revenue. After peaking in 2020, operating income has declined over the past five years due to slow revenue growth and high costs.

The good news is that Clorox appears to have found a better balance – for the first time in four years. Clorox just reported fourth-quarter and full-year 2024 results, which showed higher gross margins and better cost management. The guidance for fiscal 2025 calls for net sales growth of just 0 to 2 percent, but a 100 basis point increase in gross margin and adjusted earnings per share of $6.55 to $6.80 – an increase of 6 to 10 percent.

Clorox is doing better, but not great. But like Target, the stock price already reflects the company’s challenges – Clorox is currently below pre-pandemic levels.

On July 30, Clorox increased its quarterly dividend from $1.20 to $1.22 per share, a marginal increase, continuing a dividend streak that dates back to 1984.

With a yield of 3.4%, Clorox is another company making progress in turning its fortunes around and could reward patient shareholders with generous passive income.

Should you invest $1,000 in Walmart now?

Before you buy Walmart stock, consider the following:

The Motley Fool Stock Advisor A team of analysts has just found out what they think The 10 best stocks for investors to buy now… and Walmart wasn’t among them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Think about when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have 641,864 USD!*

Stock Advisor offers investors an easy-to-understand plan for success, including portfolio construction guidance, regular analyst updates and two new stock recommendations per month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 6, 2024

Daniel Foelber does not own any of the stocks mentioned. The Motley Fool owns and recommends Apple, Microsoft, Target, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

All you need is $2,000 to invest in Walmart and each of these two dividend stocks to generate over $150 in passive income per year. was originally published by The Motley Fool