Legendary fund manager Li Lu (who was backed by Charlie Munger) once said, “The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.” So it may be obvious that you need to consider debt when thinking about how risky a particular stock is, because too much debt can bankrupt a company. We can see that Allison Transmission Holdings, Inc. (NYSE:ALSN) does indeed use debt in its business. But is this debt a cause for concern for shareholders?

What risks are associated with debt?

Generally, debt only becomes a real problem when a company can’t easily pay it back, either by raising capital or through its own cash flow. A key part of capitalism is the process of “creative destruction,” in which failed companies are mercilessly liquidated by their bankers. A more common (but still costly) case, however, is when a company must issue shares at knockdown prices, permanently diluting shareholders’ equity, just to shore up its balance sheet. However, the most common situation is when a company manages its debt reasonably well—and to its own advantage. When considering how much debt a company has, you should first look at its cash and debt together.

Check out our latest analysis for Allison Transmission Holdings

How much debt does Allison Transmission Holdings have?

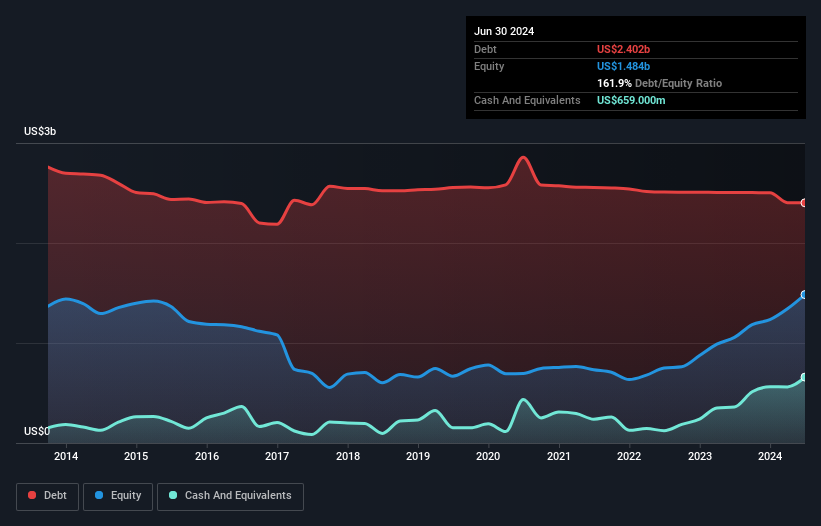

You can click on the chart below to see the historical numbers, but it shows that Allison Transmission Holdings had $2.40 billion in debt as of June 2024, up from $2.51 billion a year earlier. However, the company also had $659.0 million in cash, so its net debt is $1.74 billion.

How healthy is Allison Transmission Holdings’ balance sheet?

Looking more closely at the most recent balance sheet data, we can see that Allison Transmission Holdings had liabilities of US$511.0m due within 12 months and liabilities of US$3.18b due beyond that, versus US$659.0m in cash and US$383.0m in receivables due within 12 months. So liabilities total US$2.65b more than the combination of cash and short-term receivables.

Allison Transmission Holdings has a market capitalization of $7.71 billion, so it could certainly raise cash to bolster its balance sheet if needed, but we certainly want to be on the lookout for any indications that the company’s debt is creating too much risk.

To quantify a company’s debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest coverage ratio). The advantage of this approach is that we take into account both the absolute amount of debt (net debt relative to EBITDA) and the actual interest expense associated with that debt (its interest coverage ratio).

Allison Transmission Holdings’ net debt of 1.6 times EBITDA suggests it is using its debt responsibly. And the fact that its trailing twelve months EBIT was 9.8 times interest expenses fits with this theme. Also positive is that Allison Transmission Holdings was able to grow its EBIT by 10% over the last year, further improving its ability to manage debt. When analyzing debt levels, the balance sheet is the obvious place to start. But it is future earnings above all that will determine whether Allison Transmission Holdings can maintain a healthy balance sheet going forward. So if you want to know what the professionals think, you might find this free report on analyst earnings forecasts interesting.

After all, a company can only pay off its debt with cold hard cash, not accounting profits, so we need to make sure that EBIT is leading to free cash flow to match. Over the last three years, Allison Transmission Holdings recorded free cash flow equal to 68% of its EBIT, which is about normal considering that free cash flow excludes interest and tax. This cold hard cash means the company can pay down its debt if needed.

Our view

Allison Transmission Holdings’ interest coverage suggests that the company can manage its debt as easily as Cristiano Ronaldo could score a goal against an under-14 goalkeeper. And the good news doesn’t stop there, as its conversion of EBIT to free cash flow also reinforces this impression! Taking all these factors into account, it seems that Allison Transmission Holdings can easily manage its current debt. Of course, this debt can increase return on equity, but it also brings with it higher risks, so it’s worth keeping an eye on. Undoubtedly, the balance sheet is where we learn the most about debt. But ultimately, every company can contain risks that exist outside of the balance sheet. A typical example: we have 1 warning signal for Allison Transmission Holdings You should be aware.

Ultimately, sometimes it’s easier to focus on companies that don’t even need debt. Readers can access a list of growth stocks with no net debt. 100% freeat the moment.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.