Americans are looking to switch insurance coverage more often than before after a rise in premiums put a strain on household budgets, a new industry report shows.

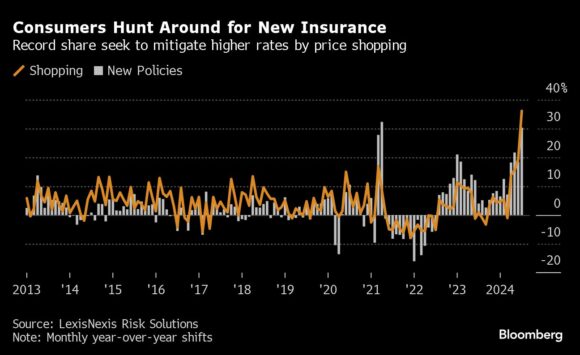

According to LexisNexis Risk Solutions, an insurance data clearinghouse with access to more than 95% of the auto insurance market, so-called policy shopping rates – essentially the share of policyholders who shopped around for quotes from a provider – rose an average of 16% year-over-year in the second quarter of 2024. In July, the number rose even further, to over 30%.

The search for money-saving alternatives reflects a rapid increase in insurance premiums in recent years, due in part to the rising cost of auto parts and repairs. While the overall cost of living has increased by about 20% since the pandemic began in 2020, auto insurance bills have increased by nearly 50%.

Prices are now “absolutely” driving buying activity in the market, Chris Rice, a senior executive at LexisNexis, said in an interview. That’s a change from previous patterns, when it was typically a life event such as a move, a new car purchase or adding a teenager to a policy that prompted consumers to purchase insurance, he said.

It wasn’t just the car insurance market that saw major changes. Buyers of home insurance were also affected by rising costs and changes in coverage, which led to providers losing some customers.

In California, for example, more than 50 percent of homeowners said insurance prices in their area had increased compared to the previous year, according to a Redfin survey conducted this spring. In Florida, the figure was even higher at 70 percent, while 12 percent of respondents said they had been fired by their insurance company.

One reason for this could be the increasing threat from extreme weather and other climate-related risks.

“Rising insurance costs and natural disasters are causing some people to move,” says the Redfin study, which found that Florida residents planning to move in the next year are twice as likely to cite higher insurance costs as a reason than Americans overall.

Rice said the recent increases in insurance premiums are “unprecedented” for the industry. He said LexisNexis data shows that middle-aged and older Americans in particular are looking for alternative policies, potentially a sign of financial stress in those age groups.

“We have definitely seen a significant increase among the elderly,” which “outpaces other age groups,” he said.

Photo: Photographer: David Paul Morris/Bloomberg

Copyright 2024 Bloomberg.

The most important insurance news, in your inbox every working day.

Get the insurance industry’s trusted newsletter