David Iben put it well when he said, “Volatility is not a risk we care about. What we care about is avoiding permanent loss of capital.” So it should be obvious that you have to take debt into account when thinking about how risky a particular stock is, because too much debt can ruin a company. AMETEK, Inc. (NYSE:AME) has debt. But the bigger question is: how much risk is associated with that debt?

When is debt dangerous?

Generally, debt only becomes a real problem when a company can’t easily pay it back, either by raising capital or through its own cash flow. In a worst-case scenario, a company can go bankrupt if it can’t pay its creditors. However, a more common (but still costly) situation is when a company has to dilute shareholders at a cheap share price just to get debt under control. However, the most common situation is when a company manages its debt reasonably well – and to its own advantage. When we think about a company’s use of debt, we first consider cash and debt together.

Check out our latest analysis for AMETEK

What is AMETEK’s net debt?

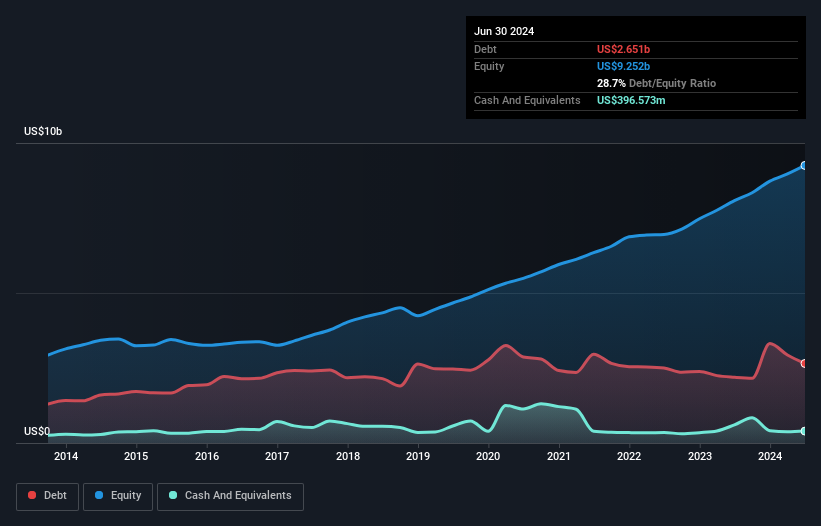

As you can see below, AMETEK had $2.65 billion in debt at the end of June 2024, up from $2.19 billion a year ago. Click on the image for more details. However, that compares to $396.6 million in cash, resulting in net debt of about $2.25 billion.

How strong is AMETEK’s balance sheet?

According to the last reported balance sheet, AMETEK had liabilities of $2.20 billion due within 12 months and liabilities of $3.34 billion due beyond 12 months. Against this, it had $396.6 million in cash and $1.13 billion in receivables due within 12 months. So the company’s liabilities total $4.02 billion more than its cash and short-term receivables combined.

Of course, AMETEK has a gigantic market capitalization of $37.8 billion, so these liabilities are probably manageable. But there are so many liabilities that we would definitely recommend shareholders keep an eye on the balance sheet going forward.

To quantify a company’s debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest coverage ratio). The advantage of this approach is that we take into account both the absolute amount of debt (net debt relative to EBITDA) and the actual interest expense associated with that debt (its interest coverage ratio).

AMETEK has a low net debt to EBITDA ratio of just 1.1. And its EBIT covers its interest expense by 18.2 times. So, you could argue that the company is no more threatened by its debt than an elephant is by a mouse. The good news is that AMETEK grew its EBIT by 9.7% over twelve months, which should allay any worries about debt repayment. There’s no doubt that we learn the most about debt from the balance sheet. But it’s future earnings, more than anything, that will determine AMETEK’s ability to maintain a healthy balance sheet going forward. So if you’re focused on the future, that’s what you can look at. free Report with analysts’ profit forecasts.

After all, a company can only pay off its debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is converted into free cash flow. Over the last three years, AMETEK has generated free cash flow equal to a very solid 81% of its EBIT, more than we would have expected. This puts the company in a very strong position to pay down debt.

Our view

The good news is that AMETEK’s proven ability to cover its interest expenses with its EBIT delights us as much as a fluffy puppy delights a toddler. And the good news doesn’t stop there, because its conversion of EBIT to free cash flow also supports this impression! Upon closer inspection, AMETEK seems to use debt quite sensibly; and that proves us right. After all, sensible debt financing can boost return on equity. We would be motivated to research the stock further if we found out that AMETEK insiders have recently purchased shares. If that’s what you’re looking for, too, you’re in luck, because today we’re sharing our list of reported insider transactions with you for free.

Ultimately, sometimes it’s easier to focus on companies that don’t even need debt. Readers can access a list of growth stocks with no net debt. 100% freeat the moment.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.