Legal cannabis market in Australia

Dublin, August 9, 2024 (GLOBE NEWSWIRE) — The report “Australia Legal Cannabis Market Size, Share & Trends Analysis Report by Source (Marijuana, Hemp), Derivative (CBD, THC), End-use (Medical Use, Recreational Use, Industrial Use) and Segment Forecasts, 2024-2030” has been added to The Offer.

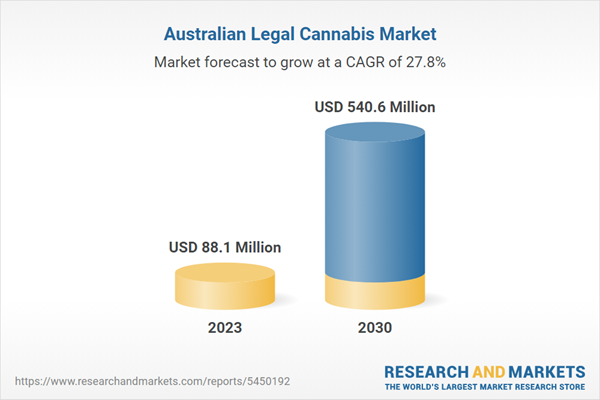

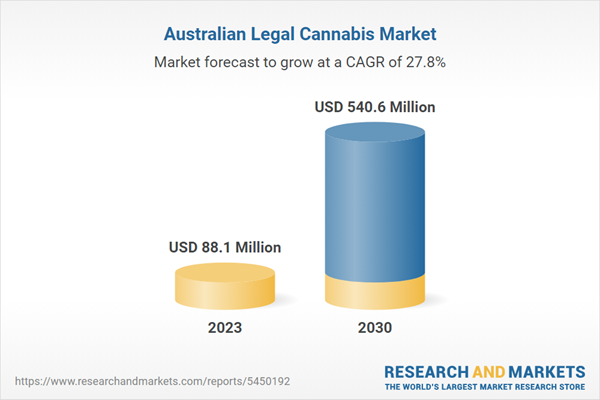

The Australian legal cannabis market is expected to reach a volume of US$540.6 million by 2030, growing at a compound annual growth rate (CAGR) of 27.8% from 2024 to 2030.

Factors such as a growing patient population, cannabis legalization, government initiatives, and the presence of local and foreign players in the country are contributing to the market growth. For example, according to data published by the Penington Institute in 2022, approximately 250,000 prescriptions for medical cannabis were issued as of June 2022.

The marijuana industry is booming due to the increasing use of marijuana for medicinal and recreational purposes. Marijuana has so far only been legalized for medicinal purposes in Australia and is expected to be legalized for recreational use as well. Through these legalizations, the government can try to curb the illegal marijuana market and focus on generating significant revenue from taxes on cannabis products.

In addition, the legalization and widespread use of cannabis and the introduction of new cannabis products are expected to increase market growth. For example, pharmaceutical company MediPharm Labs Corp. launched new GMP cannabis products such as Beacon inhalation cartridges and medicinal cannabis oil to the Australian healthcare market in September 2023.

The number of patients seeking medical marijuana for therapeutic reasons has increased. In addition, the number of companies operating in the medical marijuana market is growing. Many companies are also listed on the Australian Stock Exchange (ASX). As the market develops, the number of small local players and entrepreneurs in the Australian legal cannabis market is also increasing.

These players apply for cultivation licenses and are funded or acquired by major players. For example, in October 2023, Vitura Health Limited, a provider of medical cannabis products and digital health solutions, acquired Doctors On Demand, a telemedicine services company, to enter new service and product areas.

In addition, growing awareness among people about the therapeutic uses of cannabis and the launch of new cannabis-based products are driving market growth. For example, according to data published by the Penington Institute in 2022, the TGA granted 70,000 approvals for medicinal cannabis for chronic pain in 2021. In addition, medicinal cannabis is approved for sleep disorders, anxiety, and cancer pain.

Highlights of the Australian Legal Cannabis Market Report

-

According to Quelle, the hemp segment dominated the legal cannabis market in 2023 due to its application in several medicinal products as well as in the textile and non-textile industries.

-

Based on derivatives, the CBD segment led the market in 2023 due to the legalization of low-dose CBD products by the Therapeutic Goods Administration (TGA).

-

By end use, the industrial application segment dominated the market in 2023 due to the application of cannabis products in the construction, personal care, food and beverage, automotive and textile industries.

Featured companies

Main features:

|

Report Attribute |

Details |

|

Number of pages |

90 |

|

Forecast period |

2023 – 2030 |

|

Estimated market value (USD) in 2023 |

88.1 million US dollars |

|

Projected market value (USD) until 2030 |

540.6 million US dollars |

|

Average annual growth rate |

27.8% |

|

Regions covered |

Australia |

Main topics covered:

Chapter 1. Methodology and scope

Chapter 2. Summary

2.1. Market outlook

2.2. Segment outlook

2.3. Insights into the competition

Chapter 3. Variables, trends and scope of the legal cannabis market in Australia

3.1. Market outlook

3.1.1. Outlook for the parent market

3.1.2. Related/complementary market outlook

3.2. Market dynamics

3.2.1. Market driver analysis

3.2.2. Market restriction analysis

3.3. Tools for analyzing the legal cannabis market in Australia

3.3.1. Industry analysis – Porter’s

3.3.2. PESTEL analysis

3.3.3. Regulatory scenario

3.3.4. Case study analysis

Chapter 4. Legal Cannabis Market in Australia: Source Estimates and Trend Analysis

4.1. Source market share, 2023 and 2030

4.2. Segment Dashboard

4.3. Global Australian legal cannabis market by origin

4.4. Marijuana

4.4.1. Market estimates and forecasts 2018 to 2030 (in million USD)

4.4.2. Flowering

4.4.3. Oil and tinctures

4.5. Hemp

4.5.1. Market estimates and forecasts 2018 to 2030 (in million USD)

4.5.2. Hemp-CBD

4.5.3. Additions

4.5.4. Industrial hemp

Chapter 5. Legal Cannabis Market in Australia: Derived Estimates and Trend Analysis

5.1. Market share of derivatives, 2023 and 2030

5.2. Segment Dashboard

5.3. Global Australian Legal Cannabis Market by Derivatives Outlook

5.4. CBD

5.5. THC

5.6. Miscellaneous

Chapter 6. Australia’s Legal Cannabis Market: End-Use Estimates and Trend Analysis

6.1. End-user market share, 2023 and 2030

6.2. Segment Dashboard

6.3 Global Australian legal cannabis market by end-use outlook

6.4. Medicine

6.4.1. Market estimates and forecasts 2018 to 2030 (in million USD)

6.4.2. Cancer

6.4.3. Chronic pain

6.4.4. Depression and anxiety

6.4.5. Arthritis

6.4.6. Diabetes

6.4.7. Glaucoma

6.4.8. Migraine

6.4.9. Epilepsy

6.4.10. Multiple sclerosis

6.4.11. AIDS

6.4.12. Amyotrophic lateral sclerosis

6.4.13. Alzheimer’s disease

6.4.14. Posttraumatic stress disorder (PTSD)

6.4.15. Parkinson’s disease

6.4.16. Tourette syndrome

6.4.17. Miscellaneous

6.5. Leisure

6.6. Industry

Chapter 7. Competitive landscape

7.1. Current developments and impact analysis by key market participants

7.2. Categorization of companies and competitors

7.3. Analysis of the company’s market position

7.4. Company profiles

7.4.1. Company overview

7.4.2. Financial performance

7.4.3. Product benchmarking

7.4.4. Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/mhxi6e

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900