We have just Alibaba Group Holding Ltd. (BABA), the China-based online shopping giant. The company generates most of its revenue from several e-commerce stores, but also has a booming cloud business that Sales of AI-related products saw triple-digit year-on-year growth last quarter, says Clif DrokeEditor of Turnaround letter from Cabot.

Although Alibaba is a leading e-commerce player in China, it is relatively unknown among casual shoppers in the U.S. and Europe. And on that front, the company is actively trying to expand its presence internationally, particularly through its AliExpress retail platform, which sells directly to consumers worldwide. Meanwhile, Alibaba Cloud, its cloud computing arm, has been building out its data centers and services outside of China, particularly in Asia, Europe, the Middle East and North America.

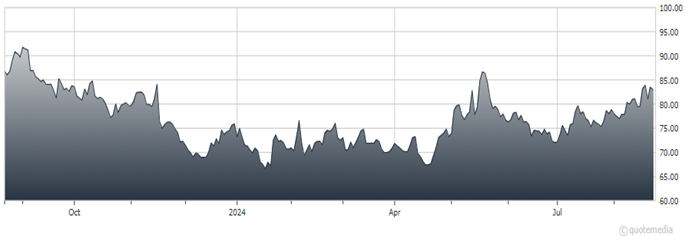

(BABA)

Alibaba’s financial arm, Ant Group, has also been expanding its digital payment services internationally through partnerships and acquisitions, while its digital wallet Alipay is launching in several new overseas markets. I see the push for international expansion as a big part of the turnaround here.

Turning to key financial metrics, Alibaba’s free cash flow fell in the fiscal first quarter. The company attributed this to a “significant increase in spending on AI infrastructure investments.” However, it expressed confidence that it would return to double-digit growth in the second half of the fiscal year, with a gradual acceleration thereafter as it begins implementing its integrated cloud and AI development strategy.

Just recently, a major Wall Street bank published a list of the 50 stocks that most frequently appear in the top 10 holdings of “fundamentally oriented investors from quantitative funds or funds that track private equity investments,” which is another positive factor for the future.

However, a position in Alibaba is not without above-average risk due to the weak economic situation in China. For this reason, I will monitor this stock more closely than I normally do with our other portfolio holdings.

Recommended action: Buy BABA.

Subscribe to the Cabot Turnaround Letter here…