The UK’s Competition and Markets Authority (CMA) has concluded its investigation into the app stores of Alphabet’s (GOOGL) Google and Apple’s (AAPL) ahead of new digital markets laws coming into force. Although the investigation is now complete, the tech giants could still come under scrutiny when the new rules come into force later this year.

The investigation into Apple’s App Store was launched in 2021, followed by an investigation into the Google Play Store in 2022. Importantly, the tech giants were accused of imposing unfair terms on app developers using their respective app stores.

New rules are the focus

The UK’s new Digital Markets, Competition and Consumers Act (DMCCA) aims to tackle anti-competitive practices by large online platforms. This law will allow the CMA to assess competition issues from a global perspective. If Google or Apple are deemed to have “strategic market status”, the CMA will be able to investigate their practices in both the UK and international markets.

A key reason the regulator has closed its investigation is the belief that Google and Apple’s app store practices can be better addressed under the new legislation.

With this in mind, let’s see what Wall Street thinks about the two tech giants.

Should I buy, sell or keep Apple?

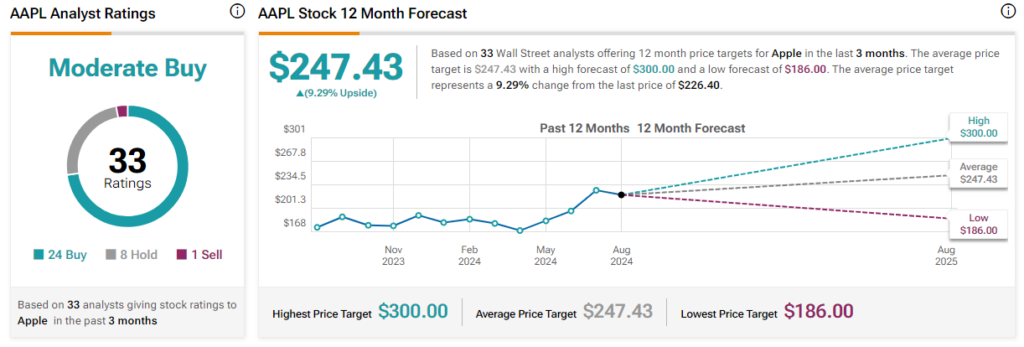

Overall, AAPL has a consensus rating of Moderate Buy on TipRanks, based on 24 buy recommendations, eight hold recommendations, and one sell recommendation. The average analyst price target for Apple shares is $247.43, which represents an upside of 9.29% from current levels. The stock has gained 23.1% over the past six months.

What is the price target for GOOGL shares?

On TipRanks, GOOGL has a consensus rating of Strong Buy, based on 29 buy recommendations and seven hold recommendations from analysts over the past three months. After a 15.2% share price increase over the past six months, the average analyst price target for Alphabet shares of $205.18 implies an upside potential of 23.71%.

notice