US Confection President Charles Raup completed a sale of 2,065 shares of The Hershey Co (NYSE:HSY) on August 19, 2024, according to a recent SEC filing. Following this transaction, the insider now owns 22,245 shares of the company’s stock.

Known for its confectionery, the Hershey Co. is a major player in the chocolate and sugar confectionery market. The company produces and distributes a wide range of chocolate and non-chocolate confectionery products.

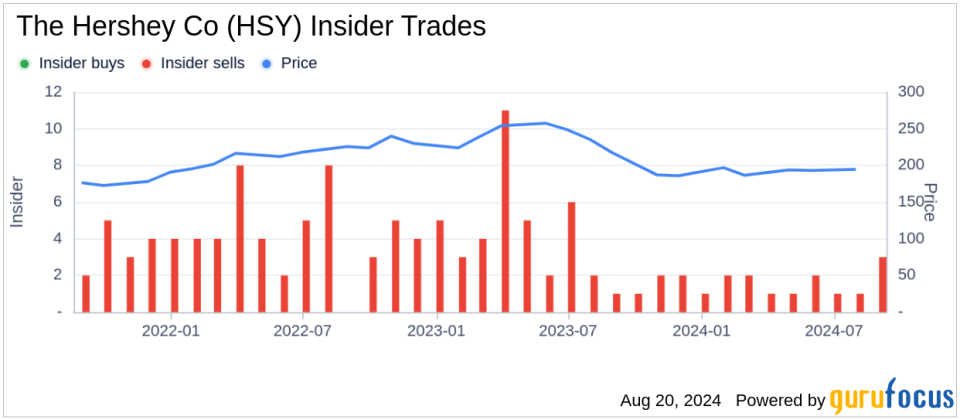

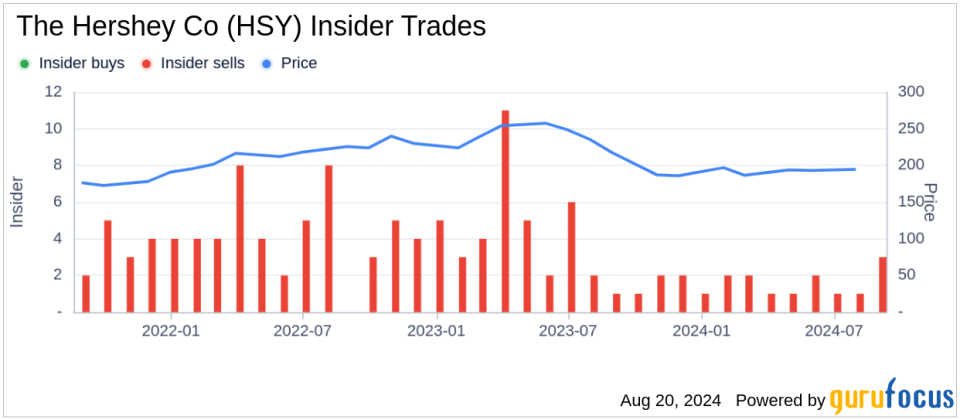

Over the past year, Charles Raup has sold a total of 8,260 shares and made no purchases. The overall trend of insider transactions at The Hershey Co shows a total of 20 insider sales and no insider purchases over the past year, indicating an overall selling trend among the company’s insiders.

The Hershey Co’s shares were trading at $193.87 on the day of the transaction. The company has a market capitalization of around $40.03 billion. The stock’s price-to-earnings ratio is 21.99, which is higher than the industry average of 17.96.

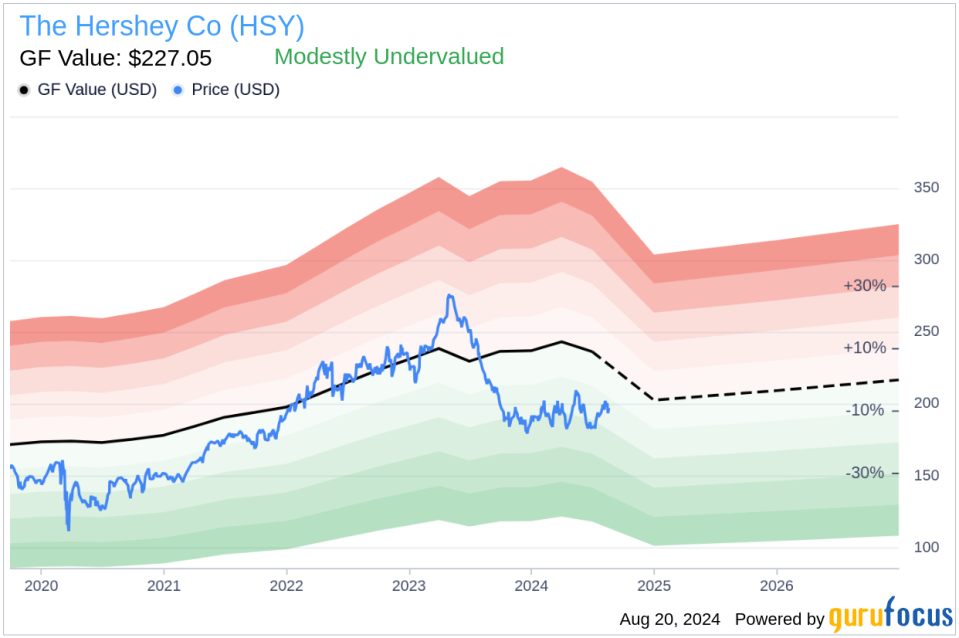

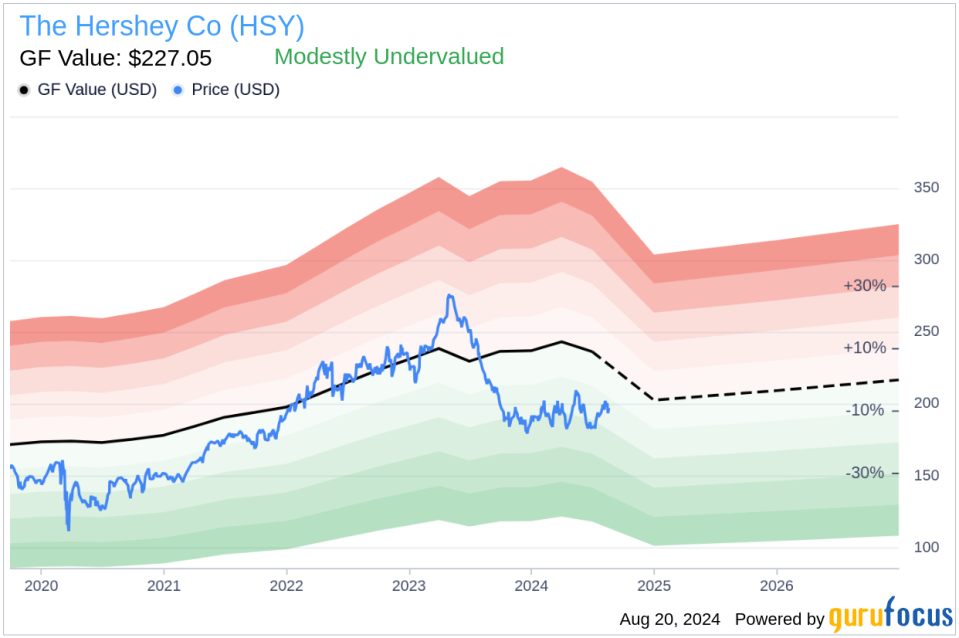

According to GF Value, The Hershey Co is considered slightly undervalued with a GF Value of $227.05, suggesting potential for value appreciation based on intrinsic valuation metrics.

The GF value is calculated by taking into account historical trading multiples, a GuruFocus adjustment factor based on past earnings and growth, and analysts’ future business performance estimates.

This insider sale may be of interest to investors who follow insider behavior as an indicator of confidence in the company’s current valuation and future prospects.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.