Chief Legal Officer David Hyman sold 10,794 shares of Netflix Inc (NASDAQ:NFLX) on August 13, 2024, according to a recent SEC filing. Following this transaction, the insider now owns 31,610 shares of the company’s stock.

Netflix Inc. is a streaming entertainment service provider offering television series, documentaries and feature films in a variety of genres and languages. The company offers its members the opportunity to receive streaming content via a variety of internet-enabled devices.

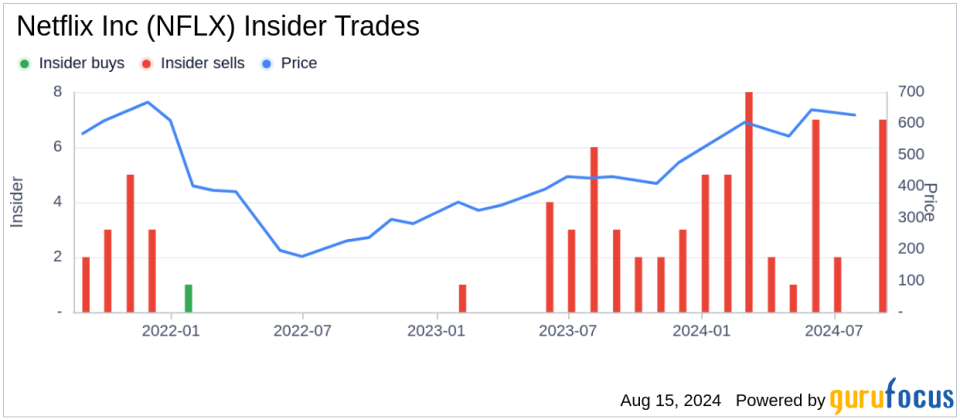

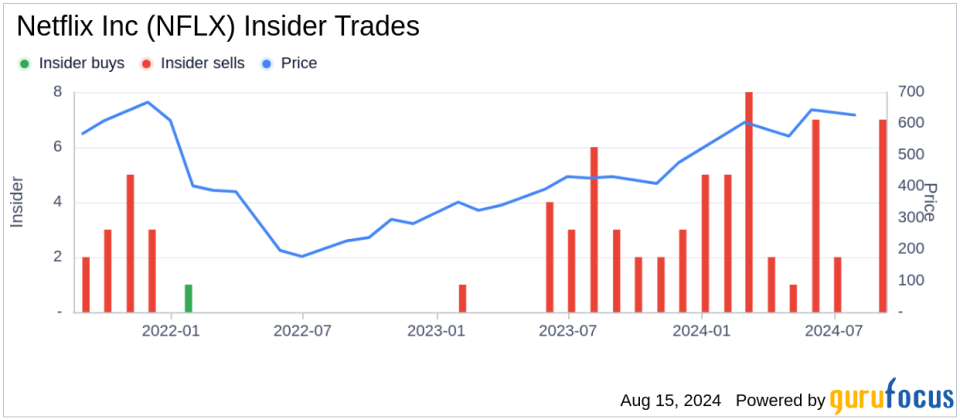

Over the past year, David Hyman has sold a total of 99,435 shares of Netflix Inc. and made no purchases. This latest transaction continues a trend from the past year in which there were 45 insider sales and no insider purchases.

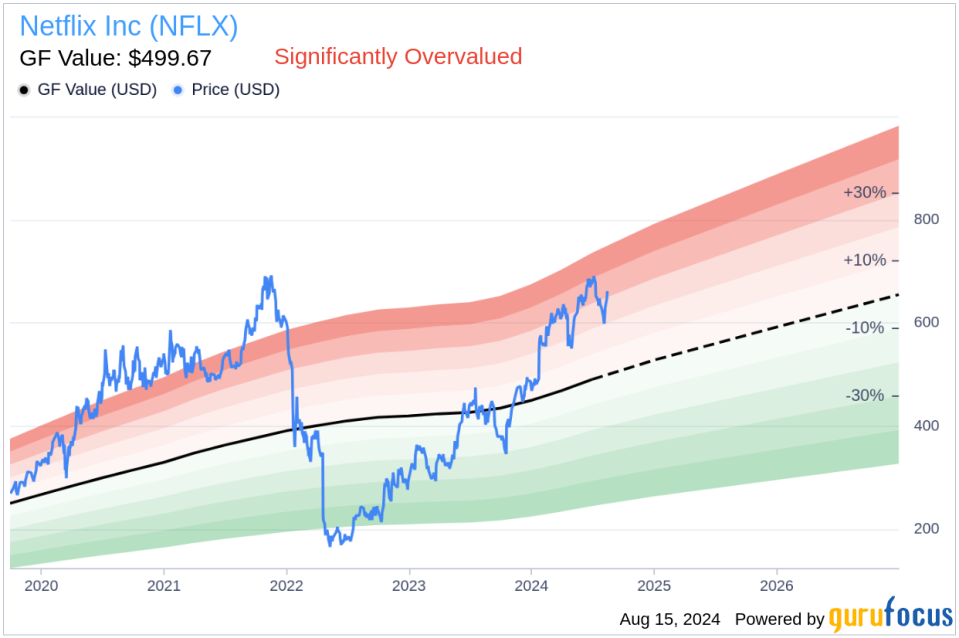

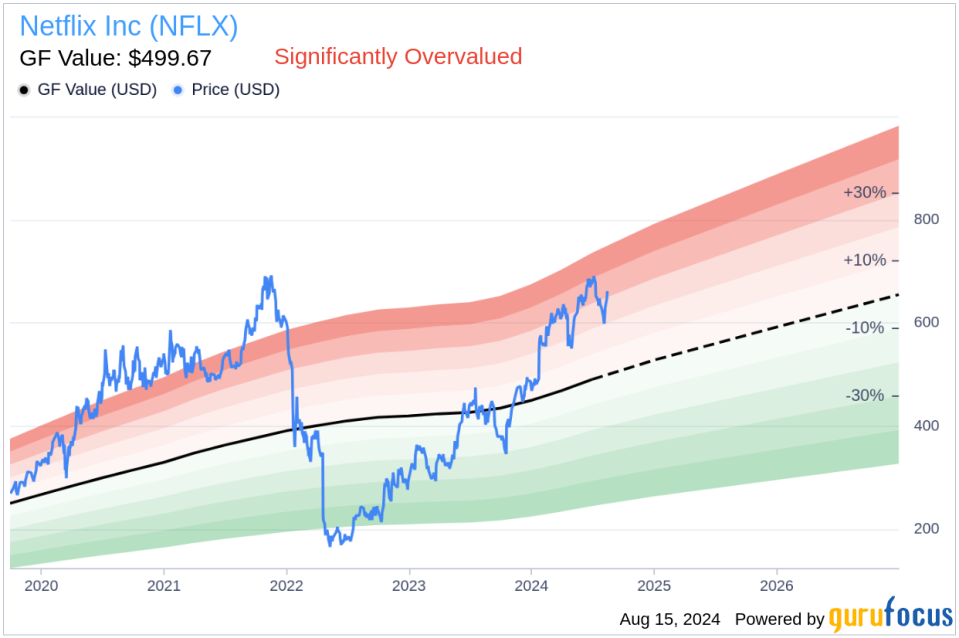

Netflix Inc.’s stock price was $650 on the day of the sale, bringing the company’s market capitalization to around $283.97 billion. The company’s price-to-earnings ratio is 41.36, which is higher than the industry average of 17.25.

The stock’s valuation metrics show a GF Value of $499.67, which suggests that Netflix Inc. is considered significantly overvalued at a price of $650 with a Price to GF Value ratio of 1.3.

The GF value is calculated based on historical trading multiples such as price-to-earnings ratio, price-to-sales ratio, price-to-book ratio and price-to-free cash flow, adjusted for the company’s past performance and estimated future business results.

This insider sale may be of interest to investors who monitor insider behavior as an indicator of the company’s future performance and valuation.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.